-

The drastic changes are shaking up the status quo of estate planning. Here’s how financial planners need to change their approach.

January 3 -

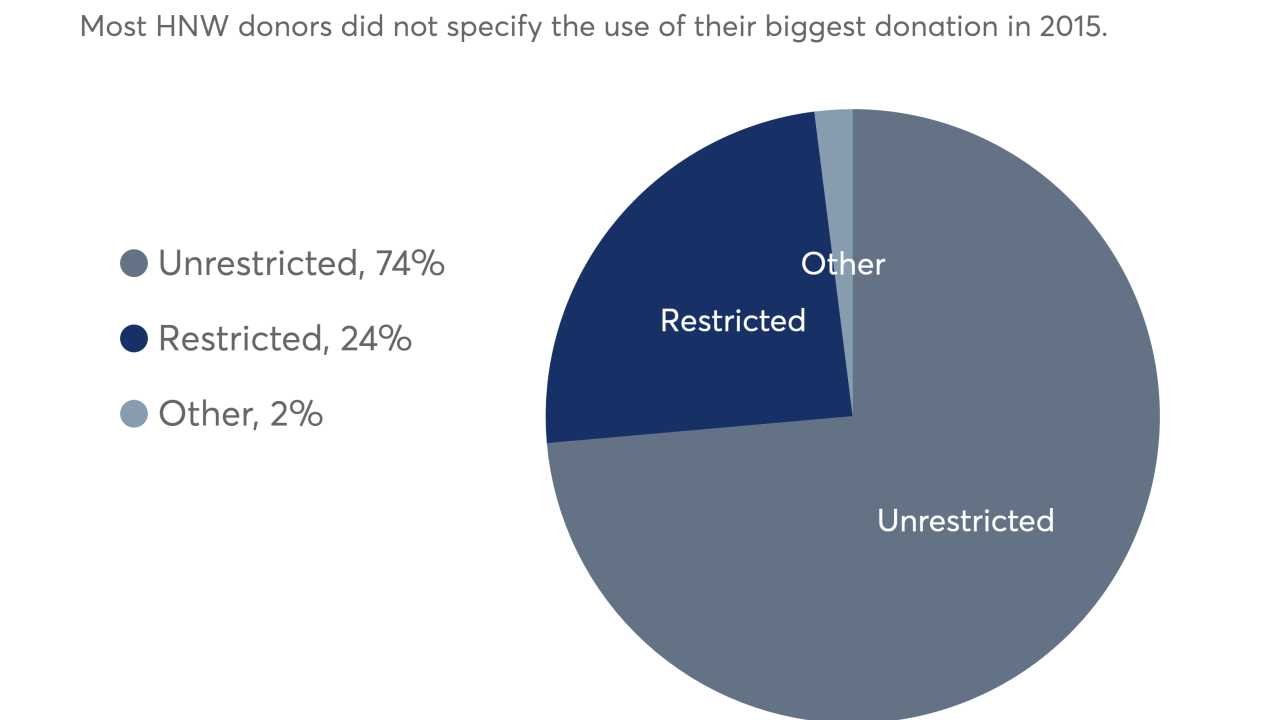

Become a go-to source for philanthropic clients, and your practice could grow.

October 31 -

Planners should help clients navigate complex transactions to ensure risk is mitigated as much as possible.

October 26 -

Five ways to build a successful charitable planning practice.

October 24 CEG Worldwide

CEG Worldwide -

The federal exemption does not cancel out key planning matters affecting everyone at death.

October 24 -

Details matter, explains an expert, like where their boat is docked.

September 13 -

Here’s what advisers should know about this increasingly available option, so they can help clients make the most educated choice.

May 31 -

For ultrawealthy clients who own property, an adviser's starting point should be an irrevocable trust. But you can't stop there.

May 30 -

Most fortunes disappear by the time grandchildren have taken control.

May 22 -

Bequests, endowments and other gifts demand expertise beyond traditional tax and estate help.

April 11