When women with STEM degrees decide to go into financial services, they have to turn down other opportunities that are often more directly related to their fields of study. So why do they choose to work in a bank or fintech instead of a chemistry lab or research vessel? The top factors are resource accessibility, a feeling of affinity and having role models in the field, according to a

As technology fuses with financial services and firms seek to hire more diverse workforces, there are more opportunities for women with STEM degrees. Many financial services firms want to recruit and retain more women with STEM degrees as hiring priorities shift in the industry.

“I think STEM is an attractive field. There would be no reason, I believe, that women couldn’t be just as attracted to it as men are,” says GAO Director of Financial Markets and Community Investment Alicia Puente Cackley, who oversaw the research.

As the financial services industry evolves, it has become increasingly reliant on technology, and the number of workers in the field with STEM degrees has grown. More than one-fifth of employees in the industry have degrees in STEM, in part because financial services firms rely on technology for online resources and protection against cybersecurity threats.

Simultaneously, private sector organizations have placed more emphasis on recruiting and retaining women in general to serve a diverse consumer base. With those two priorities, finding and keeping women staffers with STEM degrees has become highly important to many financial services firms.

Cackley and her team began working on the report in April 2020 when Congresswoman Ann Wagner, Republican of Missouri, who is a ranking member on the Subcommittee on Diversity and Inclusion of the Committee on Financial Services, requested it.

“What we were asked to do is look at how women with STEM degrees were supported and encouraged to go into the financial services industry and what were some ways firms recruited and retained women in those industries,” Cackley says.

To gather information, they spoke to many firms and some women who are in STEM fields. Cackley’s team also looked at trends based on

Among those interviewed for the report were financial services firm representatives, nonprofit organizations and associations across the industry. GAO picked participants based on prior work and a literature review.

GAO found that several financial services firms are trying to pique women’s interest in STEM by spreading awareness about careers in the industry among college-age women, by donating to nonprofits that encourage girls to participate in STEM activities and by implementing career training specifically for women. “What we learned from industry folks and some of the nonprofit groups that are working with women in STEM earlier is that if you reach them earlier in their schooling, they have a tendency to stick with the topic,” Cackley says.

The hybrid firm’s giant parent tapped a new leader as it builds out a growing team with a mission.

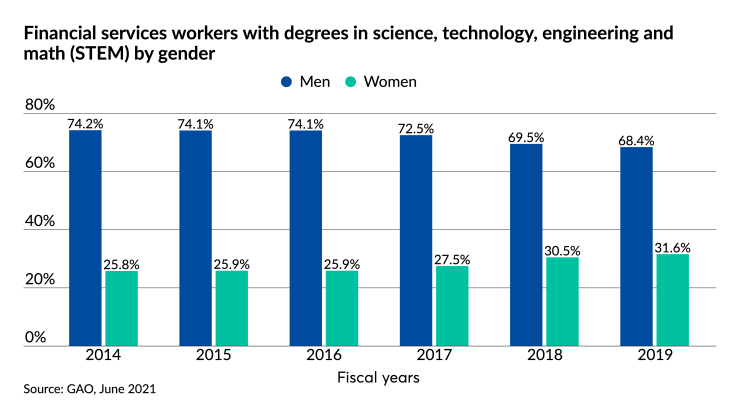

The percentage of workers in the financial services industry with STEM degrees who are women has steadily increased since the 2014 fiscal year. With the figure at 31.6% in the 2019 fiscal year, Cackley says that “the increase is likely to continue.”

One expert suspects that the number will rise because of the innate abilities of women in STEM. “Women are more naturally good with communication skills and problem solving,” says Carolyn McClanahan of Life Planning Partners, based in Jacksonville, Florida.

McClanahan majored in microbiology in college but says her MD degree is what helped her become a better financial planner because of the communication skills she acquired. “One of the most important skills that financial planners need to have is that they have to be very comfortable communicating about difficult subjects,” McClanahan says.

Some firms have programs for employee retention—such as leadership guidance and employee support groups—that are aimed at women with STEM degrees. “It’s not just a question of getting people in the door but also keeping them and finding what practices are most effective at retaining people,” Cackley says.

Because the goal is to create algorithms that maximize returns for clients, women who have degrees in data science and quantitative analysis are particularly attractive to financial services firms.

“I think those of us in financial services and those of us with STEM backgrounds, we need to continue encouraging women to enter the STEM world,” McClanahan says. “I think it’s only getting better and better.”