Advisors have been dealing with clients' concerns about inflation, interest rates and the supply chain for months, but the Russian invasion of Ukraine has elevated retirement worries to a new level.

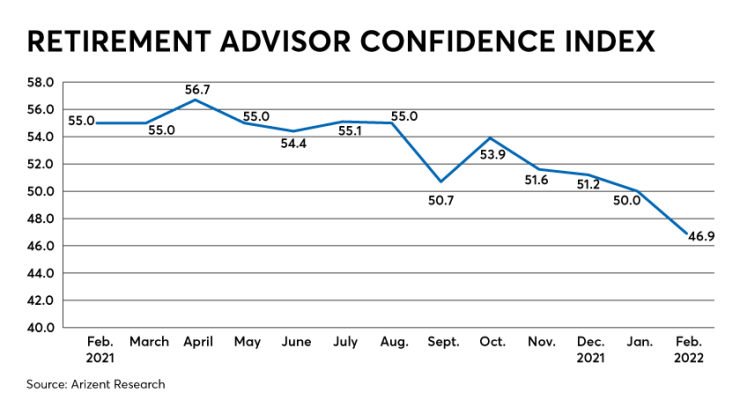

Many investors are spooked, and key metrics in the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers, bear that out in dramatic fashion.

"Inflation and the war in Ukraine are major factors affecting my clients," one retirement advisor said. "People are more worried about the economy than they have been in many years."

Consider clients' views toward stocks. The RACI component that tracks retirement investments in equity-based securities slipped to 48.5, the lowest mark since May 2020, at the outset of the pandemic.

RACI scores higher than 50 signify an increase in confidence, while scores below that mark point to a decline.

February was the first time since spring 2020 that the RACI equities score dipped below 50, dropping 3.8 points from January, and 17.2 points from February 2021. Equity scores had spent much of 2021 hovering in the 60s before starting to slide last fall as investors began to factor in the long-expected interest rate hikes that finally began in March.

"The anticipated interest rate increases make clients more risk averse toward equities," one advisor said.

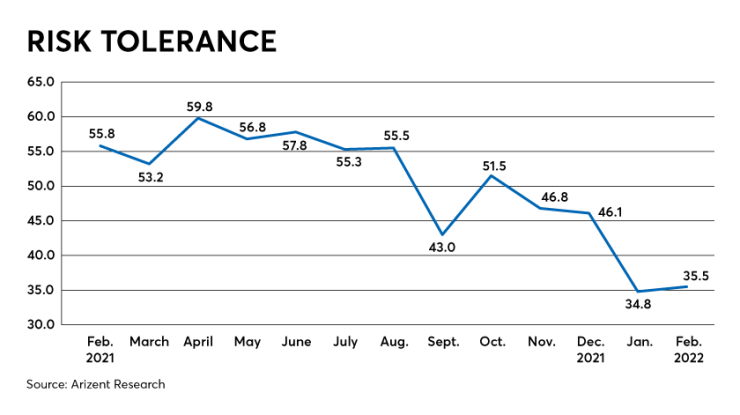

Risk tolerance remains a significant factor for clients mulling their retirement plans these days. The element of RACI that tracks clients' appetite for risk posted a dismal 35.5 in February, which, while a modest 0.8 point increase from January, was off 20.3 points from the year-earlier period, and represented the second-lowest score in the category since April 2020.

"Clients have been just sitting tight on putting any money into the markets right now," one advisor said. "Too much uncertainty."

Overall, February saw a composite RACI score of 46.9, the first time the index has slipped below 50 since October 2020. February's mark, the fourth consecutive monthly decline, was down 3.1 points from January and off 8.1 points from February 2021.

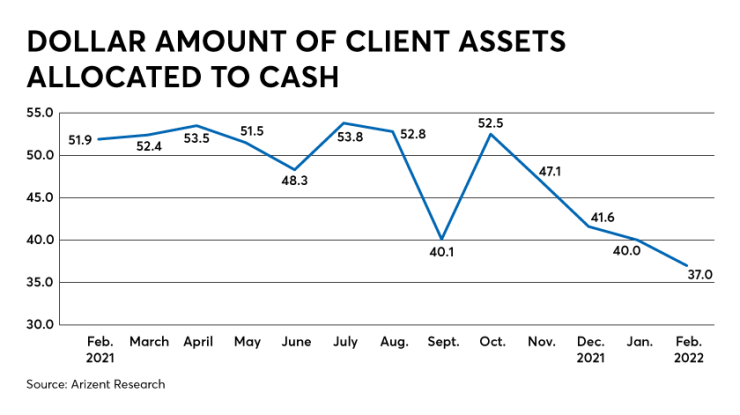

Often when clients are feeling risk averse and want to allocate money away from equities, they gravitate toward cash. But that was not the case in February for a very important reason.

"Probably the biggest is the worry about inflation," one advisor said. "We are currently putting recommendations together to try and hedge that issue."

The unit of RACI that tracks cash allocations dipped to 37, the lowest mark since December 2018. That amounted to a month-over-month decline of three points and was down nearly 15 points from the same period a year ago.

"The inflation we have been experiencing, along with the war with Russia and Ukraine, has everyone on edge," one advisor said. "Now with the war, we are expecting higher inflation. These issues have been affecting clients' risk tolerance."

While many advisors are scrambling to reassure clients and find hedges against some of the immediate headwinds, some are also trying to look past the short-term volatility.

"We play the long game," one advisor said. "Slow and steady wins the race."