The impeding acquisition of Investment Professionals by Ameriprise brings another major retail securities firm to the bank channel.

In fact, the acquisition enables Ameriprise, with 10,000 advisers, to leapfrog into a significant presence in financial institutions. For comparison, LPL has 14,000 advisers; Cetera, 8,000; Raymond James, 5,100; NPH, 3,300; and Ladenburg Thalmann, 4,000.

These numbers are cross-channel and not specifically bank advisers, but they illustrate the opportunities to leverage technology and infrastructure beyond existing employee and independent advisers. For IPI, the merger provides an expanded product platform, marketing support, service capabilities, technology and digital solutions, while maintaining its existing management team and partner institution relationship managers.

But what does the deal mean for the overall TPM segment?

Plenty. After the rapid expansion of the 1990s, TPMs have generally grown in four ways – by acquiring competitors, luring institutions away from competitors, financial institution consolidation, and improvements in customer penetration in the banks and credit unions they serve.

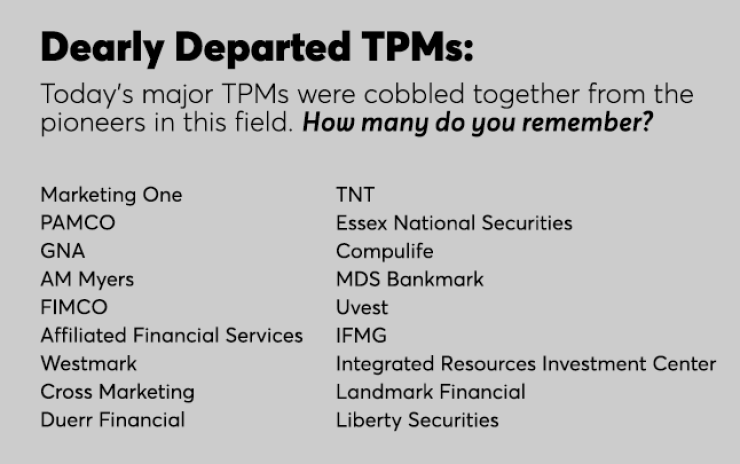

We feel the acquisition of IPI by Ameriprise has probably ended the long-run consolidation of the major TPMs, which were generally independent firms founded by entrepreneurs. The current major TPMs were cobbled together from the pioneer firms. Only INVEST and Investment Centers of America have survived this consolidation, operating as separate business units of the NPH network.

Now, eight of the top 11 TPMs are part of broader, independent broker-dealer firms, and 2 are largely owned by some of their partner institutions. The other – CUNA Brokerage Services – is a unit of an insurance company with extensive business through credit unions.

The bottom line: TPMs can no longer expect to grow by acquisition, as they have in the past.

CHERRY PICKING HELPS YOUR SLICE BUT THE PIE NEVER GETS BIGGER

In addition to acquisition, TPMs also have focused in recent years on luring partner banks and credit unions away from each other. This may help their slices of the pie, but it’s done nothing to increase the overall size of the market. Indeed, nearly three in four banks (72%) still do not offer investment services. Granted, this percentage has improved modestly over the years – it was 78% a decade ago – but the overarching question becomes: What are the obstacles to penetrating this opportunity?

Many of the banks that are not offering investment services are quite small – over 3,000 of them, or 78% of the banks not yet selling investments, have less than $250 million in core deposits, the level that generally supports one or two advisers. That size business is too small to support a full-time sales manager, so they tend to have producing managers – an adviser who works with clients and manages the interface between the bank and the TPM – or rely on a regional manager at the TPM who manages advisers at several banks or credit unions.

Another obstacle to penetrating the remaining banks not yet offering investment services is their ownership structure. Most of them are not public companies. Many publicly owned banks have been dragged into offering investment services by pressure from market analysts who downgrade a bank if its fee income is low relative to its peers. Independently owned banks do not have that pressure. Moreover, a fair number are family-owned institutions where there is a tradition of the status quo, so they continue to do business the way the founder did.

To be sure, TPMs can educate banks on the benefits of offering investments, including: generating income without capital expense, increasing customer loyalty and protecting them from competitors. Still, they face major headwinds from a common resistance to change.

Then there is also the lingering bogeyman of disintermediating deposits. While substantial research has demonstrated that this concern is not founded in experience, smaller independent banks are much more dependent on consumer deposits to fund their lending, and are wary of seeing them used to purchase investments.

All this suggests that the pace of TPMs signing up banks to start selling investments should not be expected to quicken. But the digital advice platforms, centralized call centers, and back office platforms that integrate securities brokerage, trust services, and asset management now being brought to market by the TPMs could be a wild card in the proliferation of investment services in financial institutions.

Nearly three in four banks (72%) still do not offer investment services. What are the obstacles to penetrating this opportunity?

The continuing consolidation of the banking and credit unions industry will widen the number of financial institution branches where someone can get investment advice, as larger banks already partnering with a TPM acquire institutions not yet offering investment services. But that consolidation will sometimes result in winners and losers for TPMs. In the cases where two institutions that work with separate TPMs merge, one of the broker-dealers will lose the subsequent beauty contest.

All of this leaves organic growth in the banks and credit unions that are already working with TPMs as a possible path to growth.

One of the best markets for growth opportunities comes from existing customers. Here at Kehrer Bielan, we have demonstrated with our research that if all financial institutions adopted known best industry practices, industry revenue could double. For instance, banks do not have enough advisers to seize the full opportunity in front of them. Plus, some referrals should be diverted to new advisers who should also focus on clients not being served well by the existing advisers. Moreover, turnover is high in this industry because many advisers last only two or three years, so banks need onboarding plans to nurture advisers while they are finding their feet. Finally, adviser and management compensation should be aligned with the objectives of the bank, investment services, the adviser and the client.

Banks that partner with TPMs have captured only half of their customers’ investible assets. So the successful TPMs of the future will focus on increasing penetration of the customer base in their partner institutions and capturing an increasing share of the end client’s investment wallet.