The leading independent robos announced this week they would be giving clients the option to invest with their values.

Betterment and Wealthfront both unveiled socially responsible investing approaches, responding to demand from clients that have made SRI, otherwise known as impact investing, an $8 trillion category.

Betterment has developed an SRI portfolio that clients can select, the firm said. It uses a different mix of ETFs from iShares to improve social responsibility scores in U.S. large cap assets. More SRI funds in the future will be added, the firm said.

The goal, Betterment said in a statement, was to "replace components of Betterment’s portfolio strategy without sacrificing the parts of Betterment’s advice that protect investors’ returns." The option is immediately available for its retail and Betterment for Advisor clients.

Wealthfront, on the other hand, said it would give its clients the choice of removing any security that doesn't align with their values from its direct indexing platform.

"We’ve seen numerous requests from our clients wanting to omit buying securities in sectors spanning four main categories: fossil fuels, deforestation, weapons and tobacco," stated Wealthfront CEO Andy Rachleff in a company blog post. "So we’re taking our cue from you and will build a one-click feature to omit one or all of these categories from your portfolio."

Wealthfront will also allow clients to omit individual securities regardless of what category they fall into by entering them into an exclusion list.

These platforms are the latest online to offer socially responsible investing options. Earlier this year, Motif launched

And one of the few new robo adviser launches this year to attract venture capital funding was built around socially responsible investing. OpenInvest raised $3.25 million in seed financing from noted investment firm Andreessen Horowitz.

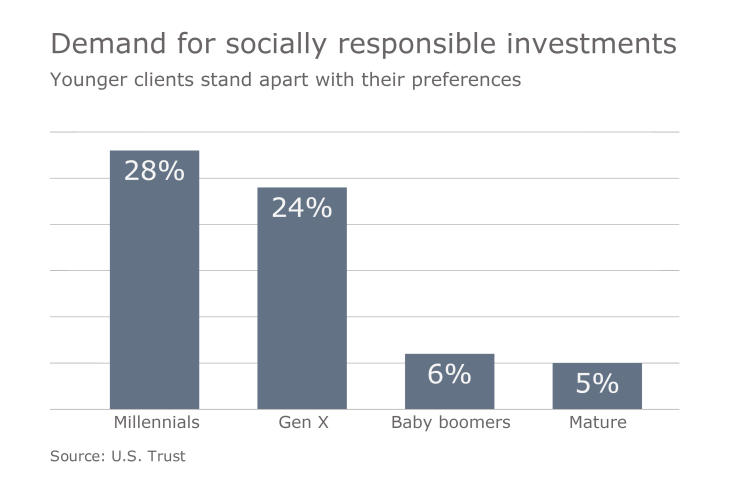

As an investing category, younger investors deem socially responsible investing as a priority: according to a study by Morgan Stanley, 86% of millennials say they are interested in the approach.

The category reached $8.72 trillion at the start of 2016, according to US SIF Foundation, the Forum for Sustainable and Responsible Investment.