-

President Donald Trump unveiled a federal plan offering government-backed retirement accounts with a $1,000 annual match for workers without employer-sponsored plans.

February 25 -

A new bipartisan bill would exempt retroactive Social Security payments from federal taxes, easing a surprise financial burden for millions of retirees.

February 20 -

More retirees are going back to work amid financial pressures and economic uncertainty, an AARP survey finds. Advisors weigh in on when "unretiring" makes sense.

February 17 -

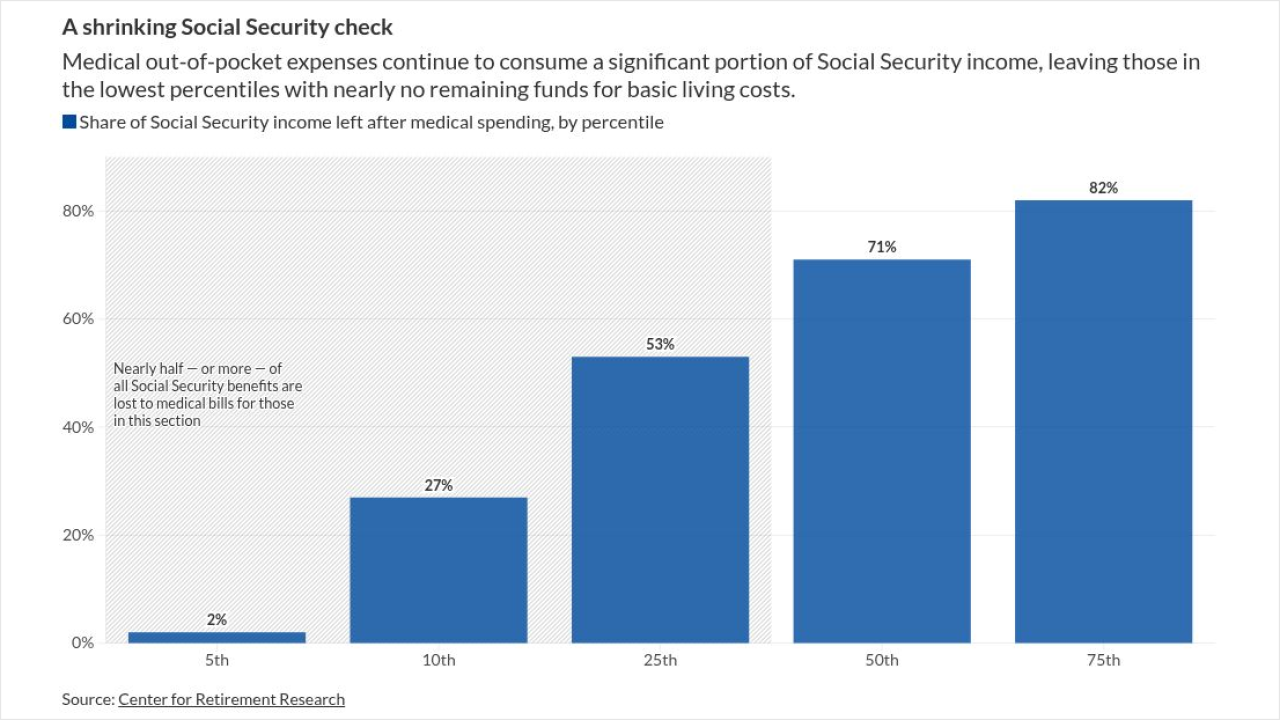

Medical inflation is projected to climb at double the rate of Social Security cost-of-living adjustments, leaving a growing number of retirees with a shrinking share of their benefits.

February 9 -

Financial advisors often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice for most households.

December 31 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

A Schroder's expert says new data speaks volumes about the importance of building a solid nest egg before leaving the workforce.

November 18 -

The Social Security Administration announced its cost-of-living adjustment for beneficiaries — a figure advocates say fails to address the reality for most seniors.

October 24 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

A government shutdown disrupts federal agencies and markets. Here's what advisors need to know to guide clients through the uncertainty.

October 1 -

Cerulli's research based on a survey of wealth and asset management firms suggest that firms have only just begun to address clients' comprehensive planning needs.

September 8 -

From aggressive tax strategies to early retirement, well-intentioned decisions can unintentionally reduce Social Security benefits. Advisors highlight four major pitfalls that can impact clients' retirement income.

August 28 -

Retired women find themselves leaning on Social Security as a primary source of income at greater rates than men, according to new research from the Transamerica Institute. Financial advisors say that has significant implications for retirement planning.

August 18 -

Between new senior tax deductions and fast-approaching funding shortfalls, it has been a turbulent few months for Social Security.

August 4 -

The move could impact future studies on retirement trends, policy and aging in America.

July 28 -

A provision in Trump's tax and budget law gives seniors 65 and older a new deduction that offsets Social Security taxes for most retirees. While it helps many keep more money, it also accelerates the program's insolvency.

July 7 -

Republicans will be planning a victory lap and Democrats will be thinking about their election strategy. But financial advisors and tax pros will be preparing their clients.

July 3 -

With the outlook for Social Security's future worsening, the agency's commissioner says he's ready to get to work on fixing the program. But with an abundance of potential solutions, it's unclear what path the program will take.

June 25 -

Older Americans are worried about when to claim Social Security. Financial advisors need to have much different conversations with their younger clients.

June 24 -

Nearly 7 in 10 Americans say Social Security benefits should be equal for everyone, regardless of marital status, according to a new survey. Financial advisors are skeptical.

June 20