As Interactive Brokers Chairman Thomas Peterffy watched the GameStop stock-price saga unfold last week, he felt nervous.

He'd seen a lot in a long financial-services career that began in the 1970s; bull markets and bear markets; Black Monday and the Dot Com bust.

Last month Reddit users drove shares of GameStop sky-high and some firms, such as Robinhood, began pumping the brakes, restricting investors' trading and provoking an outcry.

Should companies not be able to cover their client losses in volatile stocks like GameStop — “that is a major concern for all clearing firms,” Peterffy says.

That concern was centered deep in the gears of Wall Street's inner-workings, which has potentially big implications for financial advisors and their clients.

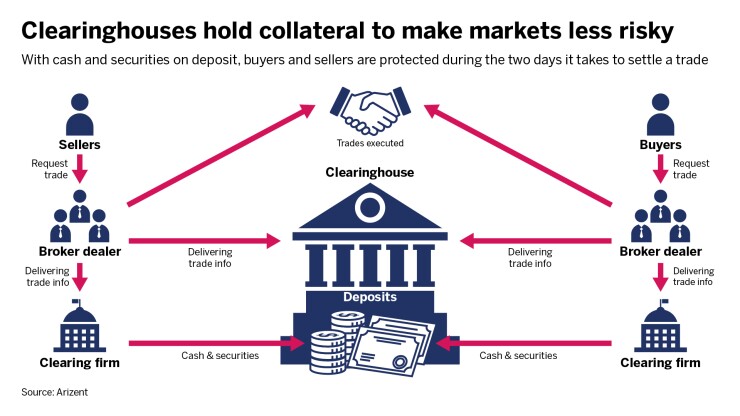

When a trade is made, it's not just a matter of clicking a button. Clearing firms and clearinghouses play a role — one often-misunderstood by many retail investors and even some advisors. But these firms underpin the mechanisms allowing investors to buy an investment and advisors to trade shares on behalf of their clients. The situation last month illustrates why it’s so important for advisors to choose their vendors and business partners wisely, experts say.

The financial system’s plumbing

The decision

But there were other factors at play when looking at how trading — and in particular, margin trading — works, experts say.

“There’s this whole intricate web of restrictions and regulations and interconnections between parties,” says Lori Zager, a financial advisor of 2X Wealth Group, a team with Ingalls & Snyder. Zager and partner Lisa James sent out a newsletter to explain to clients how the GameStop debacle occurred. “I think most people, when they buy or sell a stock, may not be aware of it.”

One critical player operating behind the scenes of every trade to effectively prevent defaults: clearinghouses.

The key clearinghouses are the Depository Trust & Clearing Corporation, for securities and fixed income, and the Options Clearing Corporation, which clears options trades and derivatives. They stand in between clearing firms or self-clearing brokers (such as Interactive Brokers, Apex Clearing, Robinhood and Merrill Lynch) on each side of a trade to help mitigate risk.

How trades are settled

Both the buyer and seller of a trade have to report it to a clearinghouse immediately. The clearinghouse has

To guard against the case that a broker on one side of the trade can’t deliver the cash or security required of them during those two days, the clearinghouse mitigates risk by requiring brokers to post their own deposits with the organization.

“Margin requirements protect the entire industry against defaults and systemic risk in volatile markets,” says a spokesman for the National Securities Clearing Corporation, a subsidiary of the DTCC.

Trades of extremely volatile stocks, such as GameStop or AMC Entertainment, heighten the risk that a clearing firm on either side of the transaction will default, particularly if a company is largely on one side of the market, according to the spokesman. In this case, the clearinghouse will demand a clearing member put down more collateral.

Stocks like Gamestop and AMC “generated substantial risk exposures” to firms clearing those trades, according to the NSCC spokesman.

Robinhood said earlier this week the NSCC had asked for

The NSCC spokesman declined to comment on margin requirements for any specific company due to confidentiality.

Money at risk

Clearinghouses require broker deposits to protect the broader market: Broker-dealers can, and have, gone bust when sustaining large losses.

While there are legal protections in place for investors, broker-dealers, by nature, take on risk in their business models.

“In the capital markets, we want investors and institutions to take risks – informed risks that they freely choose in pursuit of a return on their investments,” SEC Commissioner Daniel Gallagher

The skewed allocations “may significantly change fund performance and use case suitability until rebalance dates,” analysts say.

Margin lending poses a risk, as broker-dealers essentially loan customers funds for a trade, requiring a percentage of cash or securities as collateral.

“The concerns are always about people who are trading on margin or people who are short, which is always on margin,” Peterffy explains.

Clients who trade on margin and lose money don’t always have enough funds in their accounts to cover the losses, according to Peterffy, who says that Interactive Brokers factors into its models that it could lose about $1 million or so a month in this manner. “That’s part of the cost of the business,” he says.

Of course, when volatility is high, so is risk.

There were 27,000 separate accounts with positions in GameStop at Interactive Brokers, Peterffy says. It’s “extremely difficult” to gauge which accounts could be in trouble and which aren’t.

Accounts can go negative, and then the brokerage house can decide whether to liquidate or take over an account, according to Peterffy.

“If there are many of these customers in this position, then the broker is in big trouble,” Peterffy says. Interactive Brokers put all option trading of five stocks into liquidation on

To reduce their exposure to margin risk last week, brokerages including Interactive Brokers, Merrill Lynch and Charles Schwab upped their margin requirements for buying long to 100%.

With stocks so volatile, “a margin trade should require much more capital than a regular trade,” says Ryan Z. Farley, a finance professor at the University of Tennessee and a former institutional trader.

Another risk was at play, too: At one point last month,

The 20 categories with the biggest gains are home to nearly $10 trillion in combined assets.

Those who lend their shares to short sellers have the right to call them back whenever they choose. Theoretically, Farley says, if everyone called back their shares at once there would be a huge contraction in the supply.

“That is the big conundrum, and that’s the situation that could basically take the system down,” Peterffy says.

To be sure, there are protections in place for investors. The SEC sets minimum net capital requirements for brokerages. Congress passed the Securities Investor Protection Act in

Still, it’s critical that advisors pay heed to the stability of the institutions they work with. And they need to pay close attention to capitalization, Farley says.

“At the end of the day, money speaks louder than reputation,” he says.