Women’s biggest disadvantage as America moves toward a probable retirement crisis?

They will be alive.

With longer life expectancies than men and less saved in retirement accounts, women face an uncertain future, said Sallie Krawcheck, CEO of Ellevest, an automated investment platform tailored to women.

“Retirement is a gender issue,” she told a packed room at CB Insight's Future of Fintech conference. “Guys, you’re just going to be dead.”

While the line drew applause from the crowd, Krawcheck wasn’t kidding. In the United States, women outlive men, on average, by five years,

“We never talk about it as a gender issue," Krawcheck said. "We’re going to be left with no money. It just is.”

Half of all future retirees are at risk of not being able to cover essential expenses into retirement, according to a

Those numbers are compounded for women who tend to save much less for retirement than men. While both genders hope to retire at 67, when they reach that age, women have saved almost $100,000 less than men on average, according to

“My whole mission in life with Ellevest is to get more money in the hands of women,” Krawcheck said. “You gentlemen should be thrilled. Of course, when women have more money they’re better off, their families are better off and their daughters certainly are better off. But so is the economy, because we spend it.”

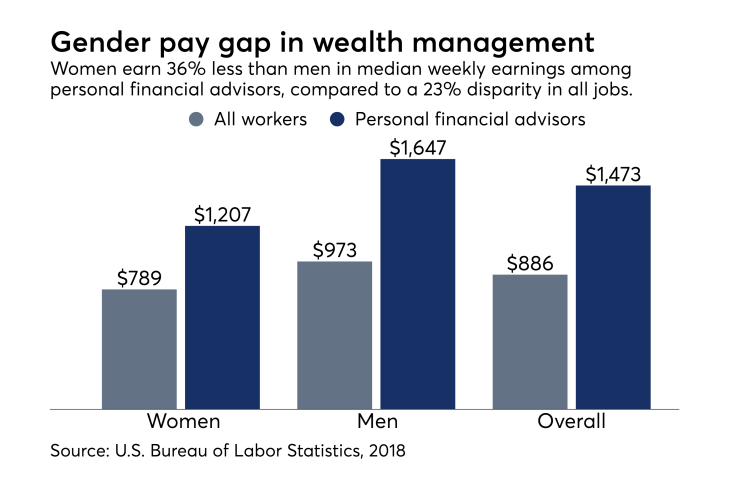

The No. 1 retirement priority for women is being financially stable in the event of outliving a spouse or partner, according to the Prudential survey. More than a quarter of women say they plan to rely on their spouse’s savings as a significant portion of their retirement income. Perhaps even more ominously, two-thirds of women surveyed said they don’t work with a financial advisor, either because they believe they can’t afford the advice or don’t have the necessary assets.

In March,

Krawcheck’s women-oriented robo advisor has secured approximately $62.5 million in equity funding since its founding in 2014 with Charlie Kroll, who now serves as the firm’s president, according to current SEC filings. Krawcheck formerly served as CEO of Merrill Lynch Wealth Management, Citi Wealth Management and Smith Barney. In line with its competitors, Ellevest charges 25 basis points for a standard plan with no minimum investment required. Fees climb as clients invest $50,000 or more, opening up access to CFPs on staff and executive coaches who offer tips on salary negotiations and career advice.

-

"Real diversity and inclusion is when we achieve gender parity and adequate representation of ethnic backgrounds," says Monica Giuseffi, principal of financial advisor inclusion and diversity at the firm.

November 20 -

Every man in the financial services industry should read this article, Nina O’Neal writes.

June 19 -

Despite the profession’s efforts to attract and retain women, demeaning experiences at industry events could be keeping them away — or driving them out.

June 20

Before the latest round of funding, Ellevest secured $32.5 million in funding in the firm’s largest Series A round in 2017 and raised another $2 million in 2015, according to SEC filings. Past investors have included the financial research firm Morningstar and tennis star Venus Williams. In the next few years, assets under management on digital platforms are

“What’s united these women is that they have agency over their own money,” Krawcheck said. “They tend to be a badass in most areas of their lives, but just haven’t found a relationship with money.”