-

Investors betting on a post-pandemic world are sending cash to riskier companies acutely sensitive to the economic cycle.

April 16 -

Hundreds of strategies that outperformed in backtesting are failing to live up to their hype once they are packaged up and sold as ETFs, a study finds.

September 3 -

The pandemic has sealed the fate of small, niche offerings that have failed to gain traction.

May 11 -

The smart-beta pioneer and sub-advisor to money managers has re-calibrated its forecasts after the coronavirus-induced crash reshaped markets.

April 9 -

The investing strategy “is close to saturation,” and the cost of keeping up with the competition may be to blame, a new study suggests.

February 19 -

The activity began last Friday when 6.4 million shares hit the tape, fueling a record daily inflow for the fund.

July 29 -

Real estate, communications, utilities and consumer staples funds have seen the most appetite, with every other sector experiencing outflows.

July 2 -

Fear of a liquidity plunge outweighed political risks in a recent JPMorgan survey.

June 5 -

Asset managers are seeking alternatives to standard mutual fund products.

May 6 -

Issuers are creating multi-factor funds that offer exposure to several return-enhancing characteristics.

April 3 -

Asset managers are increasingly using the products for targeted adjustments and risk management, a survey finds.

February 27 -

A record number of fund openings and closures were reported last year. What does this mean for the future of the industry?

January 4 -

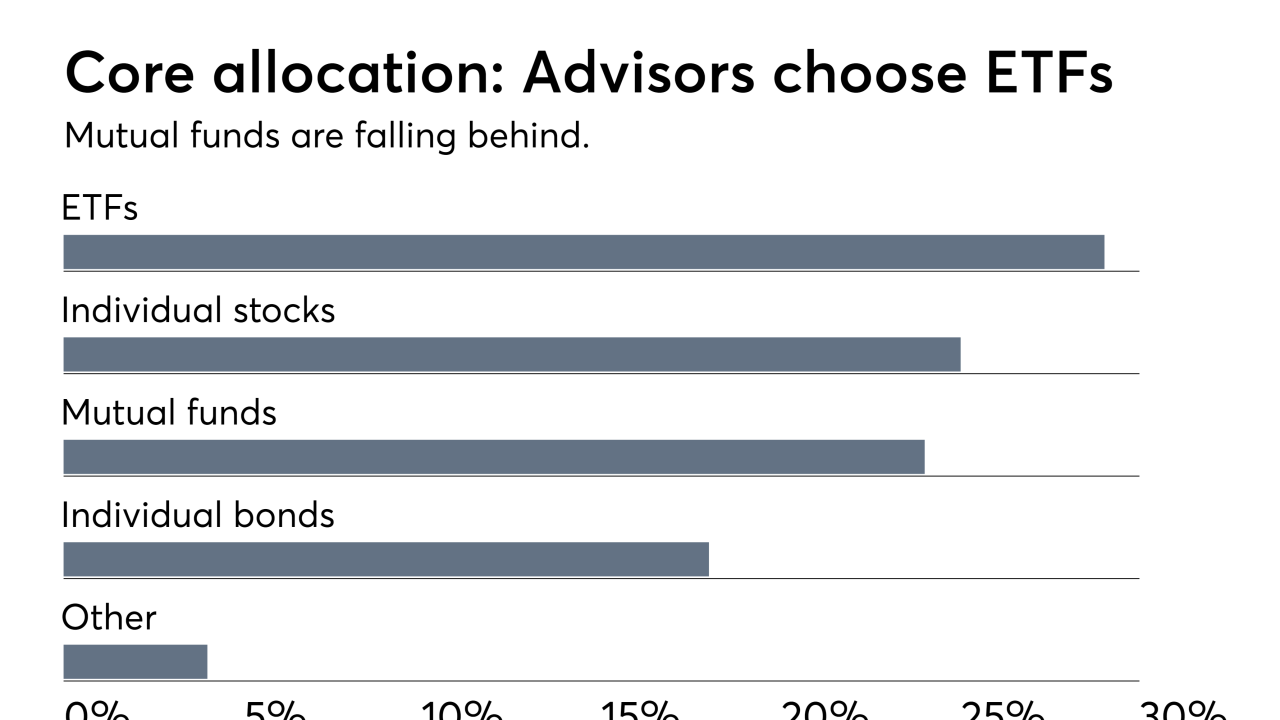

Advisors are planning to increase ETFs as a primary option, the firm finds. Plus, “the most exciting numbers in the survey.”

October 31 -

More than half of advisors would consider buying a smart beta muni bond ETF for clients, according to a Columbia Threadneedle poll.

September 6 -

In light of recent losses, risk models will tell managers to cut their exposure to the factor, which could cause a systematic sell-off.

June 26 -

The planned closures come just months after the firm introduced a lineup of artificial intelligence-driven products.

June 19 -

The once-hot investing strategy seems to have cooled off. Advisor Allan Roth hasn't lost all hope, however.

June 12 Wealth Logic

Wealth Logic -

The investment research firm debuted three new data sets that can help advisors evaluate investment options for clients.

June 11 Wealth Logic

Wealth Logic -

Outliers aside, fundamental indexing is still more expensive than old fashioned capitalization-weighted indexing.

June 11 -

One thing that excites Dana D’Auria about the industry right now is factor investing, which helped draw her to Symmetry Partners 12 years ago.

May 17