-

Everyone knows tax pros don't make mistakes, but it can't hurt to doublecheck for these mistakes before filing.

March 7 -

With tax authorities scrutinizing partnerships, CPAs and tax pros need to think more strategically about filing for extensions.

April 4 WealthAbility

WealthAbility -

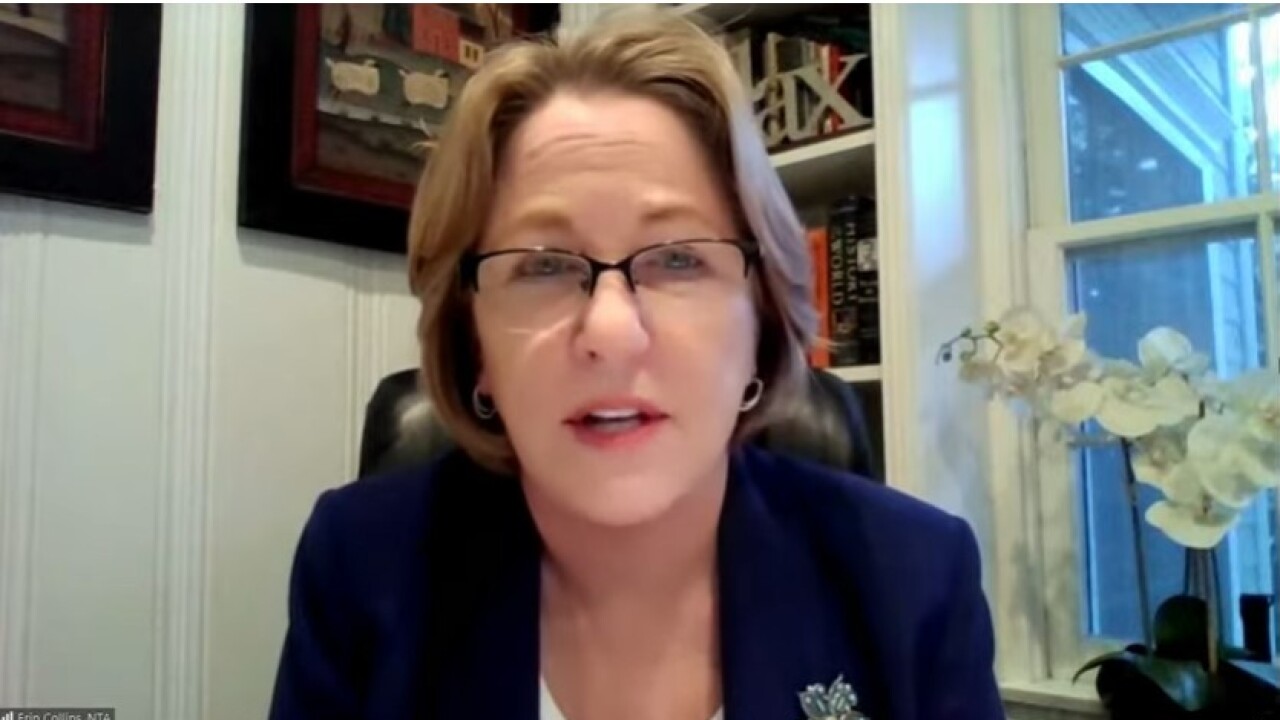

Commissioner Danny Werfel and Taxpayer Advocate Erin Collins discussed the enhancements the IRS has been making thanks to the additional billions of dollars of funding.

November 14 -

The Internal Revenue Service has caught up on much of the pile of unprocessed tax returns, but it's still not back to normal.

May 15 -

With the final stats from this year's filing in, it seems clear that it was one of the most normal in years.

April 30 -

While a securities-based loan is more commonly used to buy a fancy house or take a dream vacation, it's also an underused strategy for some affluent investors to pay large tax bills.

April 16 -

From accidentally paying state taxes on T-bill income to wonky filing deadlines, these tips will help make a federal tax return sparkle. Or at least clean.

April 12 -

Contributions to 401(k)s and IRAs now can reduce your 2022 taxes soon due this filing season. Here's what advisors, many of whom can themselves benefit, need to know.

March 7 -

Affluent investors typically have more complicated financial lives and more ways to get things wrong when filing federal tax returns in 2023.

February 28 -

The agency said unexpectedly that it was still deciding whether state rebates to taxpayers were taxable income.

February 8 -

The IRS has compiled a list of mistakes they often see on tax returns.

February 1 -

Amid the end of pandemic credits and investment losses, filing a federal return this year has sobering moments.

January 17 -

Ed Mendlowitz offers a host of tips and strategies you can implement now for a better busy season.

November 28 -

NTA Erin Collins expressed concern Wednesday about continuing delays by the service in processing tax returns filed on paper last year.

June 22 -

The service decided to destroy the documents in March 2021 because of its inability to process its backlog of paper tax returns, according to a new report.

May 9 -

National Taxpayer Advocate Erin Collins pointed to continuing backlogs at the Internal Revenue Service and difficulty reaching telephone assistance in a report to Congress Thursday.

June 30 -

A new initiative called Operation Hidden Treasure is only the latest in the service’s approach.

April 13 -

NCCPAP’s Stephen Mankowski shares details from the service on filing date extensions and more.

April 8 -

“Even the easy returns are not simple right now,” a CPA says.

March 16 -

Bitcoin and other digital currency investors face tax headaches and IRS scrutiny this filing season.

February 26