-

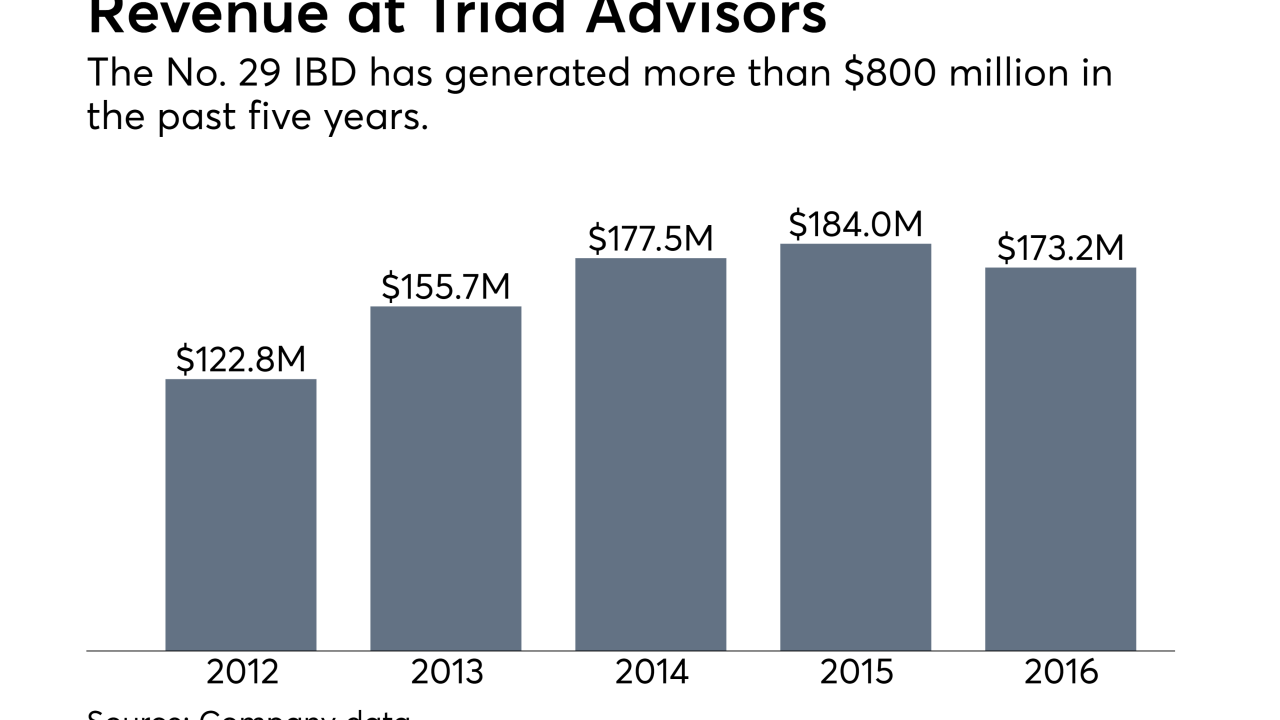

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

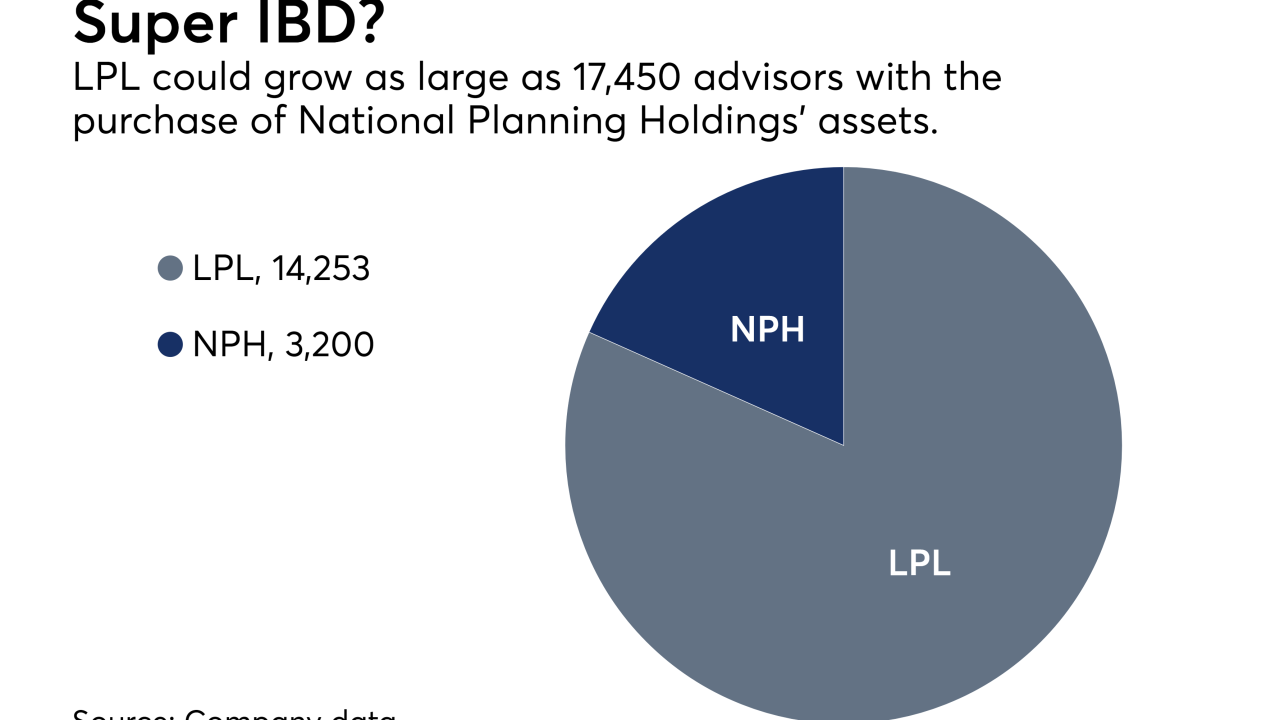

The No. 1 IBD unveiled a $1.1 billion firm that is part of the first incoming wave of NPH’s assets.

December 4 -

The No. 4 IBD has added 12 advisors with $2.1 billion in client assets since the acquisition.

November 30 -

The IBD's longtime head stepped down as part of a plan to remake the firm.

November 28 -

When disaster struck, Titus Wealth Management used one tool to find all affected clients in 15 minutes.

November 21 -

When it comes to planning, hitting financial goals is only part of the story.

November 21 Retirement Matters

Retirement Matters -

Too many advisors self-sabotage their referral process.

November 17 -

Some fund managers specializing in distressed debt smell an opportunity.

November 17 -

At least 274 advisors with $11.5 billion in client assets have left the fold since the acquisition.

November 16 -

Advisor Group BDs have poached at least four NPH practices after LPL acquired the network’s assets.

November 9 -

CEO Dan Arnold listed three reasons why the firm thinks its rivals peeled off some advisors.

November 8 -

The fourth largest IBD added a super OSJ with $650 million in AUM.

November 7 -

Independent Financial’s haul includes a new affiliated RIA launched by five of the practices.

November 7 -

Woodbury Financial has peeled off more than 80 advisors in the wake of LPL’s giant acquisition.

November 3 -

The delay was partly prompted by BlackRock’s testimony that policymakers, not index compilers, should set corporate governance standards.

November 3 -

When disaster struck, this tool helped Titus Wealth Management find affected clients in minutes.

November 1 -

Since investment programs are a small portion of an institution’s overall business, demonstrating the benefits to deposits and loans is instrumental in gaining support.

October 31 LPL Financial

LPL Financial -

Advisors must always be ready to reach out following natural disasters.

October 27 -

The Chicago-based RIA focuses on Midwest to expand its footprint.

October 27 -

When it comes to deciding who will take over your practice, advisors must find a "like-minded cultural fit," says CEO Jamie Price.

October 27