6 Planning Differences for Female Clients

Yet women face some challenges that men do not. The study, titled "Women: Investing With A Purpose," calls out six planning differences that advisors should consider when working with female clients. (It also identified one thing the industry is getting wrong about female clients.)

Page through to see the full list, or click here to see a single-page version. -- Maddy Perkins

Image: iStock

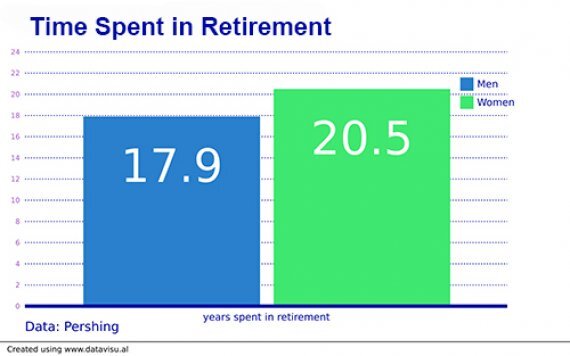

1. Women live longer than men.

On average, a 65-year-old woman is likely to live longer than a man of the same age by an average of 2.3 years, according to the study. At the most basic level, this suggests that single female clients need to put aside more money for retirement than a single man would. But advisors should go beyond the basic level ...

Image: iStock

2. Women face higher tax rates.

For many older couples, the husband managed the finances on his own -- which means a surviving female spouse may need extra help after her husband's death.

Image: iStock

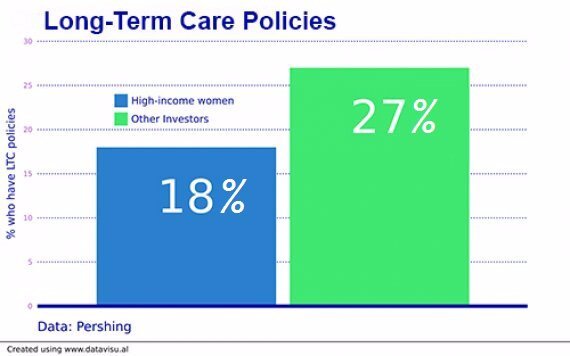

3. Women can experience higher medical costs.

And even wealthy women are less likely to have long-term care policies. Only 18% of high-income women have a long-term care policy, compared to 27% of all other investors, according to the study.

4. Women still make less.

But there's change on the horizon: The hourly earnings of women aged 25-34 are now 93% those of men -- and single, childless women in metropolitan areas out-earn men by 8%, the study reports. Income parity may not come soon enough for some of your current clients, however.

5. Women experience gaps in employment.

The implication for advisors: You may need to develop a plan that provides female clients with a financial cushion -- one that can give them more freedom and choice when considering work opportunities.

Image: iStock