Artificial intelligence

Artificial intelligence

-

The platform can offer a wide audience, but with serious content moderation and other concerns, is remaining active worth it?

January 8 -

While 2025 was a transformative year in wealth management, further implementation of AI tools into technology stacks means advisors' workflows in 2026 are sure to change.

January 6 -

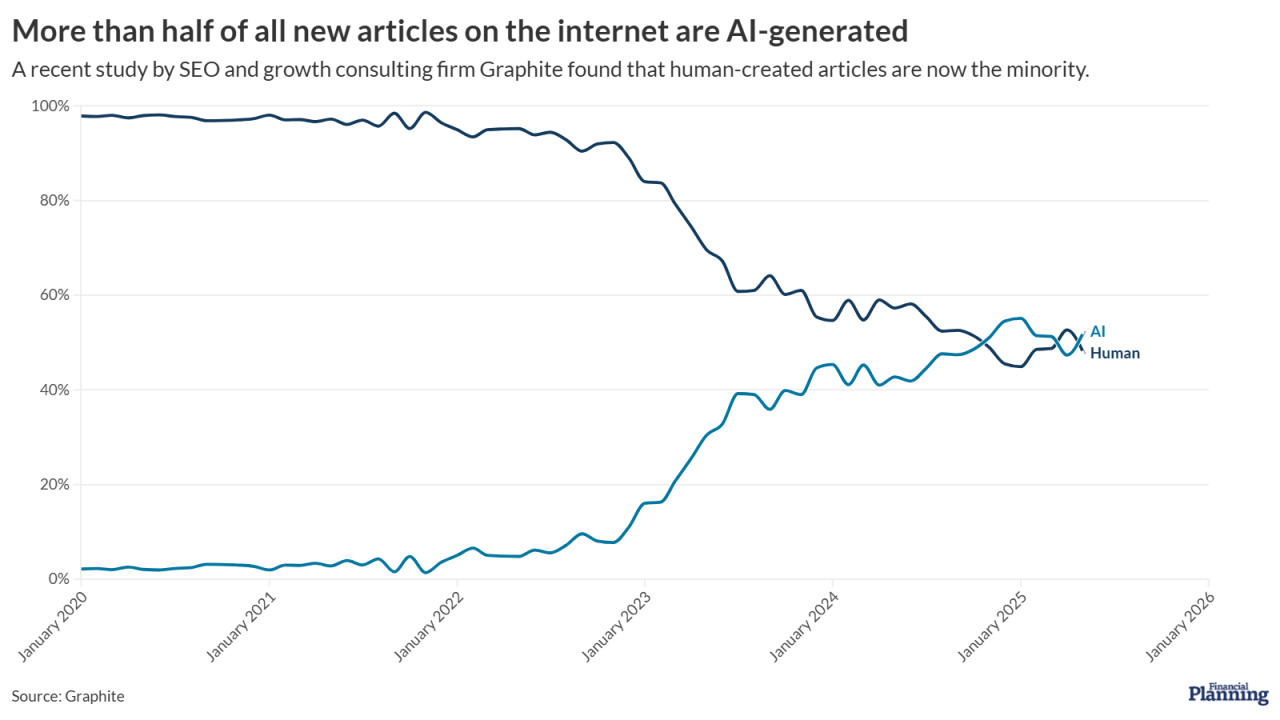

A recent study found that more than half of all new articles on the internet were AI-generated. How can advisors help their own content stand out when this deluge threatens to drown them out?

January 5 -

It's no surprise that AI saw big gains, but some longstanding winners saw their fortune flag.

December 31 -

These are the stories and issues that readers gravitated to in the last year.

December 26 -

Artificial intelligence has been integrated in the back offices of many firms. In 2026, expect to see it make the leap to the front office.

December 22 -

Yes, AI is saving many advisors time and helping them reach prospects. But some say the rapid rate of adoption and automation could put them out of a job in the future.

December 12 -

In a move some industry observers call "dangerous and irresponsible," the administration is taking down consumer protection guardrails that have been put up by states like California and Colorado.

December 12 -

For the first time in an annual compliance report, FINRA devotes a section to AI risks, including from third-party vendors and scammers.

December 9 -

Artificial intelligence isn't an algorithmic takeover but an essential wealth management tool.

December 2 -

UBS chief data and analytics officer Joe Cordeira says AI won't replace advisors. But it can help them by providing little nudges to do everything from rebalancing a portfolio to wishing a client happy birthday.

December 1 -

The hidden costs of free AI tools go beyond simple feature upgrades. Non-enterprise versions of AI tools often lack advanced data protection features.

November 21 -

The integration eliminates the need for a third-party intermediary between the two platforms, allowing for a direct connection between financial planning and tax, estate and insurance data.

November 18 -

Scary good voice cloning technology means advisors can no longer believe what — or more accurately, who — they're hearing on the phone. Rigorous verification protocols are the new key to gaining client trust.

November 12 -

Getting it right can help prospects find your firm's website, according to FMG Suite's Samantha Russell at ADVISE AI.

November 11 -

Time savings is generally understood to be among the main advantages of AI note-takers. But advisors who have incorporated them into their practices said the benefits go much deeper.

November 7 -

New tools go beyond simple automation. They're helping advisors deliver more meaningful value in client meetings.

November 6 -

Bad things can happen when advisory firm employees experiment with shiny new AI applications. An innocent "test drive" could trigger data breaches and compliance snafus.

November 6 -

Merrill wealth co-head Eric Schimpf says the firm does about as good a job as its rivals in drawing in net new assets. But given Merrill's relationship with Bank of America, "We can do better."

November 5 -

AI note-takers have become increasingly common among advisors. So has the use of wearable AI recording devices among the general population. What happens when the tables are turned?

November 5