After adding double the number of experienced financial advisors from the previous quarter, Ameriprise’s wealth manager is targeting more potential recruits in the bank channel.

In contrast to rival firms that have higher revenue per advisor with

“We have long focused on driving productivity growth for advisors and we're generating some of the highest growth rates in the industry,” CEO Jim Cracchiolo said in a call with analysts,

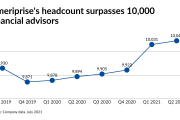

Recruiting: Ameriprise’s wealth manager added a net 168 advisors from the year-ago period to reach 10,073 in the third quarter, or a 2% gain. However, its two channels showed a contrast: the amount of independent franchise advisors rose by 2% year-over-year to 7,961, while the headcount of employee brokers ticked down 1% to 2,112. The wealth unit recruited 104 experienced advisors in the period, up from

Client assets and productivity: Based on the key metric of total client flows, the wealth manager’s organic growth rate has picked up from 4% in the third quarter of 2019 to 6% in the same period this year. Overall net client asset flows jumped 64% year-over-year to $10.04 billion, while the in-flow into wrap advisory accounts soared by 65% to $9.40 billion. In the same span, client assets grew 22% to $811.19 billion and wrap advisory assets under management climbed 28% to $430.55 billion. Adjusted annual operating net revenue per advisor surged by 15% to $766,000. In addition to equity value appreciation from the third quarter of 2020, new client acquisition and additional services and products among existing ones drove the organic growth. Its parent firm’s bank is also driving that growth, with nearly $11 billion in assets and $1.1 billion worth of cash sweep accounts coming into the bank in the quarter, Chief Financial Officer Walter Berman said. “Ameriprise Bank is adding to the growth in wealth management primarily by allowing us to pick up incremental spread cash deposits,” Berman said. “We are seeing good growth in banking products including pledge lending that has gained substantial traction with our advisor base since the product was launched in the fourth quarter of 2020.”

Bottom line: Ameriprise’s wealth management arm generated $459 million in pretax adjusted operating earnings on $2.05 billion in net revenue for the third quarter. The profit rose 43% year-over-year for the period, while the revenue was up 23%. The pretax adjusted operating margin of 22.4% increased by 320 basis points from the year-ago period. Besides the equity appreciation, the company derived its higher profit from the client asset flows, larger sales volumes and expense management, according to Ameriprise. The wealth manager’s parent company is on pace to bulk up its earnings per share in 2021 by more than 30%, according to a note after the call by William Blair analyst Jeff Schmitt. “Revenues and earnings are at record levels, driven by a leading wealth management franchise that continues to take market share, an asset management business that is breaking out after being stagnant for a number of years, continued expense discipline and favorable market conditions,” Schmitt said. “This is fueling strong free cash flow generation and high capital return, which continues to be a key driver of EPS growth.”