It may be tough to find any cause for concern when evaluating the gains made by the industry’s best-performing value funds.

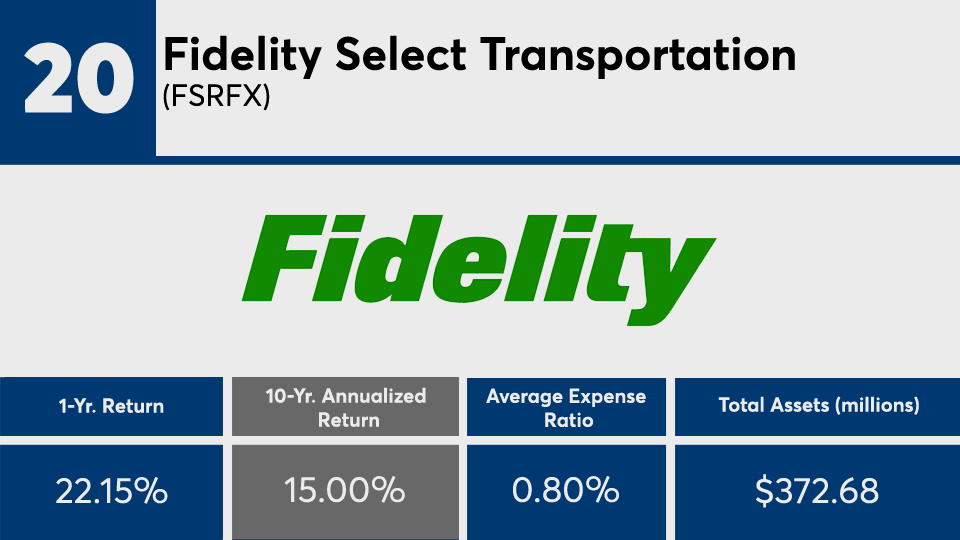

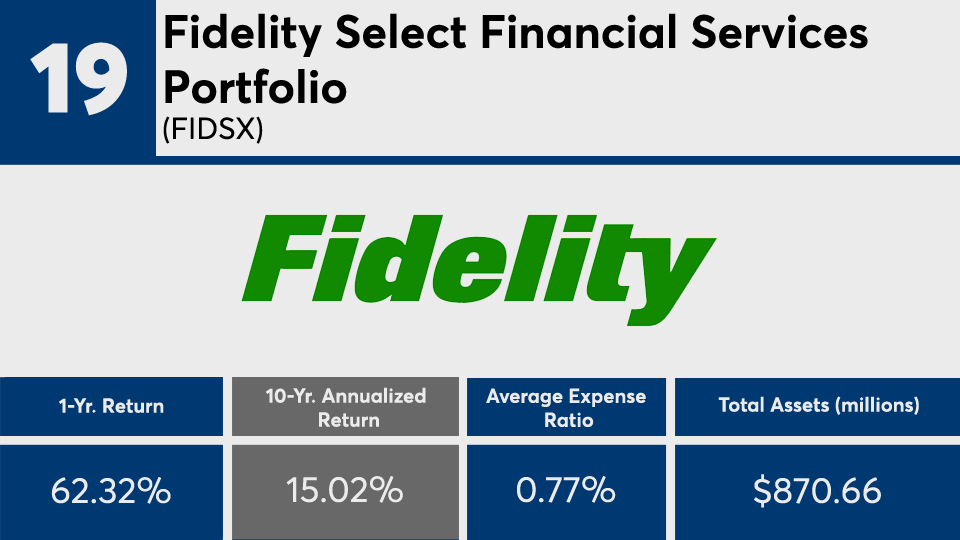

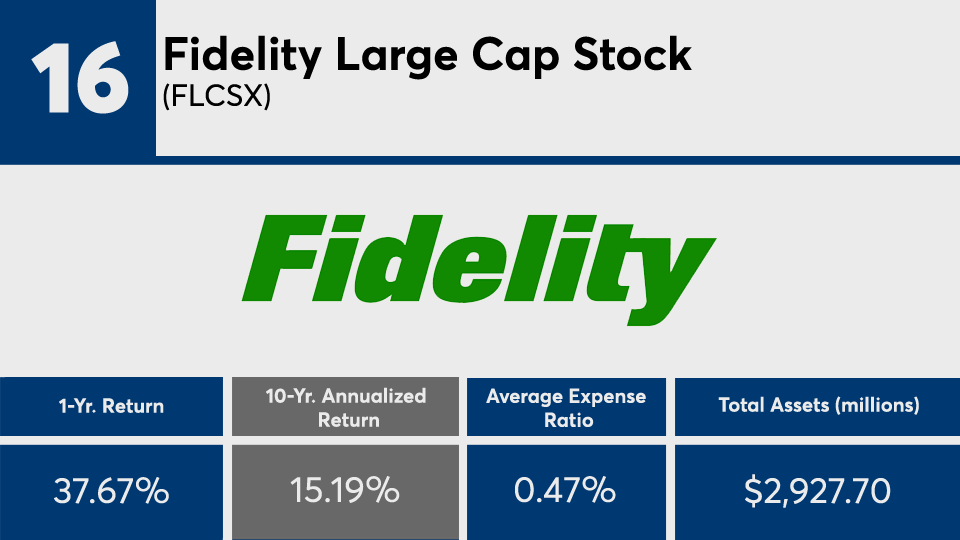

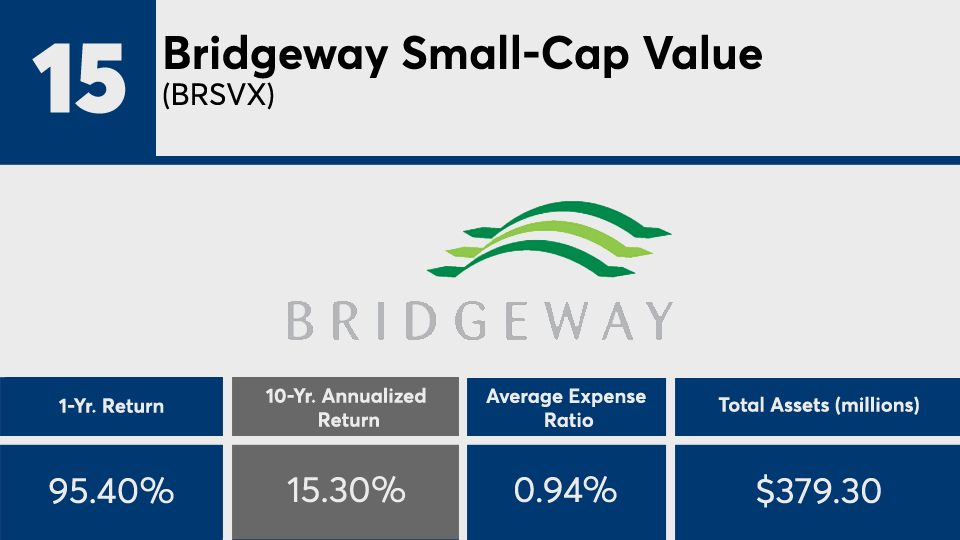

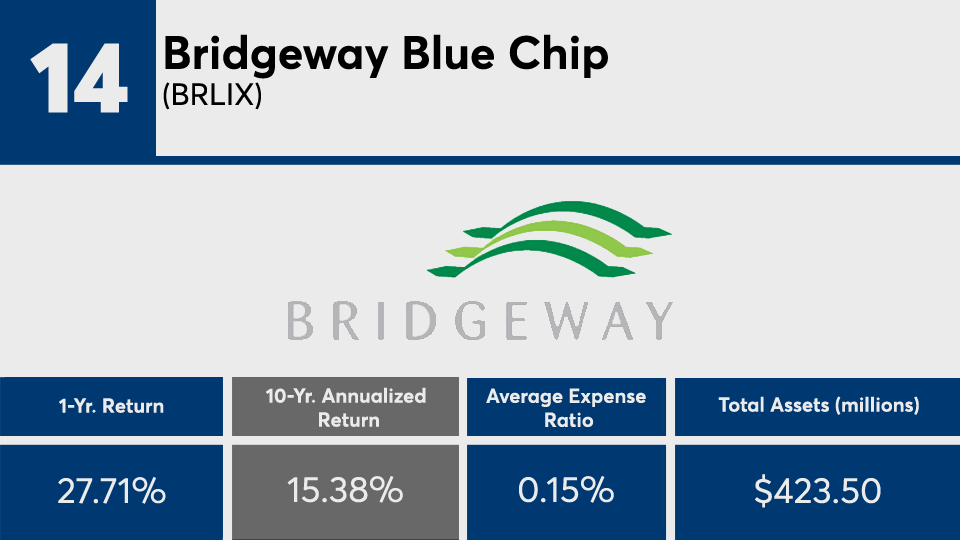

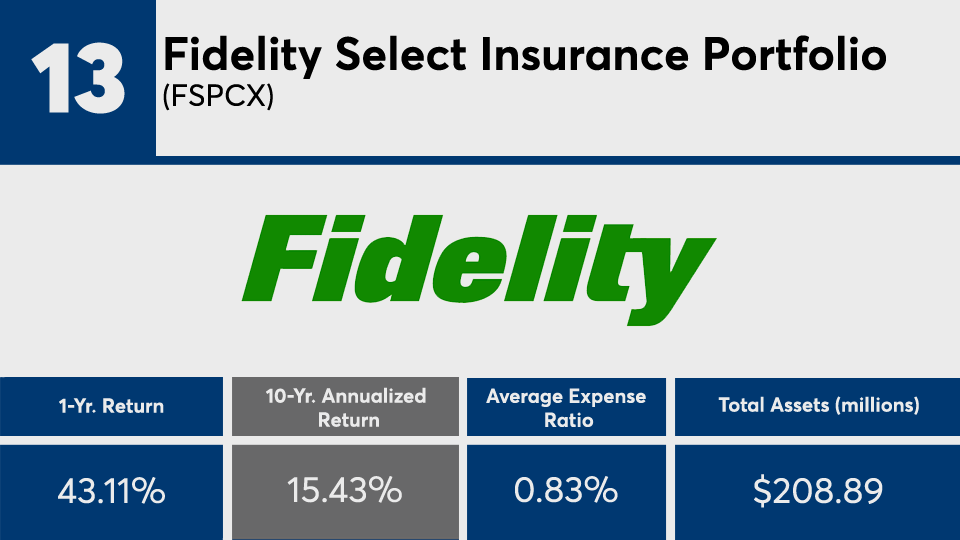

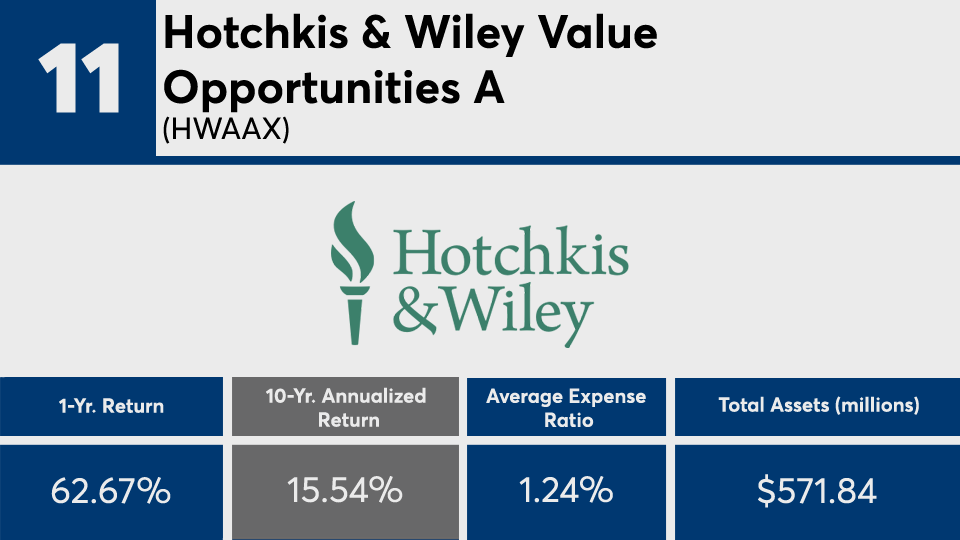

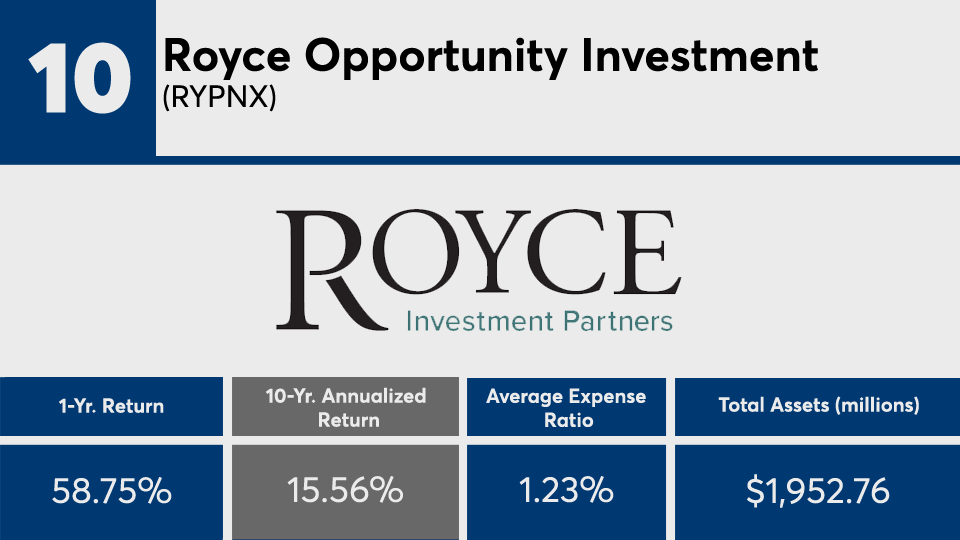

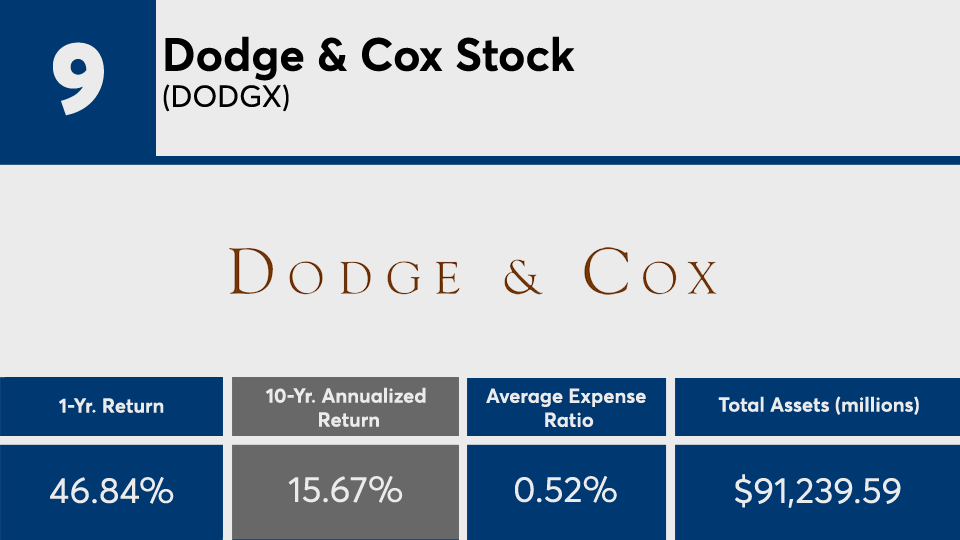

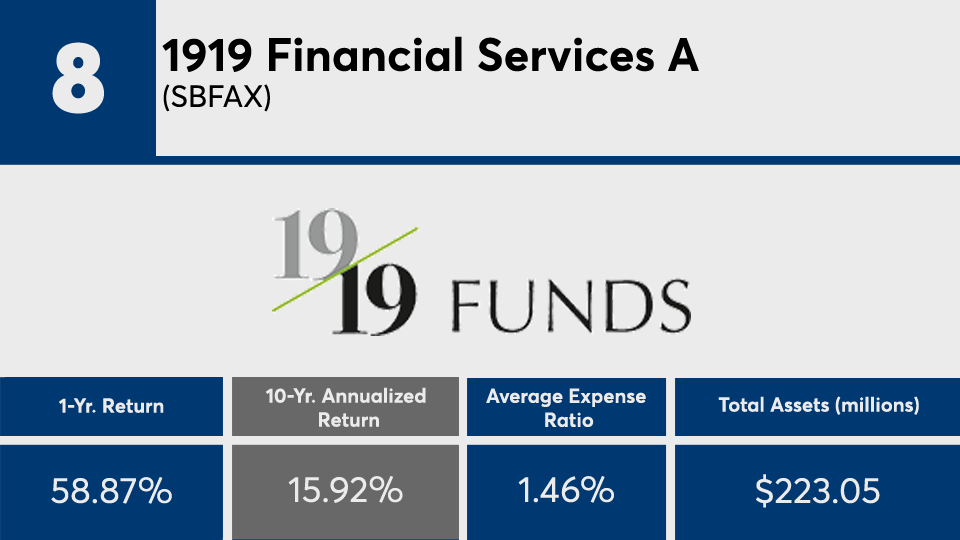

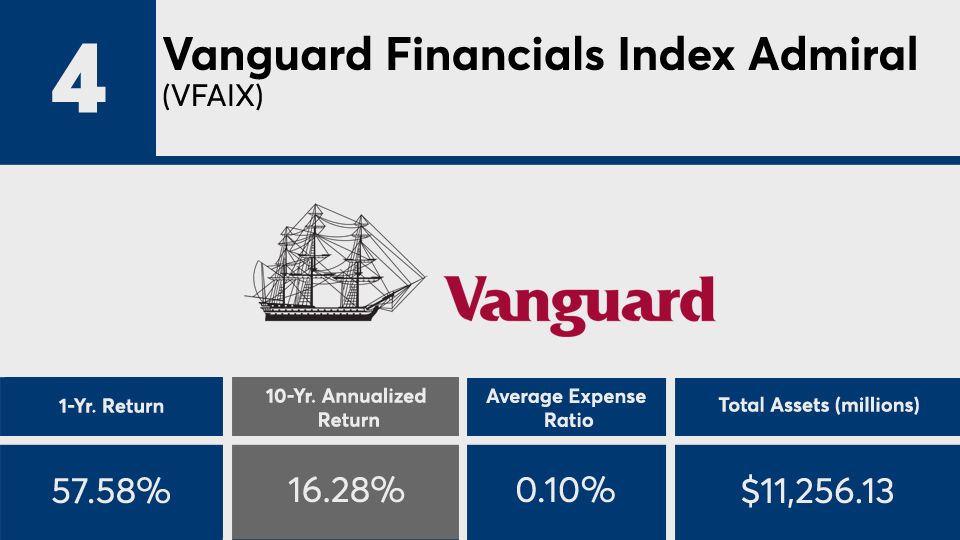

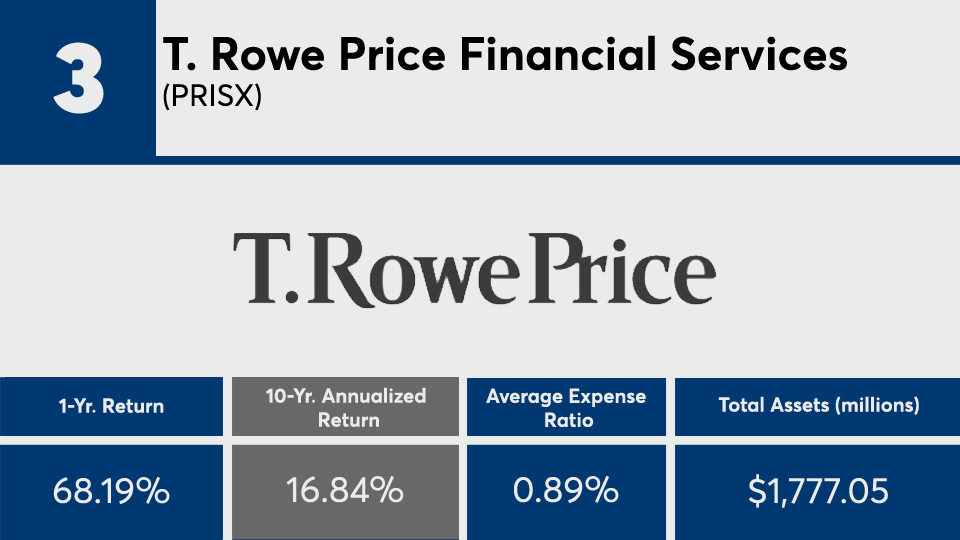

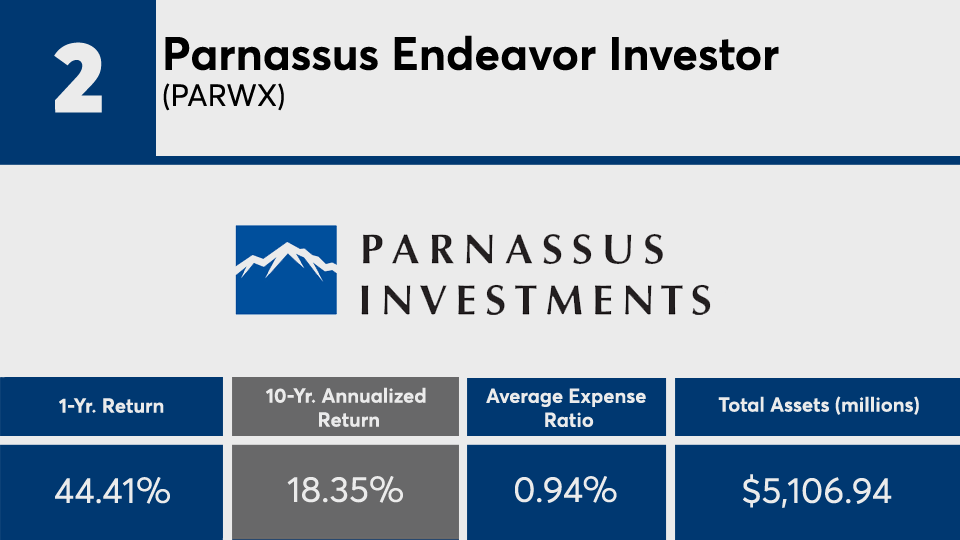

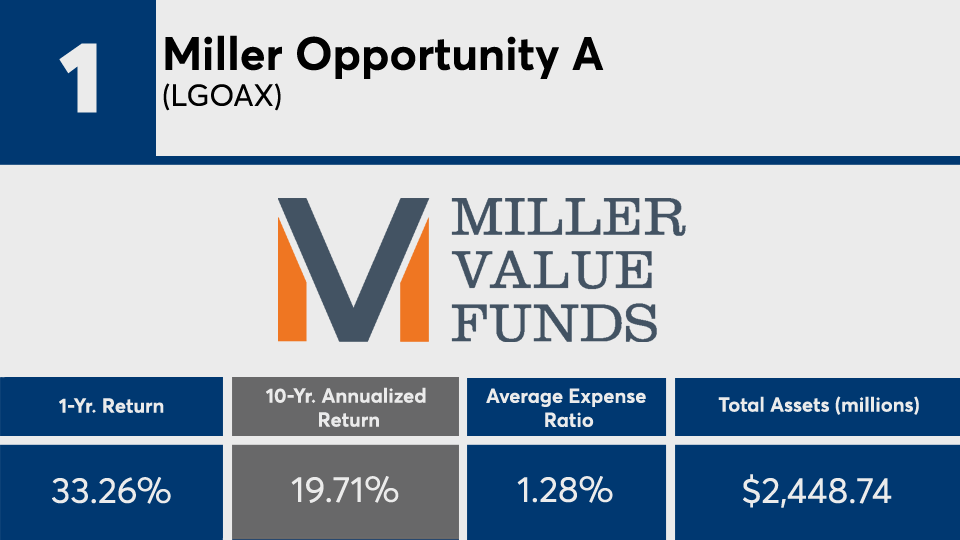

The 20 with the biggest 10-year gains, and at least $100 million in assets, have matched, if not bested, broader indexes and peers with an average 16% annualized return, Morningstar Direct data show. The same funds also had an overall 51% gain over the past 12 months.

For comparison, index trackers such as the SPDR S&P 500 ETF Trust (

The industry’s largest value fund, the $156.8 billion American Funds Washington Mutual A (

So, what could be the problem from an advisor’s or client’s perspective?

For one, high expectations for future gains to match past performance, said Brinker Capital portfolio manager Michael Hadden.

“The market as a whole has had a tremendous rally coming out of the initial shock of the COVID-19 crisis,” according to Hadden. “There has also been a shift in outperformance by value focused strategies over the past year. But as we look at the top 20 funds over the past decade, the consistency of strong performance should be stressed to clients.”

Another area that should raise an eyebrow when analyzing these funds are their fees. With an average net expense ratio of nearly 88 basis points, the funds in this ranking were more than double the 0.41% asset-weighted average expense ratio across all funds in 2020,

“In a time where fee cuts and low-cost index products have gathered lots of attention — and assets — it is as important of a time as ever to discuss fees and the nature of the fund with clients,” Hadden said, adding, “There is only one passive index product on the list. The other 19 funds are actively managed, often fairly concentrated and much different from their benchmarks.”

For advisors speaking with clients about their long-term investments, understanding the makeup of a product, the process employed by the manager and the corresponding fee charged for the product are all critical to ensure they aren’t overpaying for closet index exposure, Hadden said.

“Markets work in cycles, and as we’ve seen over the past decade, styles of investing can be out-of-favor for long periods, but using products that have a consistent proven process can help avoid performance chasing that is proven to be a loser’s game,” Hadden said. “Clients have different goals and time horizons, but in general, a focus on the long term should be stressed to help block out some of the short-term noise and volatility that is inevitable in the market.”

Scroll through to see the 20 value funds with the biggest 10-year returns, and at least $100 million in AUM, through Oct. 11. Net expense ratios, loads, investment minimums, and manager names, as well as YTD, one-, three-, five- and 15-year returns and month-end share class flows through May 1 are also listed. The data show each fund's primary share class. Leveraged, institutional and funds with investment minimums over $100,000 have been excluded. All data is from Morningstar Direct.