It’s no secret the advisor population is aging and a massive wealth transfer is looming. There’s increasing pressure to onboard younger clients and new talent.

What can be tricky for some firms is how to do it.

“They know they're going to have to start working with younger clients, but they're not quite sure who these clients are, what’s important to them and how they’re different from their traditional client,” says Jean Lynn Dunn, a client loyalty insights leader at T. Rowe Price.

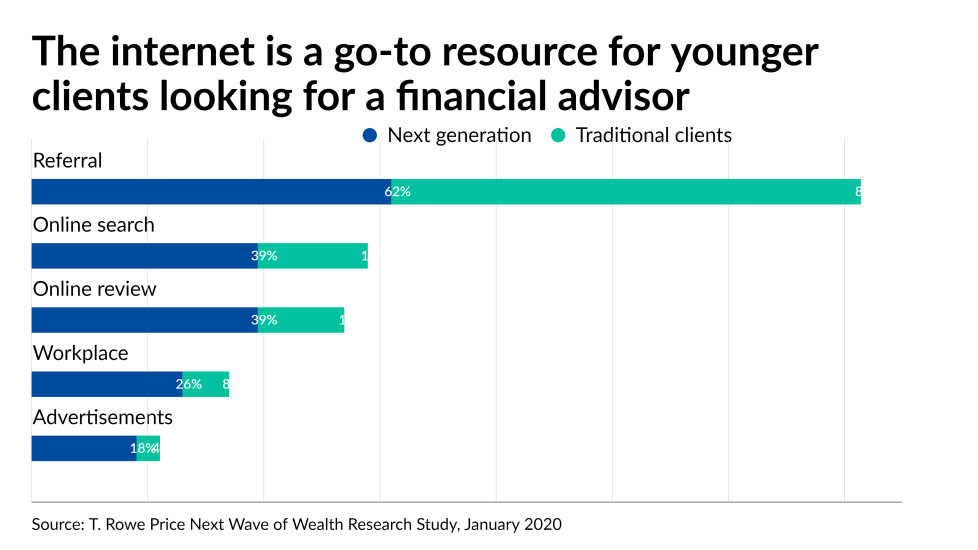

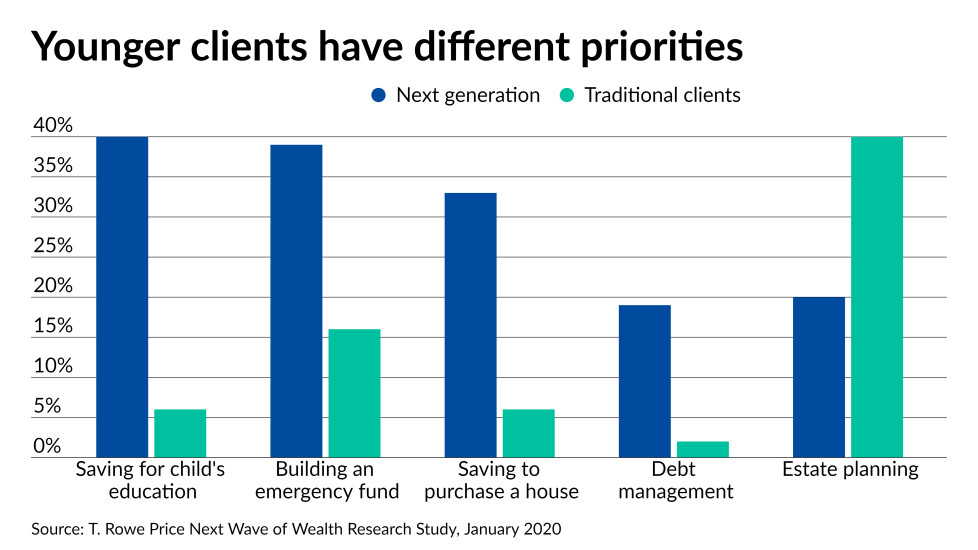

The next generation of clients thinks differently about wealth and the markets, and because they’re not multi-millionaires, they’re not sure whether they’re qualified to work with a financial advisor, according to T. Rowe Price research, which surveyed 1,461 investors between the ages of 25 to 50 and 400 older than 50.

Scroll through to see how financial advisors can better attract the next generation of clients: