-

A group of 25 Democrats in the House wrote to congressional leaders asking them to provide $12.1 billion in funding for the Internal Revenue Service, including $5.2 billion for enforcement, with an eye toward cracking down on high-income tax cheats.

November 30 -

The legislation would encourage saving earlier by enrolling employees automatically in their company’s 401(k) plan, whenever a new plan is created.

October 29 -

Educating clients with startup businesses on the new regulations can help them provide for employees without breaking the bank.

July 29 Commonwealth Financial Network

Commonwealth Financial Network -

There's a great deal of help for businesses in the CARES Act and the FFCRA.

May 5 Weaver

Weaver -

Some tax credits are refundable, meaning they can get a refund in case the credits exceed their actual tax liability.

February 25 -

While they don't need a child to claim the earned income tax credit, the benefit's value increases based on the number of kids clients have.

February 4 -

Changing filing statuses and maxing out deductible contributions to IRAs and HSAs are some ways clients received bigger reimbursements.

March 12 -

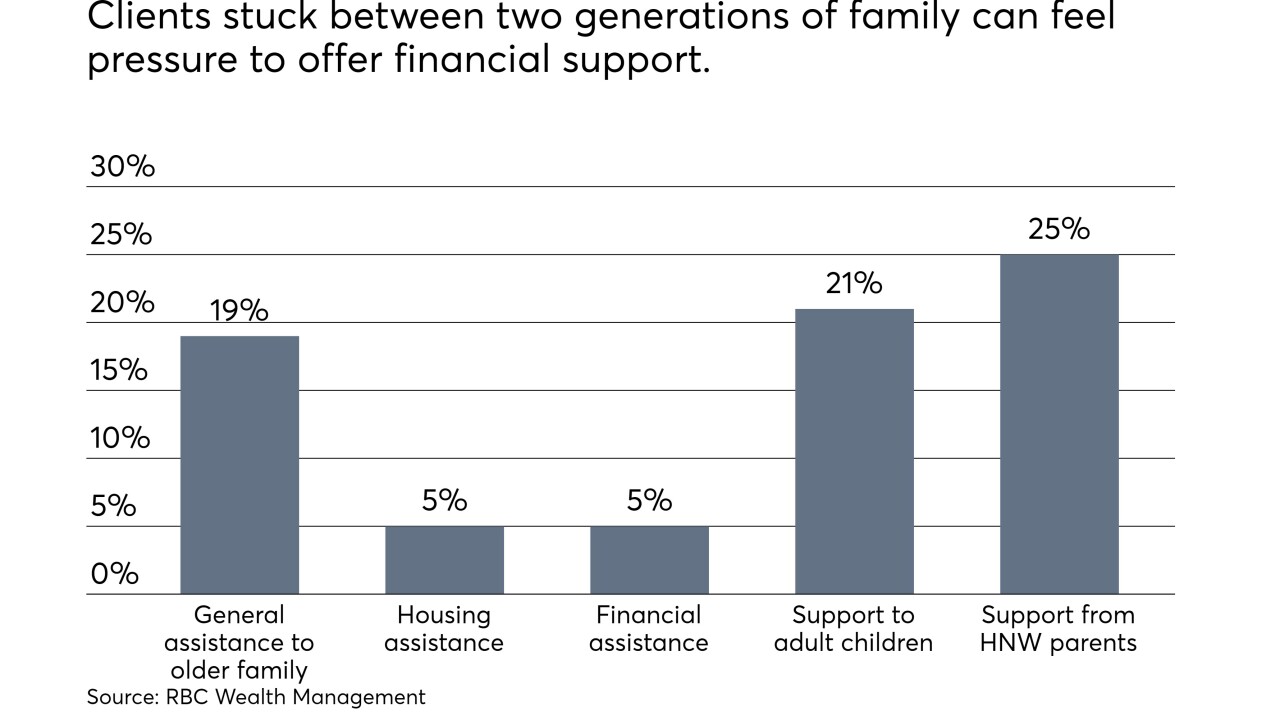

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 26 -

Working parents who paid for day care, summer camp or a babysitter on the books are advised to take advantage of this break.

December 11 -

The uncertain tax and legislative environment means that year-end tax planning is more important than usual. To help clients and businesses prepare for filing season, here are helpful tips.

November 27