A classic "Chappelle's Show" skit features a fake ad for a "home stenographer," someone who records personal interactions and reads them back on command.

With the advent of wearable artificial intelligence devices like the

Many financial advisors have jumped in with both feet on

As these tools and wearable devices spread, the question of who's recording, and who needs to know, is getting more complicated.

Who needs whose consent to record

In her practice, Yelena Ambartsumian, founding attorney at privacy and AI governance law firm

U.S. law on the recording of conversations varies at the federal and state levels. Federal law requires only one-party consent, meaning as long as a party to the conversation is aware of the recording, it is legal, said Gray Ellis, a North Carolina

READ MORE:

Financial advisors must follow the

"There are different ways to defensibly acquire consent, including through implicit consent, such as by someone seeing that there is a bot in the room, as opposed to a meeting recording tool that runs in the background without anyone knowing," said Ambartsumian. "If you are using an always-on device, in states that require express consent for recordings, then best practices would dictate that you give your users a way to obtain necessary consents."

READ MORE:

Once the meeting is over, the legal and regulatory requirements for financial advisors to archive the recordings depend on whether they are an investment advisor or a broker, said Ellis. Advisors are governed by the SEC, which requires recordings to be maintained for five years from the fiscal year of last use. A broker may be governed by the SEC or FINRA, which requires recordings to be maintained for six years. Either way, recordings are to be "easily accessible" for at least two years.

"The burden of maintenance of the recording falls on the advisor or broker, not the client," said Ellis.

This means an advisor has no control over a client-created recording. And therein lie the fears of some advisors, even those who have embraced note-takers in their own practices.

Advisor recording their own meetings

Note-takers have become standard-issue in advisors' technology stack.

Lucas Wennersten, owner and founder of

Ramiro Marmolejo, certified financial planner and founder of

"It also allows me to stay more in the moment with them when we are discussing the more sensitive topics," he said.

Similarly, Wennersten said these tools allow him to be more present during meetings.

"We can pay attention better when we are not busy taking notes," he said. "The notes are also clearer, complete and organized than trying to do it on your own during a conversation. You can forget things if you try to go back after the call to take notes manually."

Clients like that Fathom provides the notes linked to the video recording, so if they ever want to watch it again they can, said Wennersten.

"I have never had a client object to being recorded," he said. "They generally appreciate it because I send them a copy of the Fathom recording after the call."

Whether it's an in-person meeting or Zoom, Marmolejo said he also always discloses the recording ahead of time.

"I have not had one person disagree with being recorded and many have commented on how well my meeting summaries are when I email them," he said.

Meet an advisor testing wearable AI himself

When

The president and CEO of

"Doctors were already doing it," he said. "Back then, it was just a recorder, a legal pad and a willingness to improve."

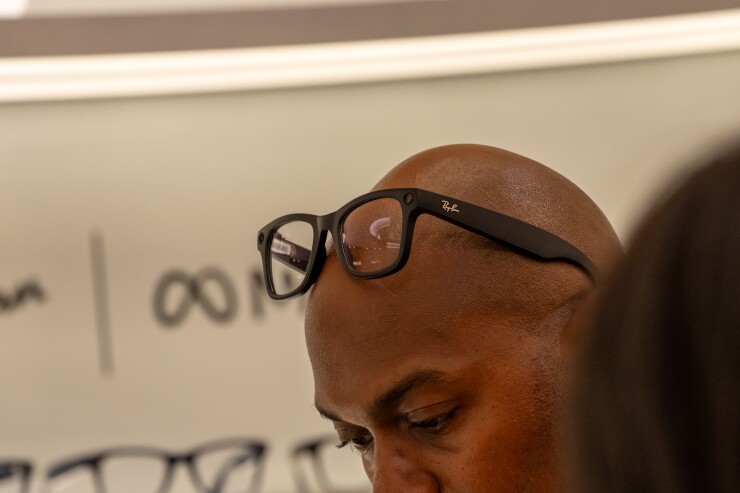

Hensley said that curiosity led him to wearables. He started with the Bee AI device and now uses Oma AI, an open-source device. He uses them personally to capture to-dos and reminders in daily life.

Hensley said he can see immense value in this technology for anyone with cognitive challenges or memory-related conditions. It's an issue close to his heart.

"As a caretaker for a parent with dementia, I juggle multiple doctors' appointments each week," he said. "These devices help me remember instructions, follow-up steps and scheduling details that could easily get lost in the shuffle."

From a compliance standpoint, Hensley said he maintains a strict firewall between his client and personal use of AI. Client meetings — especially virtual ones — are recorded only with firm-approved note-takers and always with explicit consent. He said his wearables are for personal use only: journaling, creative thought capture and life organization.

"That separation ensures full transparency and compliance while allowing me to explore the frontier of voice-based AI responsibly," he said.

Hensley said he would consider wearing one professionally if it were transparent and compliant. In Texas, where he's located, only one party has to consent to a recording.

"But legality isn't my measure — trust is," he said. "Clients appreciate accuracy and accountability, but that begins with communication."

Other advisors aren't ready to wear AI

Unlike Hensley, Marmolejo said he would not feel comfortable wearing one of these devices.

"I'm not comfortable with the public potentially knowing or accessing everything I do in my daily life," he said. "I enjoy my privacy. But I believe it's a personal choice and some people are very comfortable posting their lives on the web."

While Wennersten doesn't like the idea of wearable recording devices, he's not surprised by them. "Things have been heading this direction for several years and it looks to be inevitable that everyone will be wearing devices in the future with recording capabilities."

"People have had dashcams for several years and everyone now has a phone that can record," he said. "The only difference is that now it can be done more discreetly and continuously."

Given this reality, Wennersten said it is probably best to live life in public as though we are always being recorded.

What if you found out a client secretly recorded your meeting?

Since he records almost all his client interactions anyway, Wennersten said he would not have a problem with a client recording him.

"That said, people should respect each other's privacy and ask for permission to record," he said.

Similarly, if Marmolejo found out a client had surreptitiously recorded a meeting, he said he wouldn't be upset.

"I have always conducted my client meetings with an approach that whatever is discussed could one day become public, so I have no issues with being recorded," he said. "However, if I were to see meetings with me being posted on social media without my consent, I would have an issue."

If he learned a client recorded him secretly, Hensley said he "wouldn't love it" — but he'd also understand.

"Between Ring cameras, store security systems and smart speakers, we already live in an age of ambient surveillance," he said. "The real question isn't whether we're being recorded — it's how responsibly we choose to use what's captured."