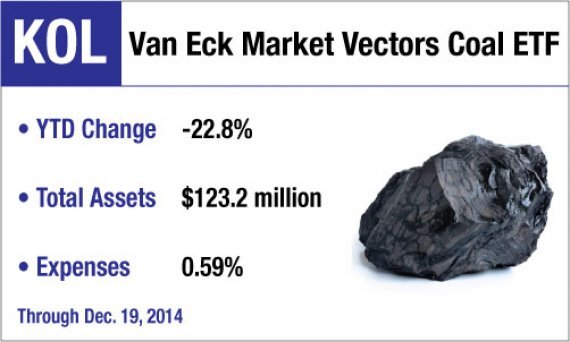

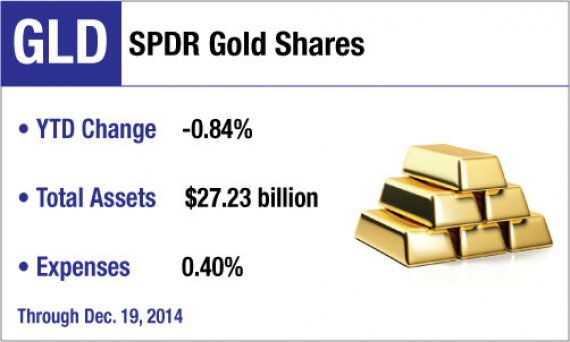

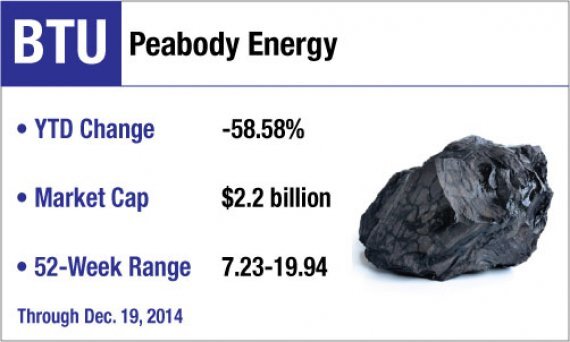

Gold or Coal: Which Fits Your Stocking Best?

December 22, 2014 8:53 AM

Here's how commenters such as the AARP, SIFMA, FSI, the Consumer Federation, NAPFA, the CFP Board and others view the Department of Labor's retirement advice regulation.

In the first three months of 2024, both profits and client assets reached new heights at RayJay's Private Client Group.

Last year, almost $1 trillion flooded into money market funds. Here are the 20 that have grown the biggest.

Amid a busy April for big hires, compliance tech provider COMPLY and wealthtech platform TIFIN have brought on industry vets Michael Stanton and Jeannette Kuda, respectively, aiming for strategic growth.

Turns out clients are as mistaken about tax preparers as they are about taxes.