-

Tax policy for the next two years, and therefore tax planning strategies, may be determined in Georgia early next year.

November 12 -

To help individuals and businesses prepare for filing season, Grant Thornton has released a collection of year-end tax tips.

December 17 -

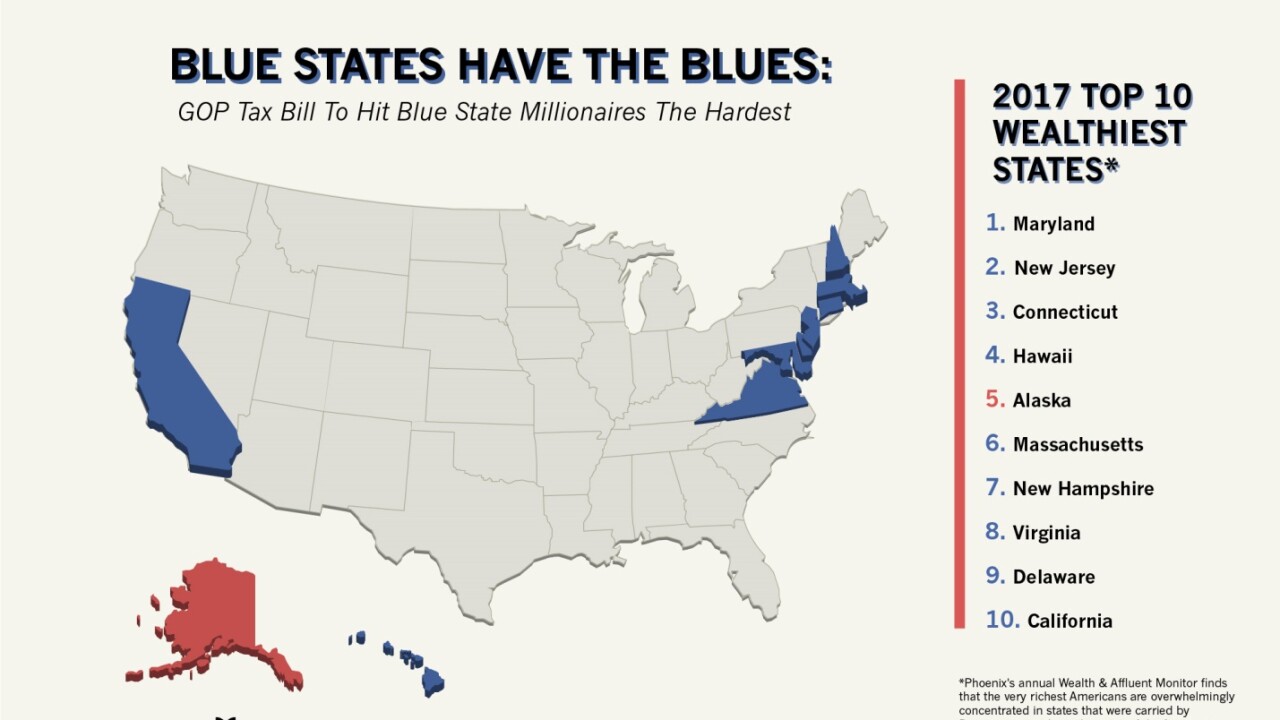

Moving to a lower-tax state is more attractive than ever with the $10,000 cap on state tax deductions.

November 26 PKF O'Connor Davies

PKF O'Connor Davies -

It’s one of the most consequential — and misunderstood — concepts for clients with properties in more than one state. Where should they call home?

March 7 -

“The more ties you cut, the better — auditors like to see a moving van and an itemized list of what was moved,” one lawyer says.

March 5 -

Each has its own requirements pertaining to tax withholding, clawback rules and filing deadlines.

November 6 Mackay, Caswell & Callahan, P.C.

Mackay, Caswell & Callahan, P.C. -

-

Cost of living is a key consideration, but a retiree’s goals and objectives are also important.

August 30 -

Taxpayers won’t get big federal write-off above state credit.

August 24 -

The president reportedly feels strongly that state and local taxes should be applied to online purchases.

February 20 -

Advisors need to be aware of how the new tax law will affect high-net-worth clients across the country.

February 7 -

Regulatory changes that ended popular deductions could prompt homeowners in high-tax states to consider relocating, a survey finds.

December 29 -

The uncertain tax and legislative environment means that year-end tax planning is more important than usual. To help clients and businesses prepare for filing season, here are helpful tips.

November 27 -

In some states mortgage closing costs can reach or exceed five figures.

November 27 -

The House GOP bill would limit the deductibility of property taxes to $10,000 annually.

November 2