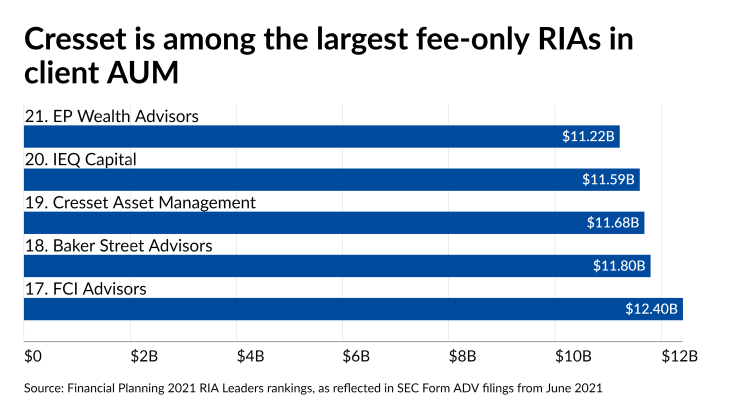

One of the largest fee-only RIAs in the country is folding into an even larger firm in an M&A deal that will create a multifamily office with $20 billion in client assets in 11 major markets.

Atlanta-based Berman Capital Advisors will merge with Chicago-based Cresset Asset Management and do business as Berman Cresset after the expected close of the

Berman has 10 advisors and 23 other employees with $4.7 billion in client assets just 11 years after former Goldman Sachs private wealth broker Justin Berman launched the firm. The merger comes as more massive fee-only RIAs and family offices fuel the industry’s record consolidation alongside the aggregators and wealth management giants more commonly associated with the flow of deals. Having completed another major

The firm represents one of the “super-regional RIAs” that Berman predicts will drive the greatest scale over the next three to five years with services like estate planning, tax services and complex needs for high net worth clients, he said in an interview.

“The true super-regionals have the resources in house to handle all of that knowledge,” Berman said. “The culture there just resonates. We're not trying to sell advice; we are partnering with our clients and delivering the best outcomes. The word ‘sales’ should not even be in our organizations.”

Among fee-only RIAs and family offices, such mega-mergers are driving the record volume of deals and average size of firms changing hands in wealth management over the past several years in a row.

Earlier this month, Tiedemann Group and Alvarium Investments unveiled a

Mariner Wealth Advisors made

“All of those things combined are causing owners of these firms to say, ‘If I was thinking about doing this in two years, maybe I should fast forward that,’” Bicknell said.

Cresset has an unusual capital structure: clients own 30% of its equity while employees control the other 70%. Becker and Stein became the first two clients when they opened the firm after being frustrated when they were searching for a family office for their own holdings, Becker said in an interview. Cresset has more than 180 employees and 80 advisors.

Its team noticed the similarity with Berman in that the incoming RIA was “offering a family office experience to a client base that has a concentration of CEO founders,” Becker said.

“We're looking for advisors and firms that are especially focused on providing a holistic integrated solution and experience for clients,” he said. “We're looking for advisors and firms who see that and want to be part of our team.”