One of the largest wealth managers is adding to its ranks with a focus on advisory assets and an expanded pool of potential recruits amid the coronavirus pandemic.

Cetera Financial Group recruited nine teams with $1.7 billion in client assets in February, and the firm poached a bank’s investment program from rival LPL Financial earlier in the week, the company said March 10. A fourth-quarter surge helped the firm exceed its goals for recruited assets from the start of 2020, Head of Business Development John Pierce said in an interview.

The incoming bank addition, Industry Bancshares, dropped LPL despite its notable success in attracting major investment programs from

Program manager Bo Thibodeaux’s team of two registered reps plans to add additional advisors with Cetera’s help, and they selected the firm after “a comprehensive RFP process” emphasizing service, says LeAnn Rummel, head of Cetera’s financial institutions community.

“That was really important to him, making sure that not only his advisors were going to be taken care of but also the bank’s clients,” Rummel says. “We've been at it a long time — 37 years. Every one of our growth officers has been in Bo’s shoes before.”

Representatives for LPL didn’t respond to requests for comment on the program’s move.

Independent broker-dealers serving as TPMs for bank and credit union investment programs are ramping up their recruiting

Cetera’s recruits in recent months have come from independent rivals, with “a smattering” from wirehouses, Pierce says. The Los Angeles-based network of five IBDs is targeting practices that are aiming to grow while placing the most value on advisory assets in its recruiting offers. Advisors have “re-engaged” on the trail after pausing for the pandemic, according to Pierce.

“Our investments that we've made last year and this year are paying off to really help our financial professionals grow,” Pierce says. “We're actually delivering on the value proposition and promises that we made when we entered this horrible pandemic, and I think that's one of the reasons that a lot of advisors are looking at us.”

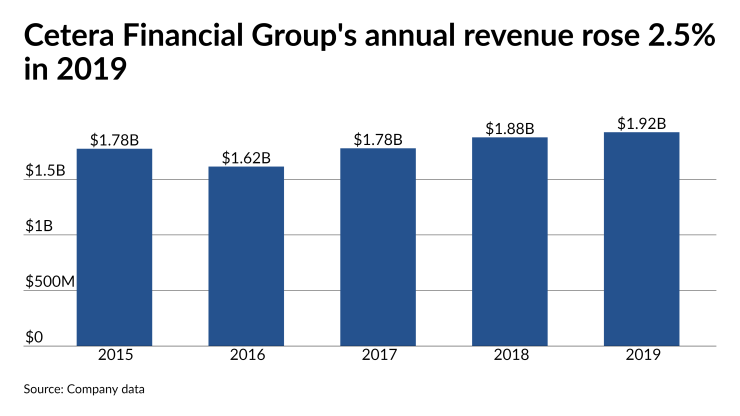

Pierce declined to share further specific metrics about the Genstar Capital-backed, private firm’s recruiting. Although Moody’s Investors Services

Industry Bancshares affiliated with Cetera’s bank channel on March 8, according to FINRA BrokerCheck. The bank has $6 billion in deposits in 27 offices sprinkled throughout rural areas in northeast and southeast Texas, and the investment program has set a goal of growing by 20% year-over-year each of the next five years. Thibodeaux moved to LPL from Cetera in May 2019 after three years with the BD and two prior years with Edward Jones.

Thibodeaux served on the “technology council that helped shape the AdviceWorks platform” in his earlier tenure with Cetera, he said in a statement, referring to the firm’s client portal. “I also witnessed firsthand its top-notch service experience. I believe it has the best bank platform and a solid track record of helping bank programs succeed.”

Additional incoming advisors to Cetera include Tracey Sapp, who joined the Mark Weeks Group of the Summit Financial Region at Cetera Advisor Networks on Jan. 21 after 18 years with Principal Securities, according to BrokerCheck. Another region — the label Cetera uses for its large enterprises — added advisor Brian Pitell from Park Avenue Securities to Benchmark Financial at Cetera Advisor Networks on Feb. 24.