-

Nearly half of advisors are considering adding this service, according to the Financial Planning's October Financial Advisor Confidence Outlook.

October 27 -

A clear division is emerging between smaller independent RIAs and their larger billion-dollar competitors, as some firms aggressively pursue a "one-stop shop" model for their clientele.

October 17 -

The National Association of Tax Professionals criticized an ad promoting Intuit's TurboTax full-service option, saying it encouraged taxpayers to leave their professional preparers.

October 15 -

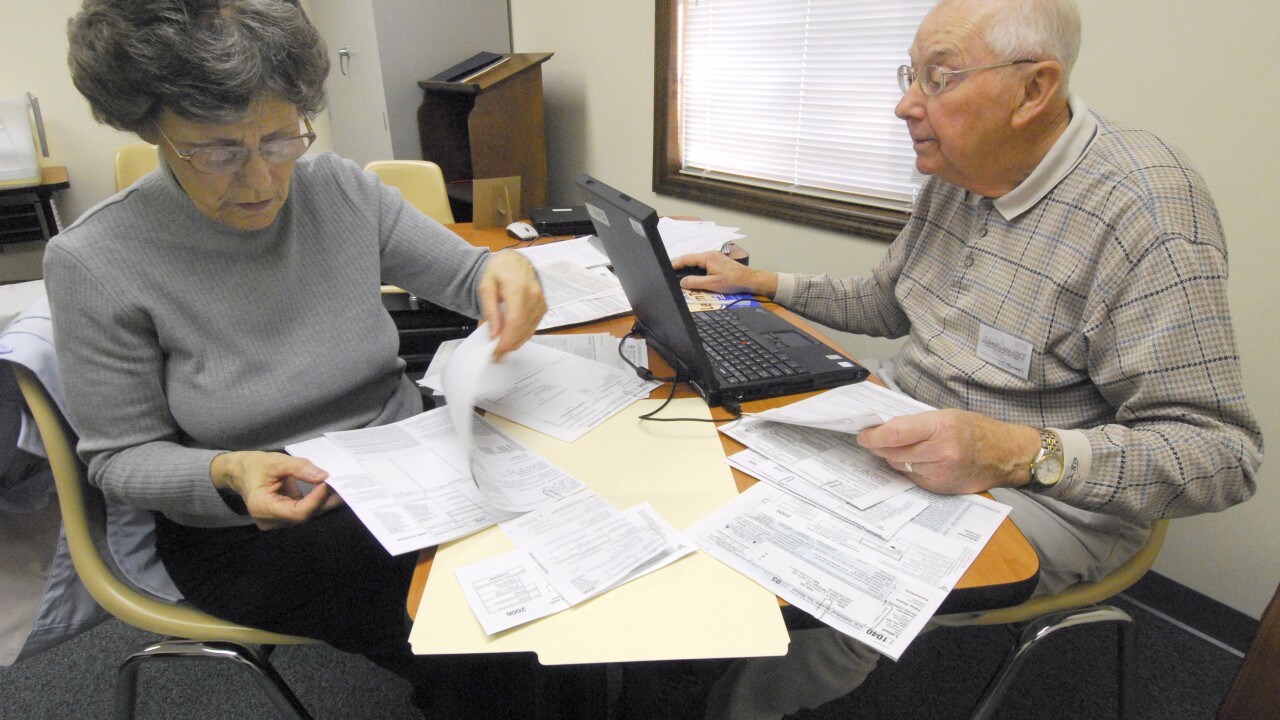

The IRS is taking applications for funds for its Tax Counseling for the Elderly and VITA programs.

May 1 -

Whether they're enthusiastic or terrified, tax practitioners are anything but indifferent to the rise of artificial intelligence.

February 15 -

Taxpayers who filed early this year and reported state tax refunds they received in 2022 as taxable income should consider filing an amended return.

April 11 -

Tax pros who have begun working on their clients' returns are encountering a slight change in wording at the top of Form 1040.

January 24 -

The Internal Revenue Service pledged to improve taxpayer service this year.

January 23 -

With the White House’s proposed Build Back Better legislation and its impact on taxes in limbo, advisors have time to implement key tax planning techniques.

April 19 -

April and Column Tax are among the startups capitalizing on the idea that taxes are part of a person’s financial life and banks are most suited to help with tax preparation and filing.

April 8 -

Bitcoin and other digital currency investors face tax headaches and IRS scrutiny this filing season.

February 26 -

The agency will send several dozens agents to make at least 800 face-to-face visits in February and March of this year.

February 24 -

The agency recently estimated a gap of $381 billion in unpaid tax from 2011-‘13, which equates to roughly 14.2% never being submitted.

January 9 -

Clients who intend to file as soon as they receive their W-2s are advised to start gathering their documents.

January 8 -

The service offers some do’s and don’ts for taxpayers who get a frightening envelope.

June 26 -

The Form N-PORT compliance era official begins in the second quarter of 2018.

December 28 -

Financial planners report wide demand to learn how to exploit changes in the tax code.

December 22 -

Practices can almost get rid entirely of expensive outside accounting services.

October 2 -

Taxes are the top expense that seniors don't plan for enough, but dental costs and hearing aids are also on the list.

August 11