-

If the client makes a mistake, they are advised to take the RMD as soon as they discover it so they can ask the IRS for a waiver of the penalty.

February 28 -

Those who signed up in the past year will get a smaller pension than they would under the old system, but they can expect additional benefits from the tax-advantaged Thrift Savings Plan.

February 27 -

Some clients may experience a taxable event that pushes them into a higher tax bracket.

February 26 -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 22 -

Medicare will charge a high-income surcharge if seniors reported more than $85,000 (or $170,000 for joint filers) in modified adjusted gross and tax-exempt interest income.

February 20 -

Although more taxpayers are expected to use the standard deduction, they can still claim the tax deduction for IRA contributions.

February 19 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

February 19 -

The tax-focused IBD’s custodial and platform transition is taking longer than the company or its advisors expected.

February 14 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 14 -

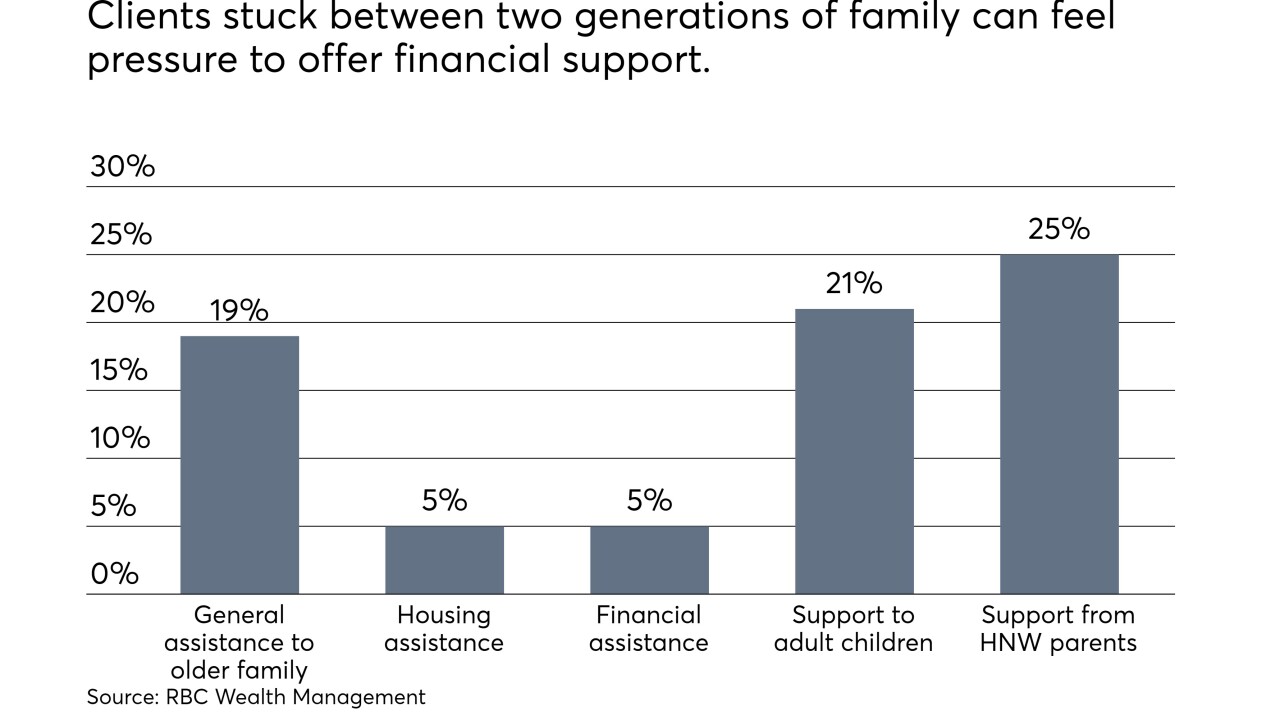

About 19% of adults support elderly family members in some way.

February 13