Making charitable contributions has long helped clients reap two benefits — getting joy out of helping worthy causes and taking related tax deductions.

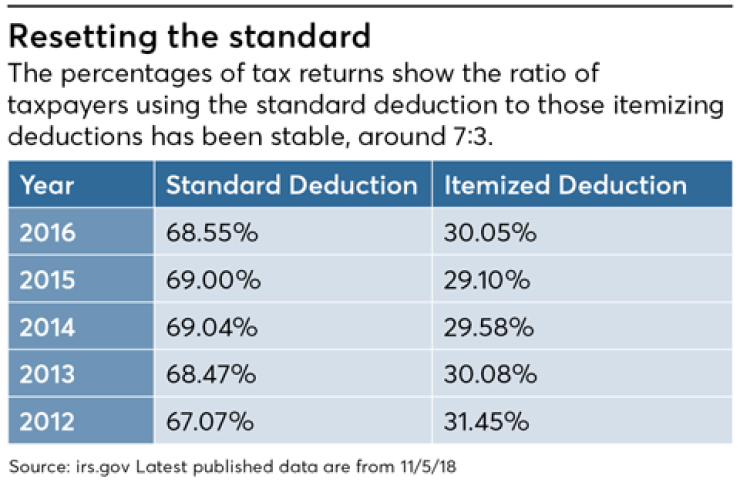

The new tax law, however, doubled the standard deduction, meaning that fewer taxpayers are likely to itemize (see "Trickle-down effects"). As a result, clients who are used to charitable write-offs may no longer see a tax benefit from their contributions.

Are there any solutions advisors can offer these generous clients?

It may be easiest to help clients older than 70-1/2, who are required to take RMDs from their traditional IRAs.

“At that age, using a qualified charitable distribution can be an ideal planning strategy,” says Roger Lusby III, the managing partner of the Alpharetta, Georgia, office of CPA firm Frazier & Deeter. QCDs aren’t deductible, but they do satisfy RMDs.

“An individual’s QCDs are limited to $100,000 per year, so a married couple can donate as much as $200,000,” says Joseph Brooks, president of Fairhaven Financial Advisory in East Lansing, Michigan. “These donations are excluded from the IRA owner’s income, which makes the lack of a charitable deduction a non issue for those amounts.”

Using QCDs reduces an IRA owner’s taxable required minimum distribution. That, in turn, lowers their adjusted gross income and delivering savings on a tax return. Potential benefits might include a larger tax-deductible loss from investment property and less exposure to the 3.8% surtax on net investment income, just to name some examples.

“I've been prompting clients to ask their tax preparer what their tax would've been had they not made the QCD,” says Chris Cordoba, founding partner and personal wealth manager at California Retirement Advisors in El Segundo, California. “This will let them recognize the savings they actually receive. One client said she did a QCD last year and liked it, so she was going to spread her QCDs across five different organizations this year.”

For clients interested in QCDs, timing can be vital. “If their RMD is scheduled to pay out annually in January to the IRA owner, the QCD option has been blown,” says Cordoba, “because the first dollars to come out are considered to satisfy the RMD.”

If monthly payouts go to the client as regular RMDs, the QCD opportunity shrinks every month.

Indeed, in Cordoba’s January RMD & QCD meetings with clients in that age group, he went over their QCD plans and alerted them to refrain from too many regular RMDs upfront.

“As one person said about giving to her religious organization, ‘Well, I was doing it anyway. I may as well make the contributions from my IRA sooner and not have to worry later,’” Cordoba says.

Another reason to urge clients to make QCDs sooner in the year, rather than later, is the lack of uniformity among IRS custodians in processing these donations. Especially when the IRA money is under management, advisors may want to be hands-on to ensure that QCDs are made properly, within the desired calendar year.

While QCDs may benefit seniors, other methods might help younger clients.

After the tax law passed, “we started utilizing either QCDs or a strategy called gift clumping with many of our clients,” says Megan Russell, COO at Marotta Wealth Management in Charlottesville, Virginia.

Gift clumping involves making a large contribution to a donor advised fund in one year, in order to take an immediate itemized deduction, even if the ultimate donations are spread over several years.

“This strategy can benefit clients who would not normally benefit from itemizing deductions,” she explains. Even taxpayers who benefit from itemizing might do better by clumping.

Russell gives the example of a married couple who donate $20,000 to charity each year. Assume their other itemized deductions are state and local taxes paid, capped at $10,000, for a total of $30,000. Over two years, they would get $60,000 of itemized deductions.

If the couple decided to use the gift clumping strategy instead, Russell says, they could give $40,000 to their DAF every other year, taking the contributions as itemized deductions in those alternate years. In their years of giving, their itemized deductions would be $50,000 ($10,000 + $40,000); in the years without giving, the couple could take the standard deduction, at least $24,400 in 2019.

Looking at both years, the couple would have total deductions of $74,400 with gift clumping ($24,400 + $50,000) versus only $60,000 by donating $30,000 per year. Then the client could spread the actual contributions from the DAF to the recipients over two or more years, replicating prior philanthropic practices.

Marty James, who heads Martin James Investment & Tax Management in Mooresville, Indiana, also uses DAFs to stack deductions in alternate years.

“For our more charitable clients who are approaching RMD age,” he says, “we are coordinating donor advised funds and Roth conversion strategies with future QCDs,” he says. (QCDs can’t go to DAFs.)

James explains that some clients have been converting traditional IRAs to Roth IRAs before age 701/2, reducing future taxable RMDs.

“More planned QCDs can result in less need to aggressively Roth-convert,” he says. “Some clients opt to do no Roth conversions and use the QCD to satisfy their RMDs and their charitable goals.”

If clients intend to use QCDs extensively, reducing taxable RMDs, there may be less need to prepay income tax with Roth IRA conversions. Such a plan may resonate with many clients because of a reluctance to pay sizable amounts of tax on IRA distributions sooner than absolutely necessary.

Strategies involving QCDs also can affect estate planning.

“For clients over age 70-1/2 with large traditional IRAs, we have been reviewing wills and trust documents for specific bequests to charities,” James says. “In some cases, we are suggesting that clients remove the charitable bequest from their will or trust and make the donation now, using a QCD. This reduces future taxable RMDs for the client and allows their heirs to inherit more non-IRA assets.”

Thus, beneficiaries would receive fewer traditional IRA dollars, to be split with the IRS, and perhaps more appreciated assets that might pass with a basis step-up at death. Planners might inform IRA beneficiaries who must take RMDs that they also can make tax-effective QCDs once they reach age 701/2.

Any philanthropic changes to existing estate plans may require amended documents, executed by a knowledgeable attorney, cautions Steve Gorin, partner in the law firm Thompson Coburn in St. Louis.

“Another idea,” Gorin says, “is to see if some clients can claim donations as business expenses, rather than charitable deductions.”

For example, cash payments to a qualified recipient that are ordinary and necessary for furthering the bottom line might be a deductible business expense.

Although the revised tax code may make it more difficult to do well while doing good, the same rulebook provides ways for planners to help philanthropic clients receive some tax breaks.