Elijah returned to Financial Planning in 2025 after working as a summer intern with FP in 2023. He earned an undergraduate degree from Berea College in Berea, Kentucky, and a master's degree in data journalism from Northeastern University in Boston. His work has been published in Bloomberg News, The Boston Globe, The Texas Tribune, WCVB, WBUR, The Drive and Autoblog.

-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

1h ago -

President Donald Trump unveiled a federal plan offering government-backed retirement accounts with a $1,000 annual match for workers without employer-sponsored plans.

February 25 -

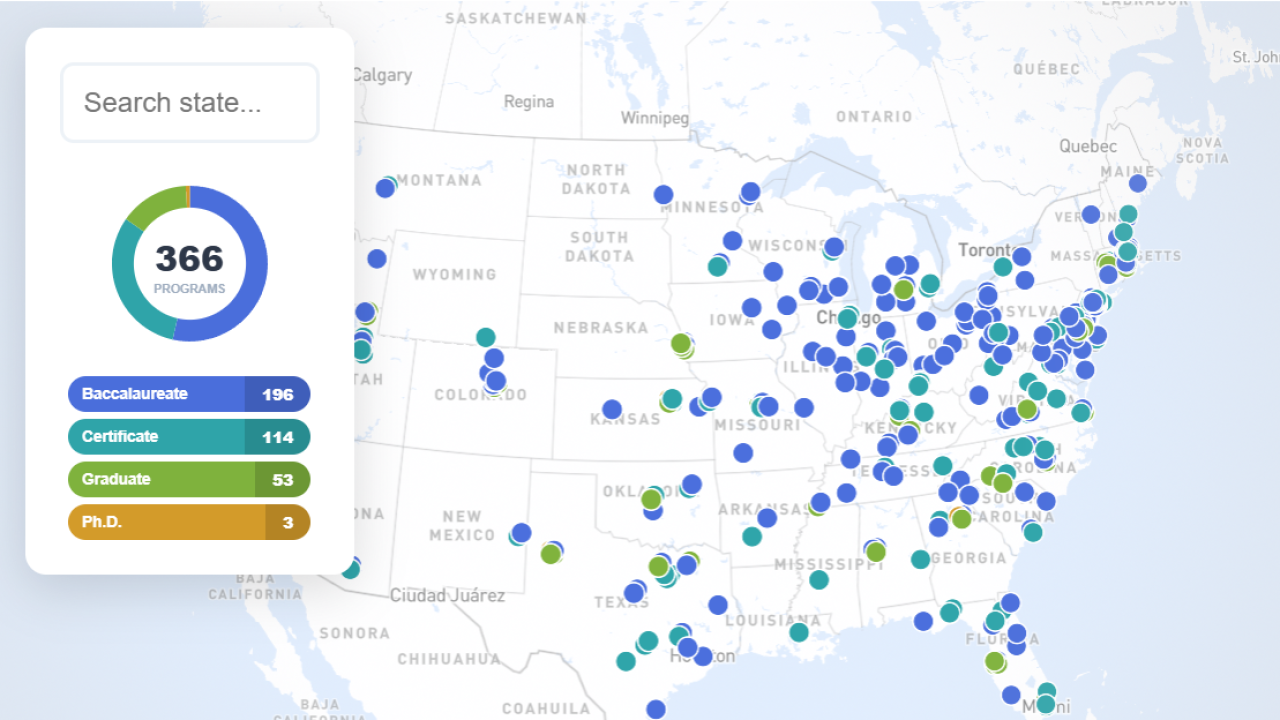

The growth of CFP Board-registered programs, from certificates to doctoral programs, reflects the industry's shift away from commission-based models.

February 25 -

New research shows visuals and gamified tools can dramatically boost client understanding and engagement around complex retirement rules.

February 24 -

Small oversights when drafting a trust can snowball into major headaches for clients and their heirs. Here's how advisors can help.

February 23 -

A new bipartisan bill would exempt retroactive Social Security payments from federal taxes, easing a surprise financial burden for millions of retirees.

February 20 -

More retirees are going back to work amid financial pressures and economic uncertainty, an AARP survey finds. Advisors weigh in on when "unretiring" makes sense.

February 17 -

New proposals in seven states could soon subject over half of all U.S. millionaires to targeted high-earner tax rates.

February 13 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

With clients expecting more from their estate planning, financial advisors are becoming the go-to source for a plurality of investors, a new survey shows.

February 10 -

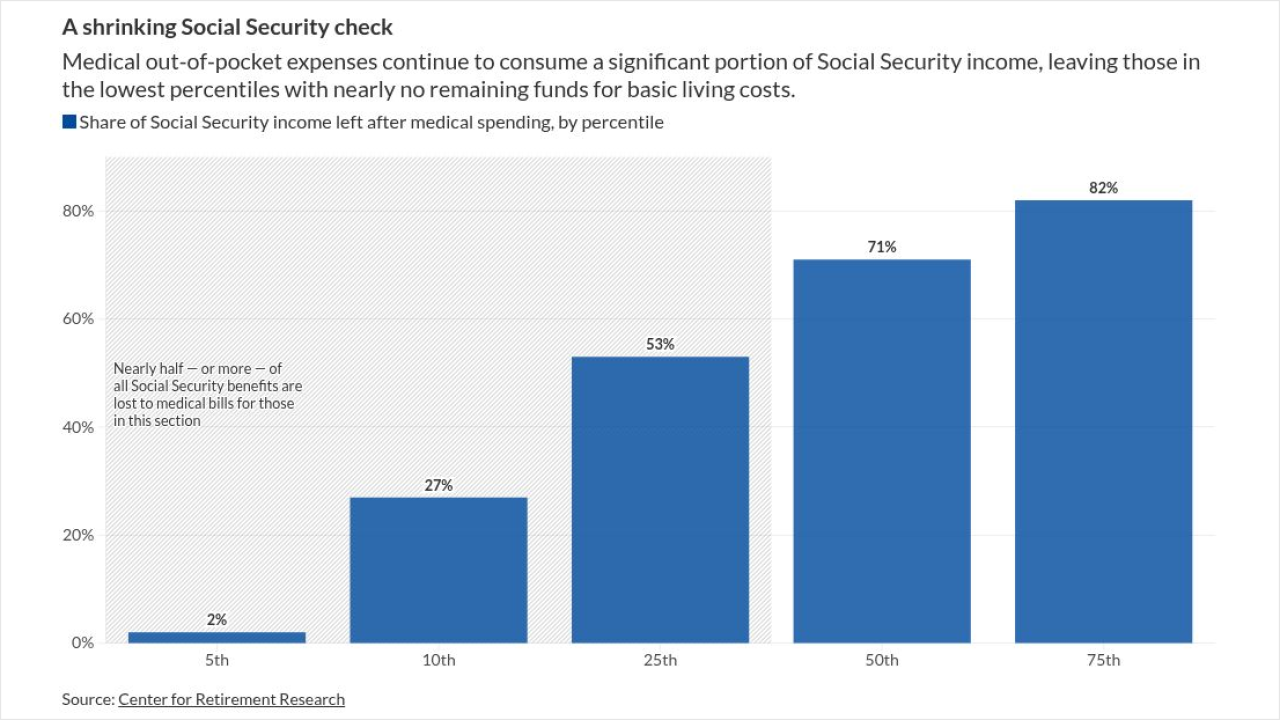

Medical inflation is projected to climb at double the rate of Social Security cost-of-living adjustments, leaving a growing number of retirees with a shrinking share of their benefits.

February 9 -

Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

February 6 -

UBS Americas reported $14 billion in net new asset outflows in Q4, marking its worst period since the firm announced major compensation changes in November 2024.

February 4 -

Raymond James tapped industry veteran Mark Buchanan to lead a new ESOP advisory group focused on tax-advantaged succession strategies.

February 3 -

As more financial advisors near retirement without clear succession plans, some RIAs are turning to ESOPs and Section 1042 rollovers to exit on their own terms.

January 30 -

In the coming weeks, the CFP Board will launch a working group to reconsider whether a bachelor's degree should remain a requirement for CFP certification.

January 29 -

Stifel CEO Ron Kruszewski said a surge in advisor recruiting and record wealth management results could lead the firm to invest even more in hiring in 2026.

January 28 -

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

Fixed-income ETFs are rapidly gaining popularity among advisors, driven by growing familiarity, diverse offerings and strong asset flows, new Cerulli research shows.

January 22 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21