-

Here's how to bring in the cash without paying a nickel to the government. Plus, 11 big mistakes to avoid and qualified charitable distributions that yield big benefits.

July 14 -

Taxes are one of life’s sure things, but clients can still make changes after the filing deadline. Here’s how.

July 12 -

Small business owners can win when planners use a stacked-pension approach for 401(k) retirement planning, says Joe Gordon of Gordon Asset Management.

July 11 -

Help clients choose investment wrappers that increase returns. Plus, comparing the advantages of rental homes against home ownership.

July 7 -

In recent tax years, some 12 million filers opted for a Form 4868 to buy another six months to file their return.

July 5 -

An estate-planning process that asks about contaminated property can save heirs from unpleasant surprises.

July 1 -

To build loyalty with the next generation, key steps include hiring younger advisers.

June 30 SunTrust Banks

SunTrust Banks -

Some advisers continue to overstate the benefits, confusing savings with deferral.

June 28 -

Some advisers continue to overstate the benefits, confusing savings with deferral.

June 28 -

A generation crosses a finish line and finds the IRS waiting. Here are some tips to help them minimize the bite.

June 28 -

Some advisers continue to overstate the benefits, confusing savings with deferral.

June 28 -

Your clients’ generous intentions can actually work against them. How to help navigate a thorny but navigable issue.

June 23 -

Some advisers and their clients are running afoul of an IRS rule, and oversights can result in substantial penalties.

June 22 -

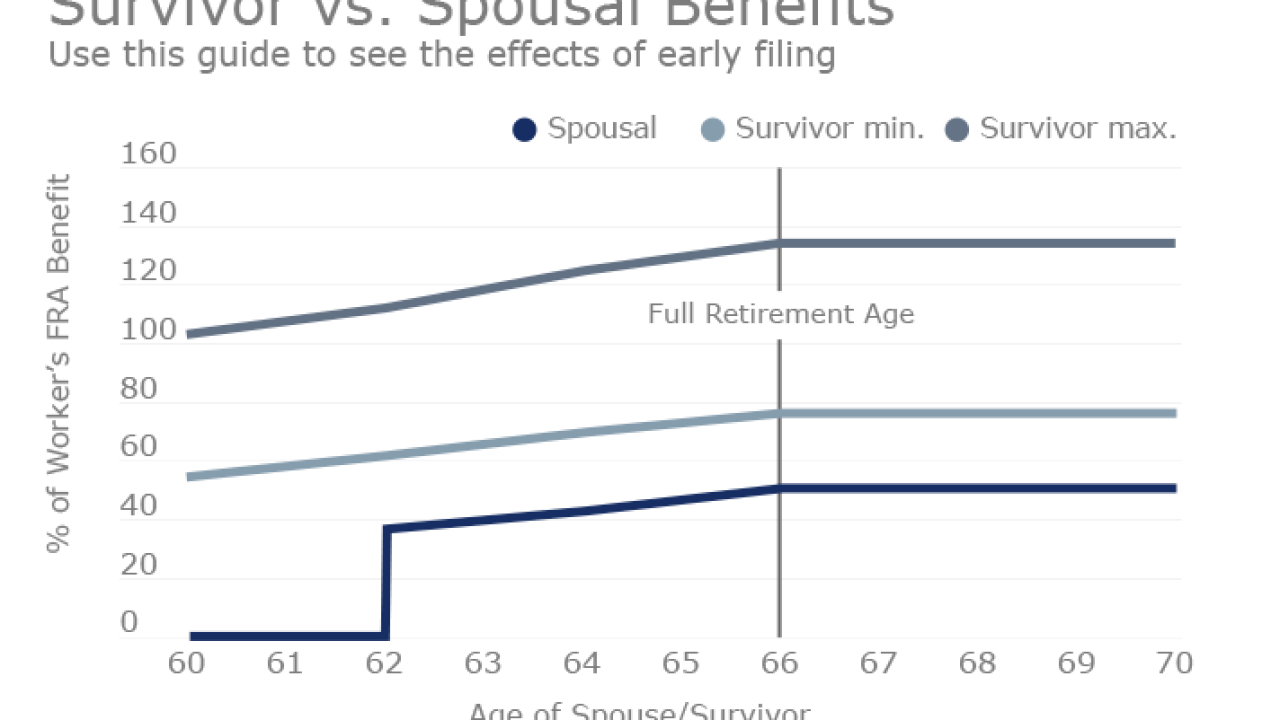

Spousal benefits and survivor benefits appear very similar, but scratch a little deeper you’ll find a tangle of regulations and features. Here’s how to unwind them.

June 22 -

The strategy raises tricky tax reporting and regulatory questions.

June 21 -

Whether clients are making 529 plan distributions, a direct tuition payment or an in-kind gift, for grandparents, timing is everything.

June 20 -

MLPs deliver returns and may help lower payments to the IRS. Plus, the costs of age-related milestones and ETFs.

June 16 -

One approach enables clients retiring with large positions of highly appreciated company stock in their 401(k) accounts to save thousands on taxes.

June 16 -

Advisers also noted a dip in their clients’ retirement savings activity after the tax filing deadline passed.

June 7 -

Advisers can use these strategies to help clients get through a marital split, says BNY Mellon wealth strategist Justin Miller.

June 6