-

IRA investors should consider implementing a charitable lead annuity trust when converting some of their funds into Roth to mitigate the tax bite.

August 14 -

The withdrawals can be taken early in the year, late in the year or in installments throughout the year. Each approach has advantages to consider.

August 11 -

Congress may have a difficult time closing tax code loopholes that benefit households more than corporations, an expert suggests.

August 11 -

New bond ETFs from the firm use alternative weightings to chase "superior risk adjusted and total returns” compared with market-cap weighted products.

August 11 -

-

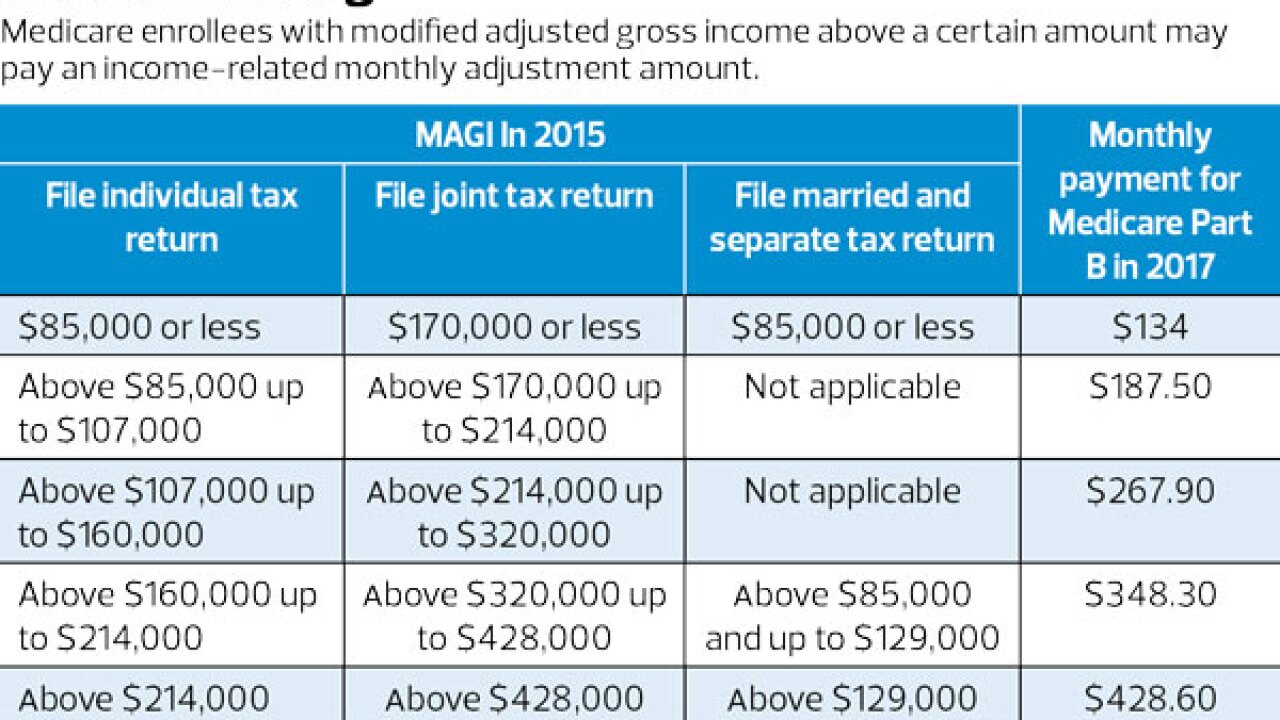

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

Surviving spouses will either receive their own Social Security benefit or the survivor's benefit, whichever is higher. But they also may get pushed to a higher tax bracket, which. in turn, could mean higher taxes on Social Security benefits.

August 7 -

If clients tap their Roth accounts at the wrong time, even after retirement, they could lose out on some potential tax benefits.

August 4 -

Yes, advisers can invest these funds in nontraditional assets, but you must understand the risks before giving clients the OK.

July 28 -

The agency says its adoption of WebEx will allow for improved outreach with clients in the more rural regions of the country.

July 28