Now more than a year after the onset of COVID-19, a look in the rearview mirror paints a stark picture of investor attitudes during the pandemic.

In March, clients' feelings about their retirement posted double-digit increases over the same month in 2020 in every major category in the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

Many advisors polled in the latest survey reported that they are seeing more businesses hiring again in their communities, which translated into heightened client confidence and an uptick in overall retirement plan sales and contributions.

"We're seeing more and more plan participants become more optimistic about their future as the economy begins to reopen," one advisor said.

The composite RACI score — the overall measure of client confidence — checked in at 55 in March, unchanged from February but up12.5 points from the same month a year ago.

RACI scores above 50 signify an increase in investor confidence. Scores below that level mark a drop in confidence.

Key RACI components also increased dramatically over last years, which advisors attribute in large part to the vaccine rollout and the economic growth that has followed.

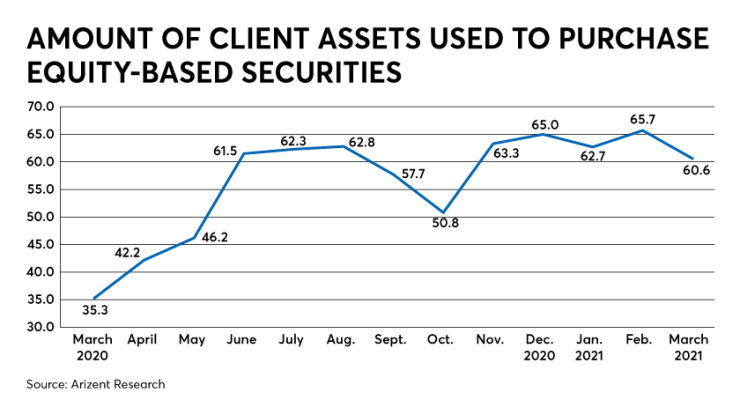

The surge in confidence year-over-year was particularly strong in clients' view on stocks. The RACI component that tracks retirement assets used to purchase equities posted a healthy score of 60.6, which was down from the previous month's mark of 65.7, but miles ahead of March 2020, which saw an all-time low of 35.3. Stocks, as tracked by the S&P 500, fell through most of March last year, but have since rebounded to record highs.

"People feel more comfortable investing," one advisor said.

Several advisors also noted the positive impact of the stimulus checks that clients have been receiving.

"The additional stimulus payment seems to have freed up funds for a number of investors," one advisor said.

Though they broadly reported strong confidence among their clients, advisors were not uniformly bullish, with some citing concerns about potential tax hikes and fears that stocks are becoming overpriced.

Those worries may have contributed to a slight monthly downtick in clients' risk tolerance, but March's score of 53.2 in that RACI category, off 2.6 points from February, was 17.6 points above last year's mark.

But the most common refrain in this month's survey was the encouraging mention of businesses moving toward full reopenings and ramping up hiring. Some see hiring as a lagging indicator of an economic recovery, giving reason for confidence about the months ahead.

"A faster-than-expected recovery from the pandemic may lead businesses that we work with to renew hiring later this year," one advisor said.

Others are seeing more immediate movement in the labor market.

"With the economy recovering, there seems to be an uptick in hiring, so new employees came on board [and] set up new retirement plans," one advisor said.

The RACI component that tracks overall contributions to retirement plans shot up to 64.6 in March, up 4.4 points from February and 20.5 points from last year, notching the highest score in that category since December.

"People are ready to be back to 'normal,' and are seeing the market stay relatively strong and want to be participating," one advisor said. "Employers are hiring more people, and by and large people want to be back to work."