-

Given recent renewed interest in the medium, top enthusiasts' collections can be worth six figures. But quality generally beats quantity, and it pays to be informed about which rare pressings are most sought-after.

February 13 -

The "sticker shock" of tax rates and IRS reporting rules may place the recent record highs and falls in a different context for investors, one expert says.

February 11 -

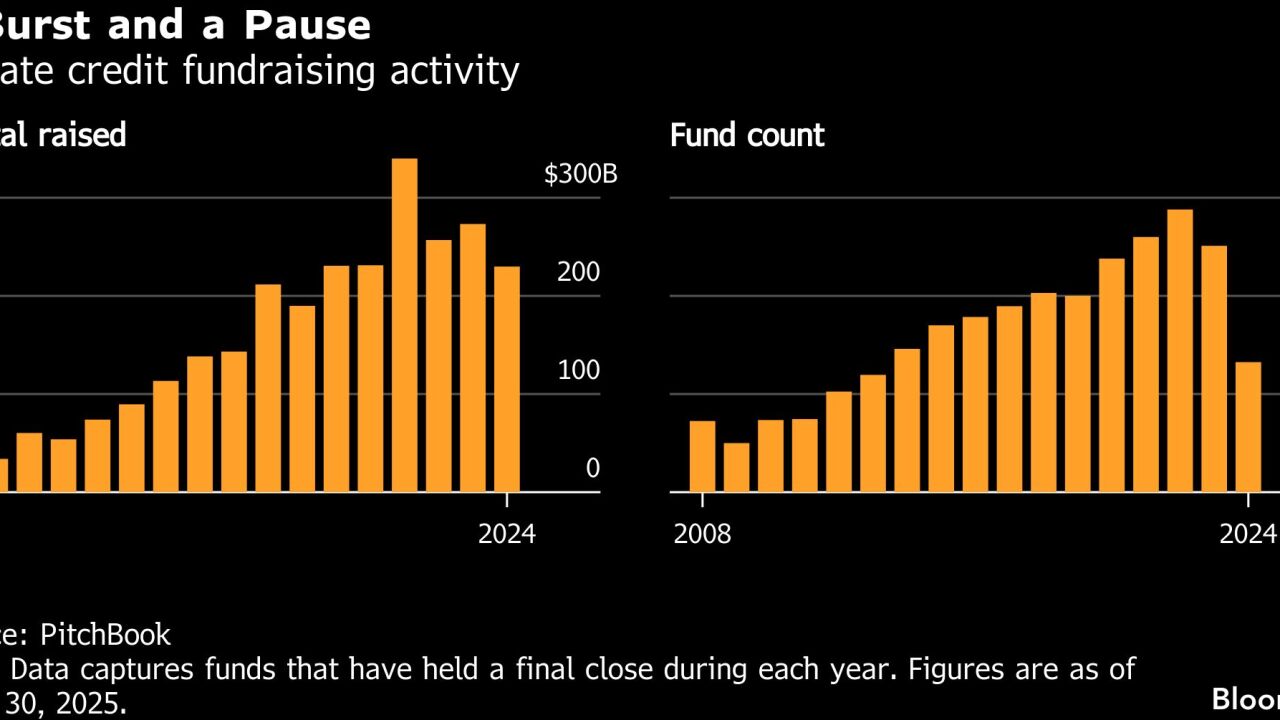

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

February 6 -

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Even as markets sometimes touched all-time highs, there was a general feeling of uncertainty among advisors and clients. Experts say that's why several tried-and-true strategies became more attractive this year.

December 23 -

From crypto to private markets to AI and beyond, here are the investing trends and themes to watch in the new year.

December 16 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

Advisors and experts say finding the right rare currency to invest in can add diversification to a portfolio. But scams are rampant, so buyers should beware.

November 17 -

Sports are in for the ultrawealthy; paintings, out. Some 20% of 111 billionaire families served by the Wall Street giant now own controlling stakes in sports teams.

November 6 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

Morgan Stanley acquires EquityZen, a private share trading platform, expanding its offerings for fast-growing startups.

October 29 -

Issues that feature a character's first appearance or death — or even a popular artist or writer's first publication — can command high prices. But a volatile short-term investment market and meticulous storage demands remain concerns.

October 8 -

Wine, whiskey, cars, handbags, guitars and watches are loved by many clients. And they may be worth serious money, too.

October 2 -

For clients holding crypto, about half have experienced notable losses. But 70% have experienced notable gains, the latest Financial Advisor Confidence Outlook found.

September 24 -

Even as Canadian investor and "Shark Tank" co-star Kevin O'Leary broke records last month with the $13 million basketball card he helped purchase, experts warn that there are pitfalls.

September 22 -

The regulator's Investor Advisory Committee said policymakers could abandon asset and income thresholds for determining who can put money into private markets and instead adopt a "sophistication" standard.

September 22 -

Merrill and Bank of America Private Bank seeks niche private equity opportunities for its ultrawealthy clients, while Goldman looks to retirement savers and Wells Fargo to everyday investors.

September 4 -

As access to and interest in alternative investments grow, financial advisors could differentiate themselves by earning the CAIA mark.

September 3 -

Rare bottles can go for several times the original price, but time, due diligence and proper storage are required to maintain these special alternative investments.

August 28 -

Volatility, concerns over security and custody, and a lack of clear regulatory framework are the key barriers to adoption, according to Financial Planning's August Financial Advisor Confidence Outlook survey.

August 20