-

The IRS has compiled a list of mistakes they often see on tax returns.

February 1 -

Amid the end of pandemic credits and investment losses, filing a federal return this year has sobering moments.

January 17 -

Ed Mendlowitz offers a host of tips and strategies you can implement now for a better busy season.

November 28 -

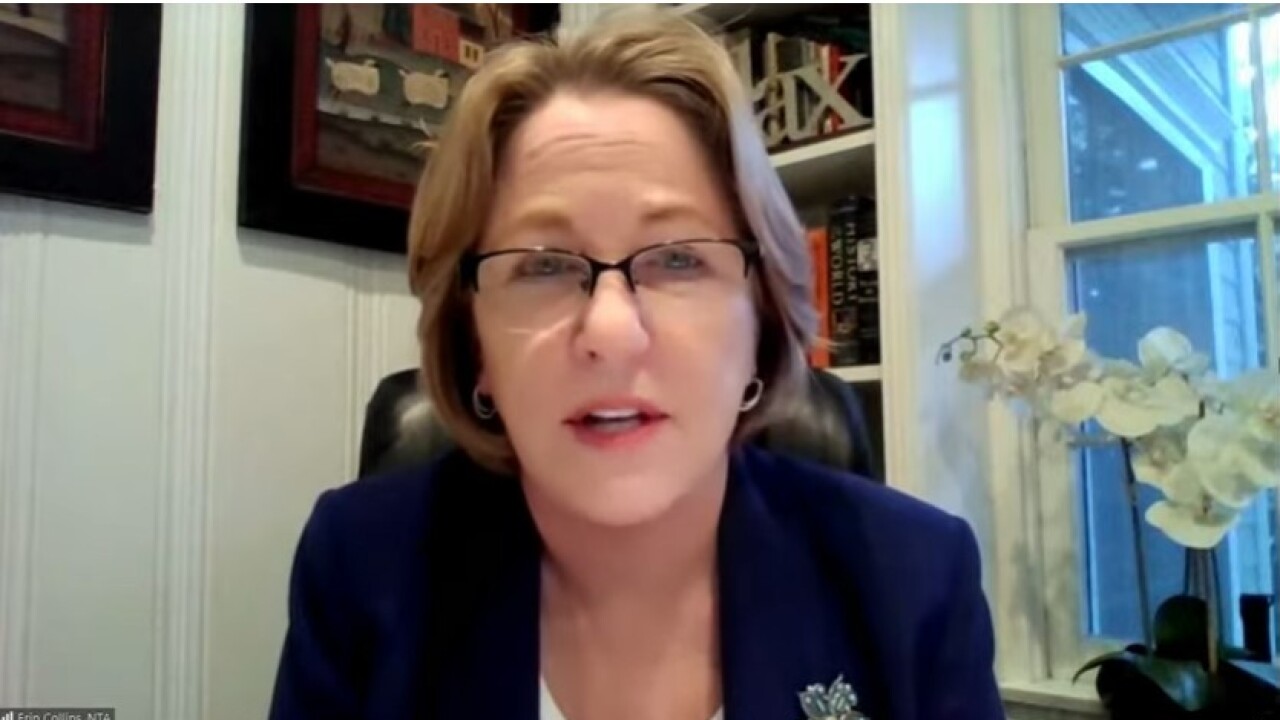

NTA Erin Collins expressed concern Wednesday about continuing delays by the service in processing tax returns filed on paper last year.

June 22 -

The service decided to destroy the documents in March 2021 because of its inability to process its backlog of paper tax returns, according to a new report.

May 9 -

National Taxpayer Advocate Erin Collins pointed to continuing backlogs at the Internal Revenue Service and difficulty reaching telephone assistance in a report to Congress Thursday.

June 30 -

A new initiative called Operation Hidden Treasure is only the latest in the service’s approach.

April 13 -

NCCPAP’s Stephen Mankowski shares details from the service on filing date extensions and more.

April 8 -

“Even the easy returns are not simple right now,” a CPA says.

March 16 -

Bitcoin and other digital currency investors face tax headaches and IRS scrutiny this filing season.

February 26 -

A ‘wave’ of claims for the Domestic Production Activities Deduction sparks an alert.

February 25 -

The agency’s commissioner is upbeat, but tax preparers and financial planners worry that this year could be especially chaotic due to the COVID pandemic.

February 18 -

With vast numbers of clients working outside the office, practitioners are advising care.

November 4 -

Though notorious for being complex, they can be incredibly helpful in the hands of tax professionals who know how to use them.

October 8 Canopy

Canopy -

The Internal Revenue Service is giving taxpayers a break if the checks they mailed in to pay their taxes still haven’t been opened up yet and are sitting in the trailers the IRS set up during the pandemic.

August 17 -

The extension also applies to Americans living abroad who would otherwise generally have had a filing deadline of June 15.

June 25 Expat Tax Professionals

Expat Tax Professionals -

Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.

April 20 -

Even as they still have to deal with tax season, the service is tasked with handling much of the stimulus packages.

April 6 -

The Internal Revenue Service is postponing the date for filing gift tax and generation-skipping transfer tax returns and making payments until July 15 because of the novel coronavirus pandemic.

March 30 -

While some tax-planning tasks can be time-sensitive, the challenge is to tackle the others that aren’t in a calculated fashion, an expert explains.

January 7