6 Things Clients Get Wrong About Investing

Here are six widely held financial biases; for each one, we offer a chart designed to explain the bias and prompt a productive discussion with the client. (Click through to see the full list, or view as a single page here.) -- Carla Fried for YCharts

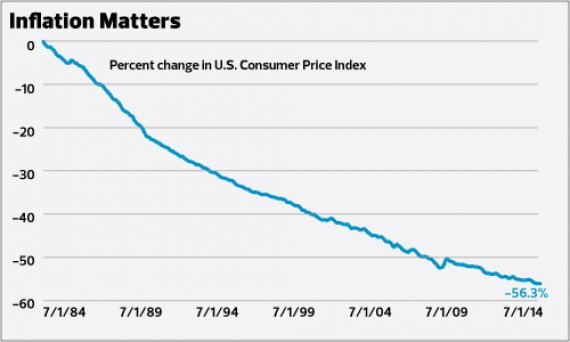

"I'll have enough money."

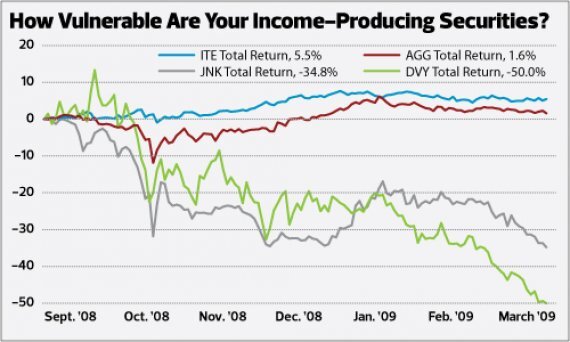

"I can handle that loss."

"I know stocks will keep rising."

The red line on the chart above shows the percent of bearish sentiment among investors; note that it's now near a 10-year low. Help your clients be courageous when others are fearful and vice versa.

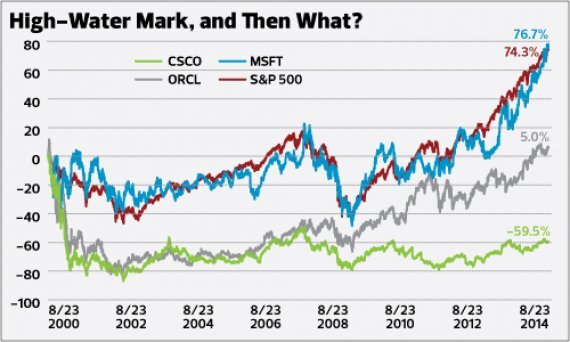

"I know how to pick a winner."

Help clients learn to beat overconfidence, objectively checking their decisions as conditions change.

"I know when to sell and when to stand pat."

"I know that stock is coming back."

You can download a copy of the entire report by clicking here. Carla Fried has covered investing for more than 25 years, writing for The New York Times, Bloomberg.com and Money Magazine. Her twice-weekly YCharts columns are available at: ycharts.com/analysis