After a 2021 marked by an expeditious stateside expansion and an aggressive approach to acquisitions, CI Financial

“2021 was the most successful year in the history of CI in terms of financial performance and asset gathering,” CI Financial CEO Kurt MacAlpine said in the firm’s

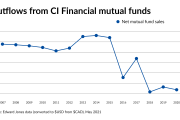

“This was the result of robust growth in wealth management and our best asset management flows in six years.”

Note: CI Financial discloses its quarterly returns in Canadian dollars. Unless otherwise mentioned, all figures are in Canadian rather than U.S. dollars.