-

One easy measure stick is the 25-times rule, which says simply that clients are prepared if they've saved at least 25 times their annual spending.

February 24 -

Advisers might want to steer their practices away from doctors and toward millennials.

February 23 -

A reverse rollover from IRAs to other retirement plans is an option that enables investors to improve their tax efficiency.

February 22 -

The proposed new Roth health savings account is designed to help people cover health insurance premiums and out-of-pocket medical costs.

February 21 -

Retirees who earned at least 40 work credits are entitled to Medicare Part A and can pay for Part B through their Social Security checks.

February 17 -

Blooom CEO Chris Costello says the firm will not develop a white labeled version of its offering, as other robos have done with their platforms.

February 17 -

With an additional $9 million in backing, the online firm's CEO and co-founder Chris Costello says the goal is to grow to 50,000 clients by the end of the year.

February 15 -

Clients who have lost track of old 401(k) accounts may get help from the National Registry of Unclaimed Retirement Benefits, a subsidiary of a firm that processes retirement checks.

February 13 -

A new comment period would give the administration time to prepare for legal challenges anticipated after it puts a delay into place, one expert says.

February 10 -

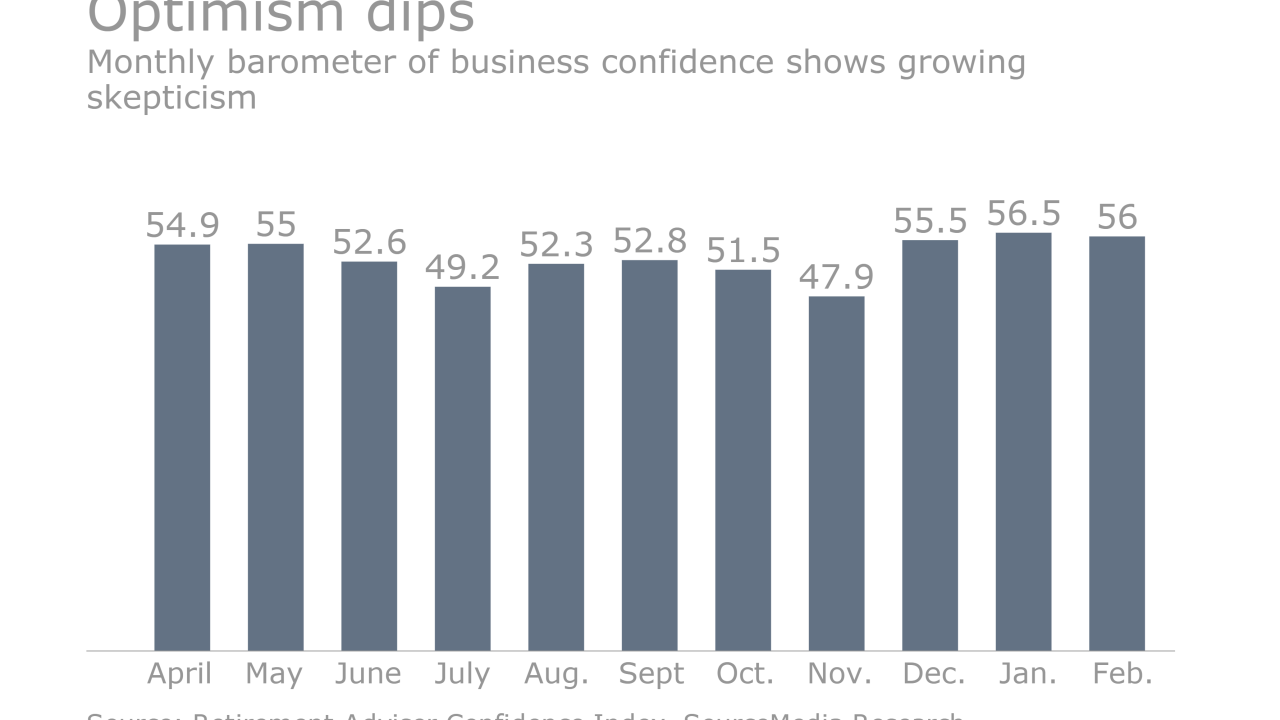

-

One way for clients to avoid or minimize their capital gains tax is to hold investments in tax-advantaged retirement accounts, such as IRAs and 401(k) plans.

February 8 -

Firms must ensure that best interest practices are part and parcel of every investment deal.

February 8 -

401(k) plans in small companies are a "blue ocean opportunity" for advisers.

February 6 -

Early withdrawals from retirement investments can trigger a hefty penalty.

February 2 -

Many workers think hey are not allowed to contribute to a 401(k), a traditional IRA and a Roth IRA in the same year, which is untrue.

February 1 -

Retirees on Social Security can expect the government to garnish a portion of their benefits if they fail to make student loan payments.

January 31 -

Clients should consider moving to a state that does not tax ordinary income, Social Security benefits or pension payouts.

January 27 -

First-time home buyers can withdraw as much as $10,000 from a Roth account without paying taxes and penalties if the account is at least five years old.

January 26 -

The move to reintroduce legislation that seeks to adjust the cap on Social Security wages and to raise the payroll tax is a step in the right direction in fixing the program's solvency woes, says expert.

January 25 -

Moving investments into these accounts may optimize returns and boost savings. Plus, know your IRAs and the impact of Trump's proposals on income brackets.

January 25