-

Whatever the outcome in November, taxpayers and their advisors should prepare for changes, an expert says.

October 6 -

While the contributions aren’t deductible, distributions such as earnings are tax-free to the designated beneficiary if they’re used to pay for qualified disability expenses.

October 5 -

The agency issued guidelines scaling back a tax break for client entertainment, following through on an element of President Trump’s 2017 tax overhaul.

October 1 -

The final regulation includes guidance on the requirements needed for properties to qualify for the deduction.

September 22 -

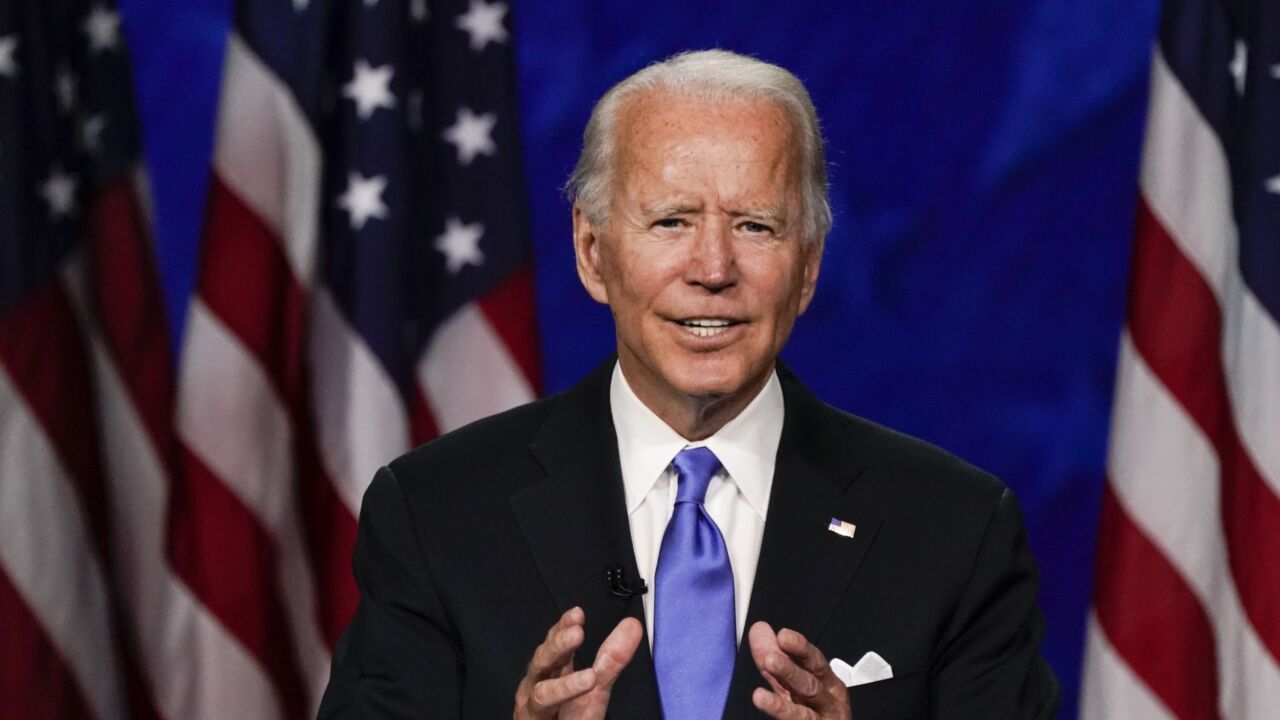

Under the proposals, the top 0.1% of earners would be subject to a 43% tax rate on their income.

September 14 -

Clients may have an ability to increase the ratio of after-tax dollars in their account by completing one or more transactions that are exempt from the pro rata rule.

September 11 -

To protect client nest eggs, advisors must know which savings vehicles are protected — and they’re not all created equal.

September 10 -

Effective tax management can add 1% percent to a portfolio annually, and potentially more in highly volatile years

September 8 Commonwealth Financial Network.

Commonwealth Financial Network. -

Waiting until year end to factor in portfolio volatility is risky business.

September 4 Russell Investments

Russell Investments -

It may seem counterintuitive, but paying appreciably more taxes in 2020 could save families a lot of money down the road.

August 31 Proquility Private Wealth Partners

Proquility Private Wealth Partners