In terms of accumulated wealth, baby boomers have outdone their parents in many instances – and likely their children too. But converting those assets into spendable retirement dollars may become more challenging for advisors due to boomers' debt, rising living costs and a potentially crowded housing market in the future.

"Many boomers will have to go into home equity," says Ben Mandel, an executive director and global strategist of multi-asset solutions at J.P. Morgan.

Mandel is a co-author of a recent J.P. Morgan study on baby boomer balance sheets. His paper reports that the median baby boomer household had roughly $253,000 of assets in 2013, considerably higher than their parents had going into retirement and probably much more than younger generations will accumulate. However, about $187,000 of those median assets are nonfinancial, primarily in residential property.

What's more, "baby boomers have been much more active users of debt," says Mandel. Equity in the median baby boomer's primary residence is only about 60% of the home's value.

"I was surprised to see so much mortgage debt for boomers," Mandel notes. "That may make it more difficult to tap their home equity, perhaps limiting their use of reverse mortgages."

Mandel and co-author Livia Wu, a quantitative research analyst at J.P. Morgan, estimate that for the bulk of boomers, income streams from Social Security and drawing down financial assets would fall in the $32,000-$36,000 per year range.

POTENTIAL CASH SHORTAGE

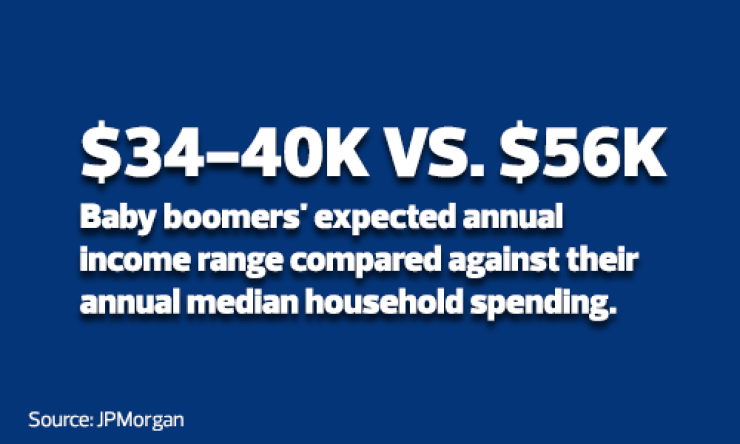

Counting expected gifts and bequests from the preceding generation brings boomers' expected annual income only up to the $34,000-$40,000 range. Yet the median boomer household spends nearly $56,000 a year. If boomers' want to maintain that lifestyle, more cash will have to come from somewhere, and the most likely source of that cash will be liquidating home equity. Worse, boomers' need for cash may be even greater, if they seek to "smooth imbalances" between generations by helping younger people financially, Mandel points out.

If the report's conclusions are borne out, what will this mean for advisors?

"It's likely that boomers will first draw down financial assets," says Mandel. "People tend to have inertia. They'll want to live in their homes as long as they can. Therefore, advisors should focus on developing portfolio drawdown strategies."

Across the industry, advisors and firms have already put a lot of focus on safe withdrawal rates.

"Other factors should be considered, such as having the right mix of assets in retirement," Mandel says. "On the one hand, boomers might want to de-risk, as they grow older, which would mean more bonds. On the other hand, as a portfolio gets smaller, advisors may want more emphasis on growth, which would mean more stocks."

In addition, a real estate sell-off by millions of boomers would create a "long-run headwind in the property market," as Mandel puts it, thus holding down prices and perhaps leading to disappointing outcomes for retirees. With that in mind, advisors may do well to become more familiar with aspects of residential real estate, from downsizing to relocation to obtaining reverse mortgages.

For boomers to realize their ideal retirement, advisors may need to find new levers to pull in order liquidate the balance sheet, says Mandel.

Read more:

-

Helping Clients Help Charities -

Help Clients Avoid Pitfalls of a Retirement Paradise -

Successful Budgeting for Clients Who May Not Have Enough to Retire