A former Ameriprise financial advisor is facing up to 25 years in prison after pleading guilty to fraud. The resolution may bring some measure of satisfaction to victims who have received less than a dozen cents on the dollar for their losses more than a decade after the firm fired him.

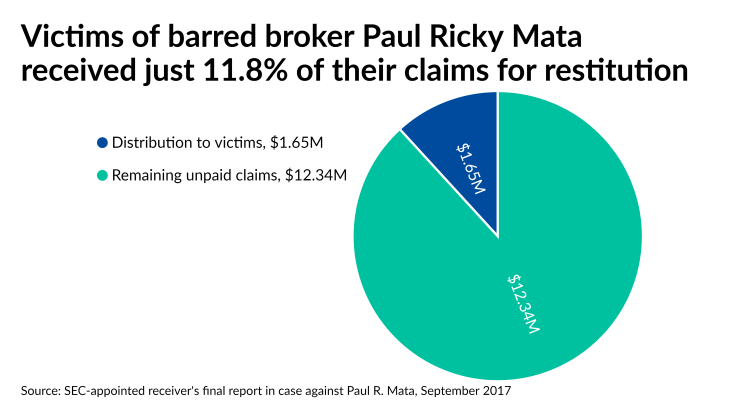

Paul Ricky Mata pleaded guilty on July 19 to 17 counts of mail and wire fraud, as well as making false statements in a bankruptcy proceeding. Federal prosecutors alleged he defrauded nearly 100 clients for $14.5 million in a real estate investment scheme between 2008 and 2015. A California grand jury

Ameriprise

The case highlights the harm that can be done by brokers who drop their FINRA registration

“Ameriprise did not adequately warn its customers of what they discovered about Paul Mata and all the red flags in his background,” Vujanov says. “The clients had no idea what was going on. There's a huge file on him at Ameriprise, and they got sent a one-page letter saying they terminated him and that's it.”

Mata’s public defender, Neha Christerna, declined to comment on the case.

Vujanov points out that firms like Ameriprise seek to avoid retaliatory defamation lawsuits from former advisors after a termination. The firm has noted in the past that it filed a U5 amendment with FINRA in 2009. The regulator, as well as state officials in Nevada and California, had filed cases before the SEC’s case against Mata in 2015, BrokerCheck

“We took appropriate action and terminated Mr. Mata in March 2009 for violating company policies,” Ameriprise spokeswoman Kathleen McClung said in a statement. “The current charges against him relate to alleged activity he engaged in away from or after he was fired by our firm.”

The FBI investigated the case and referred it to the U.S. Attorney’s Office for California’s Central District after the SEC began its civil case, according to Justice Department spokesman Thom Mrozek. Prosecutors sought an indictment once they “obtained sufficient evidence to proceed with a criminal case” against Mata, who has now been convicted on all counts, Mrozek said in an email.

“Mr. Mata engaged in a complex fraud scheme which took time to unravel,” Mrozek said. “We will proceed to seek a just sentence, to include any and all restitution available under the law for victims of the charged crimes.”

Representatives for the SEC and state regulators in California didn’t respond to requests for comment on the case, while FINRA spokesman Andrew DeSouza declined to comment on this specific case. On the more overarching topic of fraud, DeSouza cited

In the scheme, Mata steered clients’ money toward a down payment on a home outside San Bernardino, loans to his businesses and payments to other victims, according to federal investigators. He had sold them on investments into entities such as Secured Capital, which he described as a portfolio of “government-backed tax liens, asset-backed deed certificates and distressed commercial and residential properties” guaranteed to generate returns of 5% to 10% per year, the indictment states. Later, in a bankruptcy proceeding, Mata concealed a 2008 Mini Cooper and a 2001 Jeep from his assets, according to prosecutors.

The problems in the bankruptcy case likely delayed the criminal case, according to client attorney Alexander Loftus of Loftus & Eisenberg. He represented clients who

While teaching classes such as “Finances God’s Way” and “Indestructible Wealth,” Mata violated the church’s prohibition on selling products and subverted its messaging to his own uses, Loftus says.

“The core teaching is that everything belongs to God and all of your wealth is God’s wealth and you are just the shepherd of the wealth,” he says, noting that Mata stepped in to act as the shepherd of the church members’ wealth. “It's very dangerous. It still prevails that churches are teaching this. We've had a bunch of cases involving churches, and this is how it works.”

The church didn’t respond to a request for comment.

As part of pleading guilty to all 17 counts against him, Mata pledged that he understood that he faces a maximum sentence of 25 years in prison, three years of probation, a fine of $500,000 or twice the amount of losses stemming from the crimes plus the requirement of restitution, the March 2020 plea agreement shows. He formally pleaded guilty in court this week after reaching the deal last year. Mata’s sentencing hearing is scheduled for Dec. 6.