16 Ways Advisors Are Using iPads to Improve Their Business<br><br>

Most advisors find that the iPad can help them be more productive, but they are just scratching the surface when it comes to using the iPad to increase their revenue, differentiate their services and improve the client experience.

Here are 16 ideas to help advisors use their iPads to improve their business and leverage technology to set them apart from competitors.

Sources: Matt Iverson, director at Boulevard R, Ryan Wibberley, founder and Michael Fein, managing partner, at CIC Wealth Management, Kurt Rozman, president of Rozman Wealth Management, Michael Silver and Eric Sheikowitz, founders and senior managing partners at Focus Partners, and John Stuart, chief information officer at Beverly Hills Wealth Management.

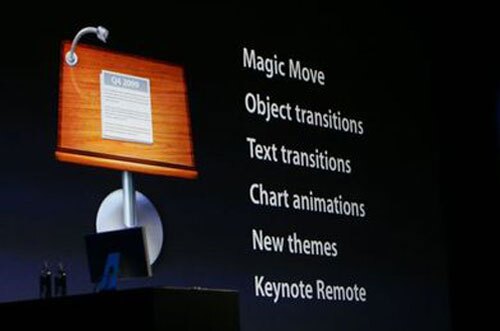

1. Develop Polished Prospect Presentations<br><br>

It is easiest to work in Keynote on a Mac and then import the presentation to your iPad. You can also import existing PowerPoint presentations into your Keynote iPad app and then touch them up.

If Keynote's existing presentation themes don't work for you, you can easily create your own or purchase them through a site that does.

2. Present From iPad to iPad<br><br>

This puts you in the driver's seat and lets your presentee ride along as you control the flow of information appearing on their iPad. It also makes for a more relaxing presentation environment where you don't have to lean over to make your point.

An iPad app that is designed for this type of presentation is Idea Flight, which connects iPads using a WiFi network.

3. Meet Virtually and Save Time<br><br>

This allows you to work from outside the office as long as you have a professional looking background such as a home office. Don't try this from the kitchen table.

A simple solution for meeting is Skype, but for a more professional presentation environment consider using Fuze Meeting, WebEx or GoToMeeting.

4. Access Client Information From Anywhere<br><br>

You can also access your mobile CRM programs (RedTail, Junxure, etc.) to pull up client information prior to meetings or to consult during meetings.

To store files, consider using GoodReader. This iPad app also lets you annotate and mark up documents.

Note: Check with your compliance department to make sure that these apps meet their requirements.

5. Give Your Clients Access to Their Accounts<br><br>

Apps that can help you with this include Orion Advisor Services and Black Diamond.

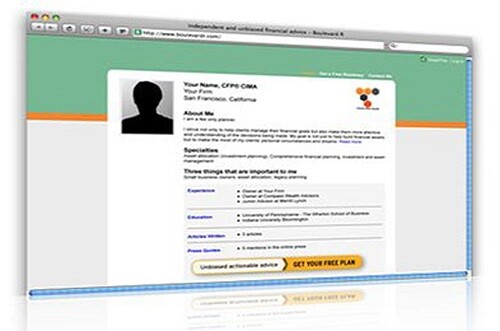

6. Differentiate Your Firm With a Custom App<br><br>

The key here is to get your brand in front of as many prospective clients as possible. If you also do marketing events, this is a great way to engage prospects and demonstrate that you offer something different than most advisors.

It's a big bonus if you can gather prospect information with your app, so that they are engaged and immediately qualified. One such iPad app that is branded for advisors is the Amp app from Boulevard R.

7. Create Urgency in the Sales Process<br><br>

You can use apps like goalGetter or Amp to run an initial assessment while you are sitting with prospects so that they can see if they are on track to reach their goals.

This sort of quick projection can wake prospects up to the fact that they might not be on track and give you an opportunity to present how you can help them. These apps are designed to move prospects from a first meeting to an in-depth interview and proposal presentation.

8. Build Your Lists at Events<br><br>

Mailchimp has a Chimpadeedo app to allow people to sign up for your lists at your events and then import them directly into your Mailchimp account.

9. Keep Up On Industry News<br><br>

You can even save pages in Safari for viewing later on when you do not have an Internet connection.

10. Get Client Signatures More Conveniently<br><br>

11. New Ways to Connect With Prospective Clients<br><br>

12. Build Better, Longer-Lasting Personal Relationships<br><br>

Advisors are able to easily accommodate clients meetings can be held in the comfort of a clients home, with the advisor having access to all relevant data; documents can be signed via the tablet, providing a quick, paperless, record; and older clients who have limited eyesight are able to comfortably view and understand a presentation or important account information.

Additionally, the iPad offers an easy way for clients to enter information such as birthdates, hobbies, and family/professional connections all of the data advisors need to know to form personal relationships.

13. More Cost-Effective, Interactive Presentation Formats<br><br>

The dynamic and interactive nature of these devices allows advisors to display and highlight information in a way that cannot be done with traditional printed presentations.

14. Greater Accountability, Transparency With Clients<br><br>

15. A Personalized Approach to Client Service<br><br>

Real-time feedback from manipulating information such as retirement age, child data, real asset values, or forecasting small business valuations connects a client directly with their plan for a more effective implementation strategy.

16. Increased Mobility<br><br>

Apps such as Fidelity WealthCentral recreate the primary function of the WealthCentral platform with features such as trading, account views, and household segmentation, empowering the wealth manager on the go.

Also see:

11 Essential Tech Tools for Advisors

10 Must-Have Mobile Apps for Financial Advisors

10 Online Tools Advisors Cant Live Without

10 Critical Social Media Tips for Advisors