Michael Cohn, editor-in-chief of AccountingToday.com, has been covering business and technology for a variety of publications since 1985. Prior to joining Accounting Today and WebCPA, he worked for Red Herring, Internet World, Beyond Computing, Accounting Technology and PC Magazine, and freelanced for a variety of other business publications. A graduate of the University of Pennsylvania with a BA in English, he studied accounting at the Wharton School of Business, and currently lives in New York City.

-

The latest version supplements the previously posted rules in order to help borrowers submit their loan forgiveness applications as provided under the CARES Act.

By Michael CohnMay 27 -

The Internal Revenue Service issued its annual inflation adjustment Wednesday for health savings accounts for 2021, at a time when many taxpayers are worried about their health in the midst of the novel coronavirus pandemic.

By Michael CohnMay 20 -

The Internal Revenue Service and the Treasury Department are beginning to send nearly 4 million economic impact payments by prepaid debit card, instead of by paper check or direct deposit.

By Michael CohnMay 19 -

The Internal Revenue Service is bringing in more help to deal with the flood of calls about economic impact payments.

By Michael CohnMay 18 -

The U.S. Small Business Administration, in conjunction with the Treasury Department, released a loan forgiveness application for the SBA’s troubled Paycheck Protection Program, along with detailed instructions for the application.

By Michael CohnMay 18 -

The IRS is extending the claims period for health care flexible spending arrangements and dependent care assistance programs and enabling taxpayers to make mid-year changes to their accounts.

By Michael CohnMay 12 -

The IRS is giving taxpayers who want to receive their payments by direct deposit a tight deadline.

By Michael CohnMay 12 -

The Internal Revenue Service has posted information on how people who weren’t supposed to receive their economic impact payments for the novel coronavirus pandemic should return the money.

By Michael CohnMay 6 -

Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.

By Michael CohnApril 20 -

The Internal Revenue Service is postponing the date for filing gift tax and generation-skipping transfer tax returns and making payments until July 15 because of the novel coronavirus pandemic.

By Michael CohnMarch 30 -

Relief comes as a result of the short notice firms were originally given to comply with the Secure Act, the agency says.

By Michael CohnJanuary 30 -

To help individuals and businesses prepare for filing season, Grant Thornton has released a collection of year-end tax tips.

By Michael CohnDecember 17 -

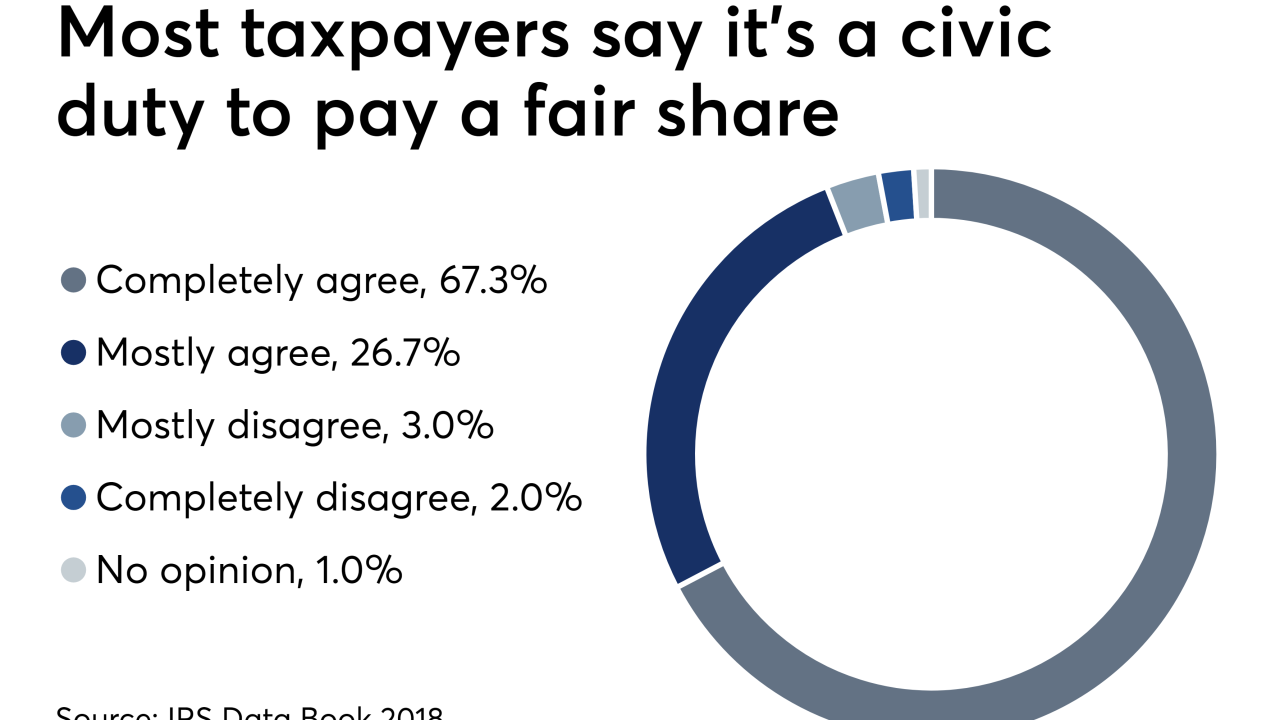

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

By Michael CohnMay 22 -

The IBD's advisors can expect new technology and product offerings, says David Knoch.

By Michael CohnApril 4 -

The Treasury and IRS are lowering the withholding underpayment threshold to 80%.

By Michael CohnMarch 26 -

Advisors take note: DAFs remain the fastest-growing charitable giving vehicle.

By Michael CohnNovember 16 - The doubling of the standard deduction will provide less incentive to itemize deductions.Sponsored by Nationwide Advisory Solutions

- Using this technology, a tax professional can look at clients' effective tax rate for income along with long-term capital gains.Sponsored by Nationwide Advisory Solutions

-

The program will give CPAs a new way to gain the institute's PFS credential — as well as provide other educational opportunities for non-CPAs.

By Michael CohnJune 13 -

There are three top specialties that survey takers said they want when choosing a new financial planner, with one clear winner.

By Michael CohnMay 17