-

Retirement investors may want to adopt the billionaire's investing strategy if their risk tolerance allows them.

February 22 -

Seniors who reach the age of 65 and are in good health have the option of opening a Medicare medical savings account.

February 21 -

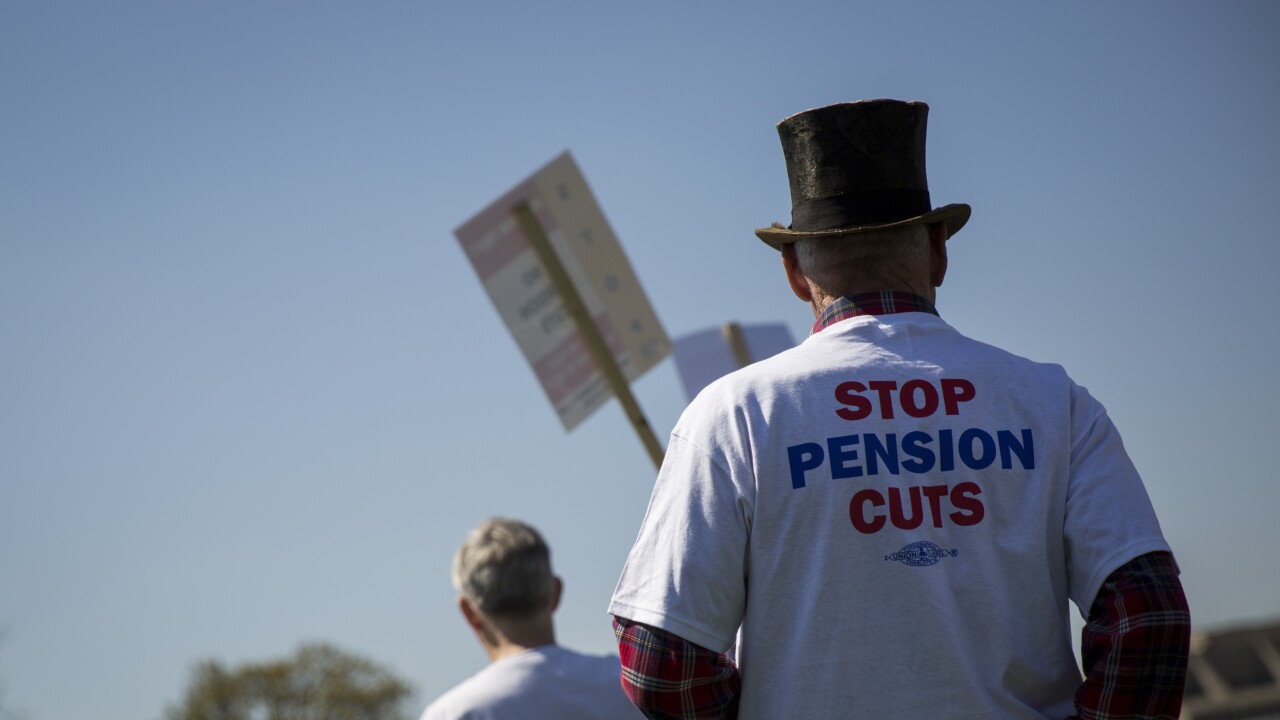

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

The proposed budget includes a provision that would give Medicare recipients the option to contribute to a health savings account, which would offer various tax benefits.

February 15 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

A partnership could extend a firm's reach, while ethical investing portfolios offer clients more options.

February 13 -

Younger investors may see the market's swing as just another fluctuation in the market, while assuming that time is on their side. Older investors, on the other hand, may be far more stressed.

February 12 -

The number of accounts with $1 million or more increased to 150,000 in the fourth quarter of 2017 from 93,000 recorded in the same quarter the year before.

February 9 -

Moving to a retirement community is a great option for seniors if they don't have enough support from family and friends and they have a sizeable nest egg to finance such an arrangement.

February 5 -

Retirees living overseas can still claim Social Security benefits, but they must see if their country of residence requires them to have a local bank account.

January 26 -

The rewrite could affect how these firms value potential buyout targets.

January 23 -

IRA investors can draw funds from their accounts tax-free if the money will be used to fund college tuition and other related costs.

January 22 -

Clients shouldn't let their egos get in the way when making investment decisions. They will be better served with a dispassionate asset mix that's rebalanced annually, rather than making investing decisions "in purely personal terms."

January 19 -

While the stock market remains strong, clients should stress-test their portfolios and ensure that they reflect their risk tolerance levels.

January 18 -

If estate planning documents don't use the right language, it can sometimes lead to costly and time-consuming alternatives.

January 17 -

Adding five years to their working years will enable clients to replace their pre-retirement income by up to 90% instead of 60% in some cases.

January 16 -

Seniors are less likely to itemize tax deductions this year as a result, an expert says.

January 16 -

Annual contribution limits for 401(k) plans have been raised to $18,500 this year, with catch-up contribution limits capped at $6,000.

January 12 -

In a crowded robo market, firm co-founder Rob Foregger says the firm chose to focus on enterprise retirement product needs.

January 10