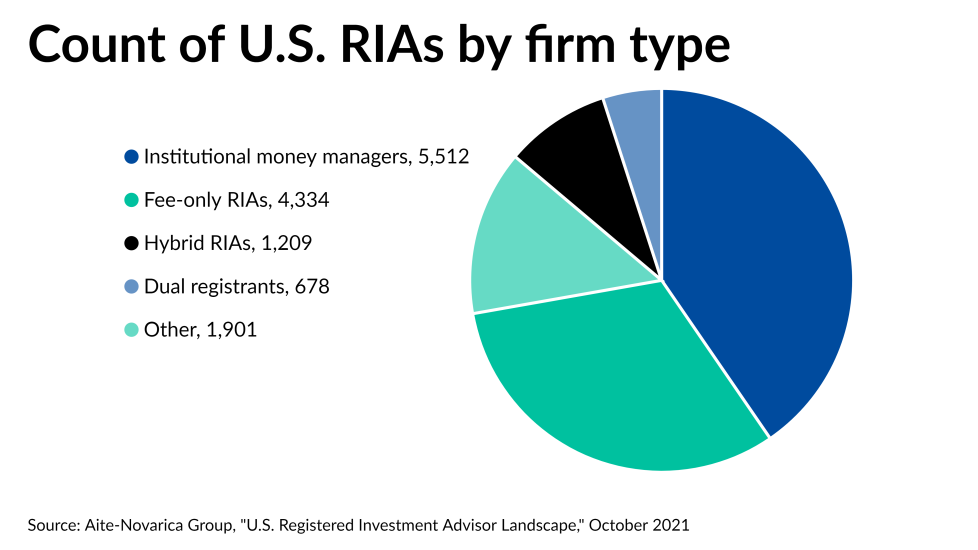

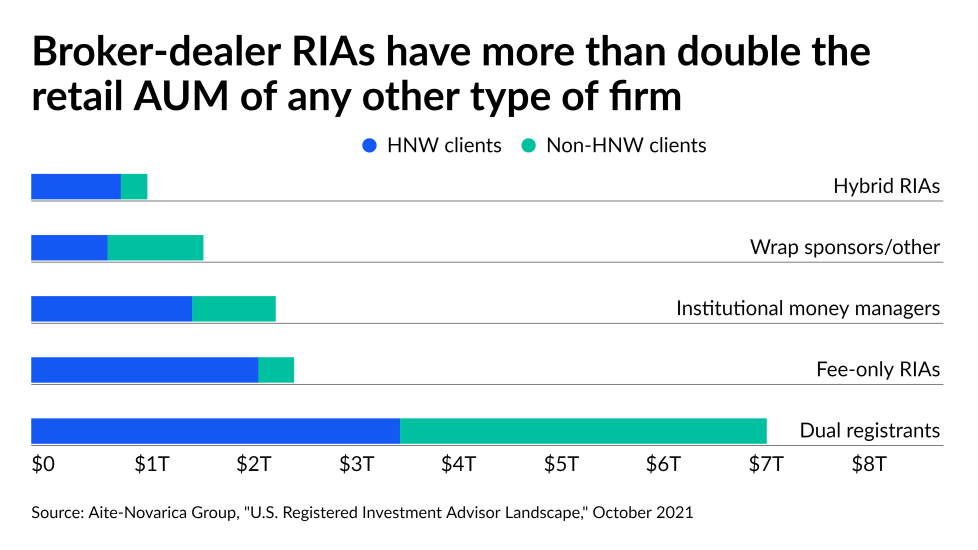

Dividing RIAs by their size and whether they have a brokerage affiliation reveals differences in the types of clients and amount of assets managed among the industry’s more than 5,000 firms.

Despite the difficult year for the world in 2020, retail-facing RIAs of all types grew substantially last year in terms of the number of firms and their quantity of assets under management,

The industry’s two most significant distinctions — between big and small firms and dually registered or fee-only practitioners — jump out of the data in notable ways. For one, a larger percentage of hybrid RIAs provide planning services to clients and accept hourly or fixed fees, despite those business models being more

Disparities in the number of accounts and AUM per rep display “the advantages of scale,” Whitt said in an interview.

“There was literally almost no difference between the fee-only firms and the hybrid firms, but you saw dramatic differences when you sorted the firms by size,” Whitt said. “The larger firms have more resources to devote to building out an infrastructure, and that infrastructure allows advisors to become more productive.”

The findings may prompt celebration among RIA consolidators offering practices greater reach through the record M&A, although Whitt says he also understands that smaller firms could use the greater attention to a smaller base of clients as a selling point. For vendors of software or other technology, the figures suggest that smaller firms need “fully designed platforms” while bigger RIAs would benefit more from capabilities they can integrate into their desktops, he adds.

Just as reflected in Financial Planning’s

“It's a mix of art and science,” Whitt said. “We have to make our own categories and make our definitions.”

To see 10 of the most interesting takeaways from the Aite-Novarica study, scroll down our slideshow. Note: All data comes from SEC Form ADV filings that reflect year-end figures for 2020, as