-

Compliance and technology hurdles have snarled firms’ efforts to address a longtime gripe.

January 22 -

‘This move highlights the increasing regulatory burdens faced by independents and the solutions that Stifel can offer,’ regional director Kevin Ortmeyer says.

January 12 -

Advisors reported significant growth in assets under management and expect more of the same in the coming months.

January 10 -

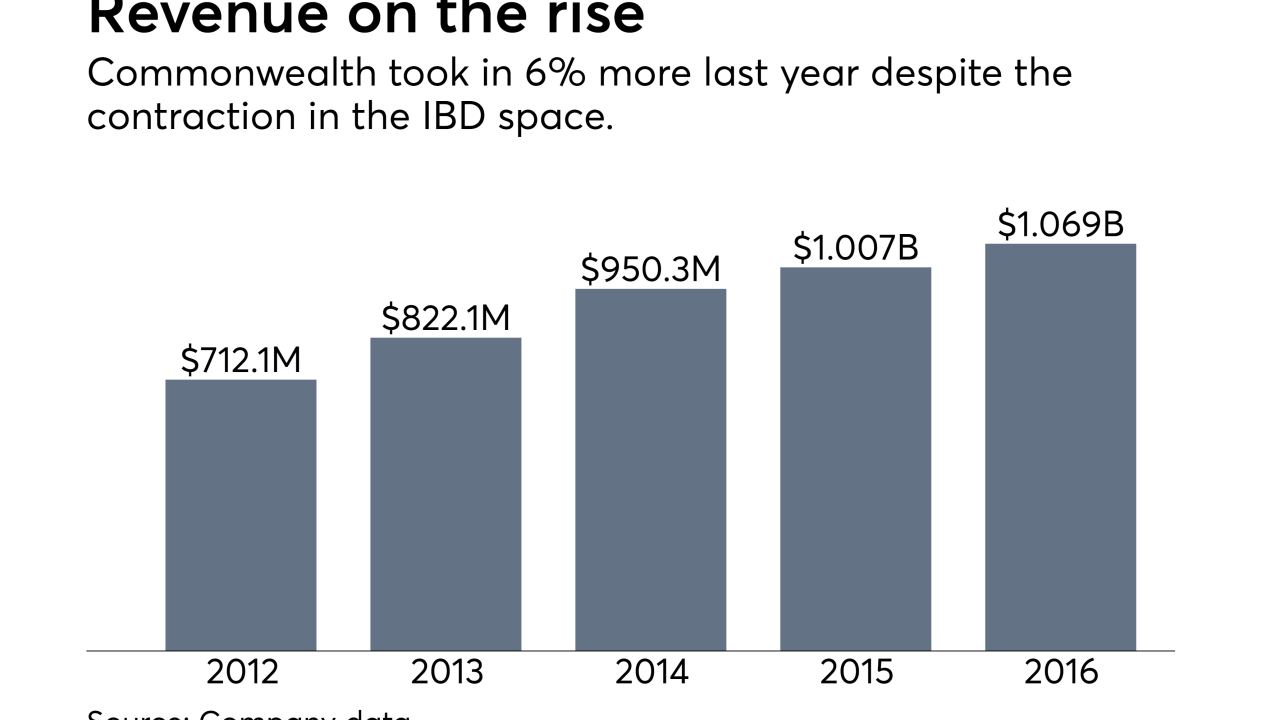

The IBD’s parent has increased its investments in advisory services while other insurers exit the space.

January 9 -

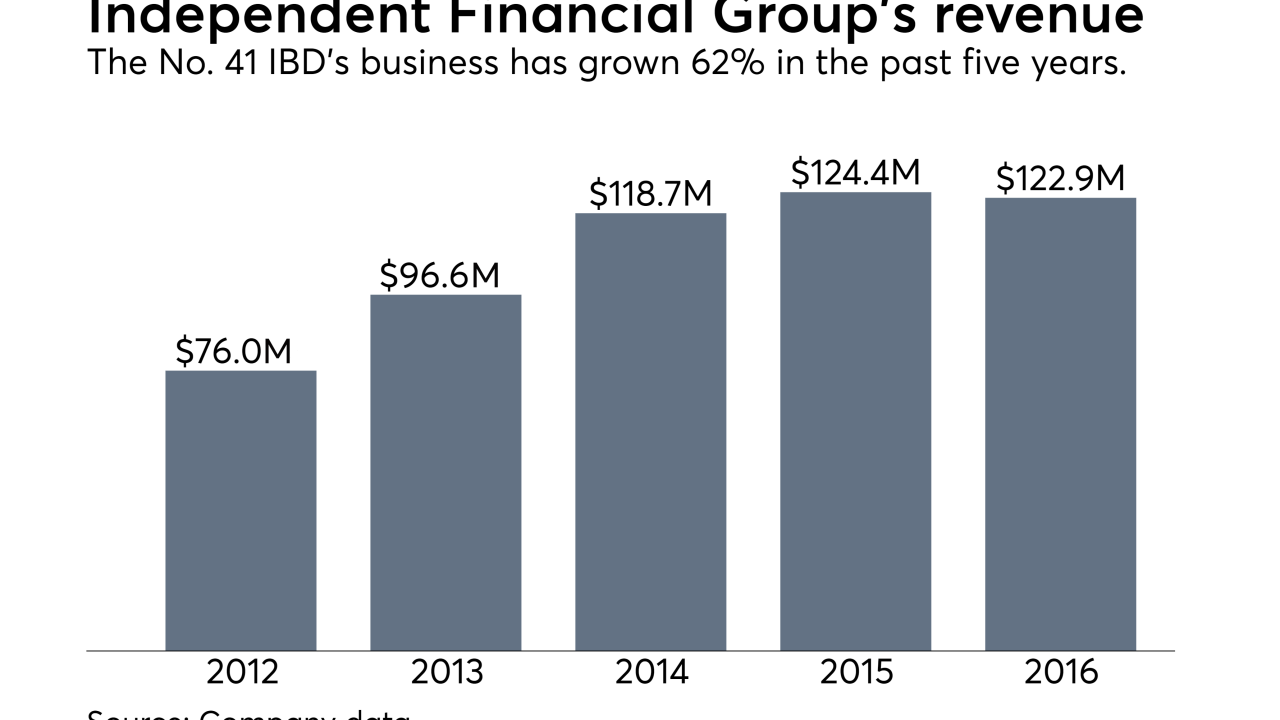

Independent Financial Group has grabbed 14 practices with 44 advisors from NPH firms since the LPL deal.

January 3 -

Kestra Financial’s James Poer offers advisors his three predictions for the new year.

December 22 Kestra Financial

Kestra Financial -

The No. 20 IBD unveiled a total of 15 practices joining its ranks in the fourth quarter.

December 21 -

Advisors are jumping to firms with established infrastructure.

December 19 -

The five consultants spent a combined 55 years at the No. 1 IBD, and they set up shop near two of its main corporate offices.

December 18 -

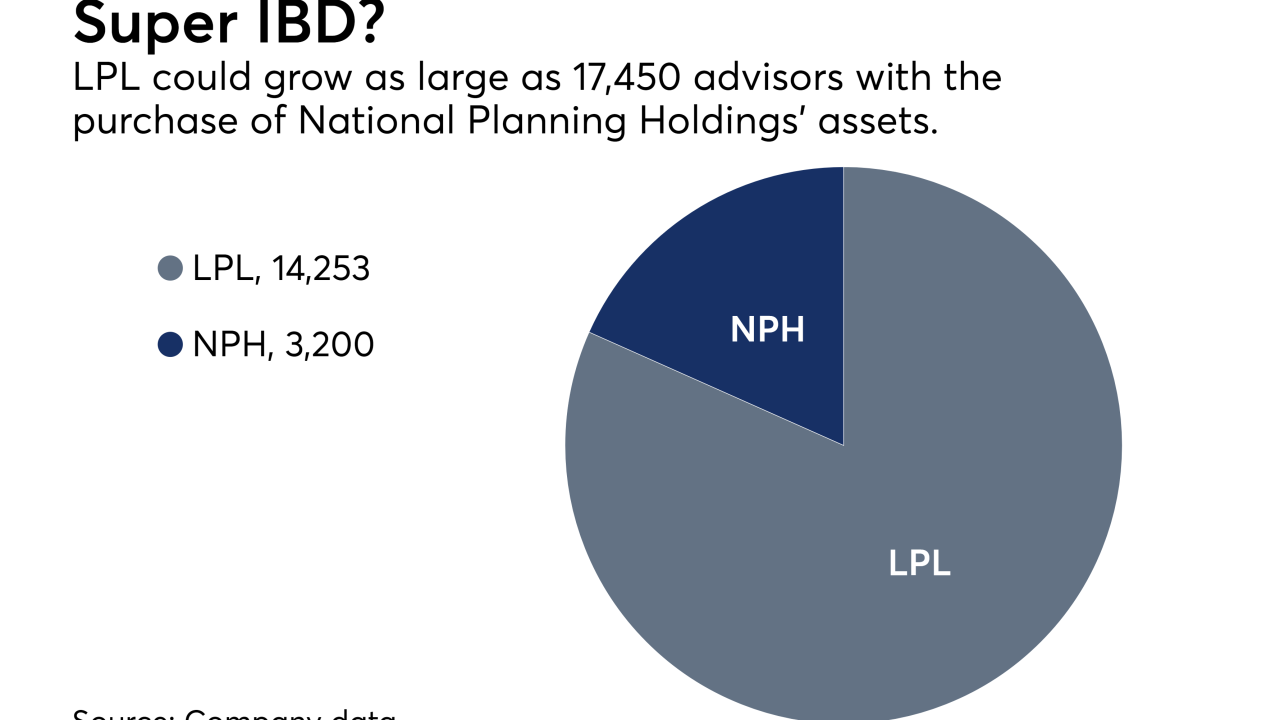

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

December 18 -

Exclusive: The No. 4 IBD unveiled a new bank-based team even as its competitor began revealing its retained firms under the acquisition.

December 15 -

Roughly 300 ex-NPH advisors have chosen smaller IBDs over LPL Financial after its massive acquisition.

December 13 -

Robo-advisors, micro-investing are making the old ways of doing business obsolete.

December 8 Simon-Kucher & Partners

Simon-Kucher & Partners -

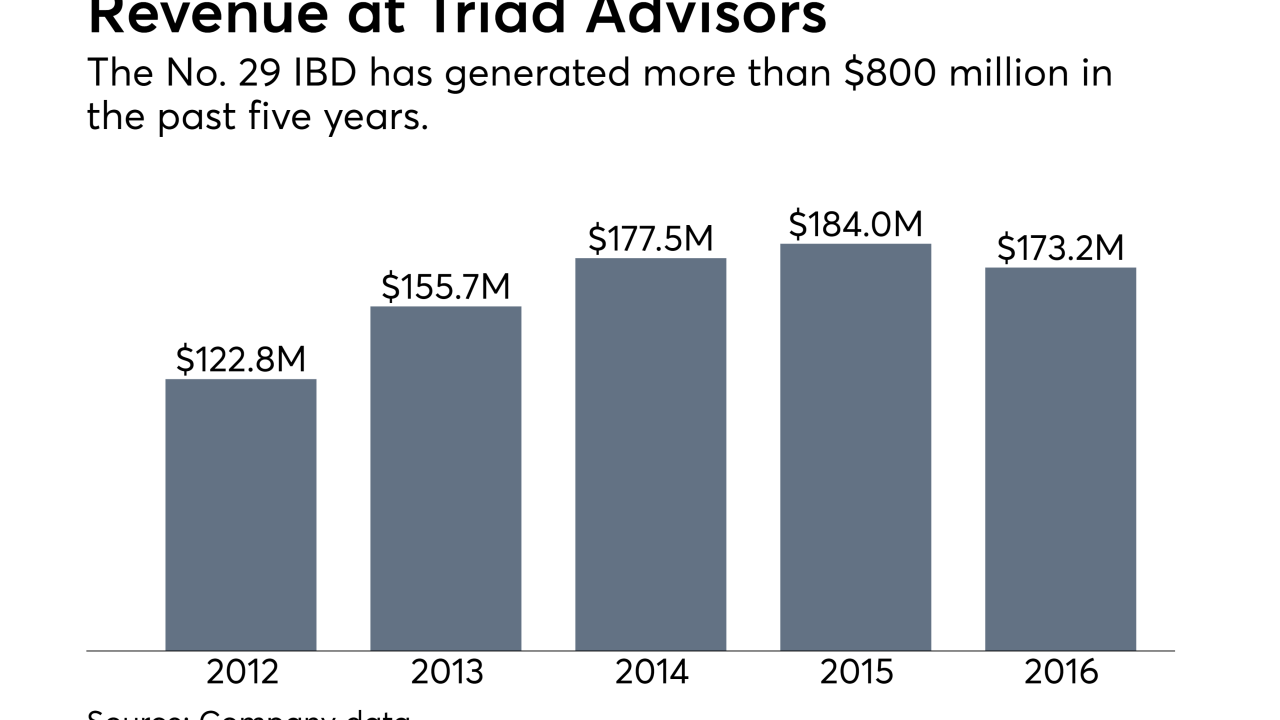

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5 -

The IBD has boosted payouts for advisors as it trims lower producers from its ranks.

December 5 -

Attracting them means knowing what’s really important (hint: it’s not retirement).

December 4 -

The No. 1 IBD unveiled a $1.1 billion firm that is part of the first incoming wave of NPH’s assets.

December 4 -

-

The No. 4 IBD has added 12 advisors with $2.1 billion in client assets since the acquisition.

November 30