Even before he opened his digital doors, Emlen Miles-Mattingly was keenly aware of the prominent role technology would have to play in his new firm’s future success.

The founder and CEO of

“When we first started in 2017, I never had any plans on ever having a physical office. This was three years before coronavirus, so people were looking at me crazy … and the only reason I got an office is because my largest client at time said they’d feel more comfortable if I did,” Miles-Mattingly told Financial Planning. “Fast-forward to 2020 when everything hit the fan, and (that client) hasn't even tried to come in to see me since. We do everything over Zoom, but I was ready because of my mindset from day one.”

His approach, deemed risky and unorthodox five years ago, is becoming commonplace as the pandemic continues to make real-life interactions challenging. That means a greater reliance on technology to get things done and a greater sense of urgency to develop digital transformation strategies with an eye toward future-proofing one’s business.

But for Miles-Mattingly and many others in wealth management, becoming a truly future-proof planner isn’t about having all of the right answers today. Instead, it hinges on the awareness that you will have to ask the right questions tomorrow.

“I think betting big on tech and having a real vision for where you want to see your business is what keeps you from falling behind,” he said. “And the work is never done because there's always something new or a few more things that we can do as a firm to make things easier for our clients. And that's the driving force — making that client or customer experience one that can be flawless, seamless and easy.”

Knowing your position in the race

Attitudes, priorities and pain points related to creating a future-ready technology strategy were the focus of a survey of 394 U.S. business leaders conducted throughout February by Financial Planning’s parent company Arizent. The group included 103 respondents in wealth management, along with representatives from the banking, insurance and mortgage industries.

Participants shared thoughts on the factors that inform decision-making, challenges they face and the benefits of successfully leveraging technology. The study also gauged confidence in those efforts and provided a snapshot of how far along respondents believe they are on their transformation journeys.

Wealth managers were found to be the most sheepish when assessing the maturity level of their digital transformations, with 62% of respondents reporting either “nascent” or “developing” digital transformation maturity.

Wealth management was also found to be lagging when it comes to effectively leveraging technology to advance digital transformation, with 40% of advisors saying they are trailing, 43% saying they are “in the pack” and just 17% saying they are leading the race.

Joel Bruckenstein, a technology consultant and producer of the

“All of a sudden, obviously, it became imperative. But a lot of firms were not set up to have clients working remotely, and I would argue that a lot of firms still

He also sees a strong push by firms and advisors to address the No. 1 digital transformation roadblock across all industries — integration.

He said years ago, big firms focused on supplying all-in-one solutions. Then over the last two decades, until recently, the strategy moved to identifying and embracing a number of technologies deemed “best of breed.”

“Now you're seeing somewhat of a backtracking where a lot of firms are looking for fewer providers because they realize the challenges of integration,” Bruckenstein said. “So what you're seeing is a lot of the providers that used to be niche providers, lets say portfolio management technology, are now sort of pivoting and trying to become platforms … and I think the reason is advisors are having trouble putting together their own tech stack, so they're looking for somebody that can combine much, if not all, of that for them.”

The survey findings and Bruckenstein also place great emphasis on the human element of transformation. While challenges remain related to tech savviness and resistance among individuals, major gains can be made by having the right people at the helm.

“If you just buy technology with no plan and you expect everybody to just use it, you're going to fail for sure,” Bruckenstein said, noting that decision-makers need to take into account how they’ll use a new tool before bringing it in-house and resist the urge to flock to products just because they garner praise from peers.

“For example, there is no universal CRM that is best for everybody. It's all based on your use case. So the best CRM for a firm that has a given business model and is of a certain size may not be the same for another firm that has a different model and is of a different size,” he said. “If you don't have the skill to understand your strategy and understand what works with what, then you’re going to rely on a sales guy from a software company telling you how great something is going to be. Then you're going to have a problem.”

Know your hand and play it with confidence

To determine what separates the digital transformation leaders from the rest of the pack, the Arizent research employed a regression model to identify the five core drivers among respondents.

Having a fully defined strategy — which includes steps such as assigning responsibility for achieving certain goals and having metrics in place to measure success — was considered the most important driver impacting the effective leveraging of technology for digital transformation by 38% percent of respondents. It was followed by data access for decisions (25%), technology orientation (16%), security and privacy (15%), and core modernization (6%).

Despite fully defined strategy taking the top spot, only slightly more than half of respondents said they have practices in place to capitalize on that.

Chris Zuczek, chief product officer at

“Coming in with a plan is a thousand times better than coming in with nothing at all,” Zuczek said, adding that problems that stem from poor planning vary based on scale. For smaller firms, infrastructure and funding limits may go unaddressed. For larger firms, there may be a fear of change, aging tech that doesn’t play well with others and lack of incentive to fix what doesn’t appear to be broken.

But with a real strategy in place, Zuczek said advisors see better outcomes. Good planning may also reveal that the solutions he has to offer may not be the right fit, saving advisors time and money in the process.

Staying close to customers from afar

For most survey respondents, the customer comes first. Improving customer experience was the top transformation goal identified, followed by driving business growth and delivering operational efficiencies.

That commitment to customer service is evident when looking at the tech already being implemented across sectors. Communication tools like Zoom, Microsoft Teams and Slack are the most prominent, with 69% of respondents saying such applications are being used for all possible use cases. The only other types of tech to see such wide implementation were enhanced security and fraud mitigation (58%), mobile apps (56%), and cloud-based architectures (51%).

These tools are boons for advisors like Nick Covyeau of

As the owner of a newer, smaller firm, Covyeau said he leaves nothing to chance when it comes to crafting his stack. He goes hands-on with each bit of tech he relies on and will often “beta test” new additions by getting feedback from friends and family.

The reason for that level of commitment, Covyeau said, is that coming out of the pandemic, he realized that the way he engages with clients has forever changed.

“They want more of me. They want more connection, and I find myself texting a number of my clients rather than emailing them and sending them a quick Loom video rather than typing something out,” he said. “I've found having more frequent, shorter interactions with them really separates me from other advisors, robo advisors and the large wirehouses.”

James Vermillion, founder of

“Removing a lot of the friction that I felt and my clients felt previously was one of my main priorities when going independent, and I was honestly expecting to spend a whole heck of a lot more than I do today to be able to create a good experience,” he said. “That was one of the biggest and most pleasant surprises.”

Vermillion said he works with younger clientele that not only expects, but demands a seamless tech experience.

“They don't want to be mailing paperwork back and forth. They want things fast, and they want a good interface, so those are some of the things that I've tried to focus on,” he said. “Being nimble, being agile and removing friction has allowed me to compete.”

Solving problems by going all-in

The roadblocks companies need to overcome to advance technology initiatives are numerous. Chief among them are challenges related to integration, customer limitations, reliance on vendors and staff availability.

Survey respondents rated challenges related to integrating new solutions into existing workflows as the most significant barrier to advancing technology initiatives at their organizations. Integrating legacy systems with new digital technologies, customer technology limitations, reliance on vendors to deploy new solutions and availability of skilled staff round out the top five.

But the nearly 400 respondents see great value in investing to clear those hurdles.

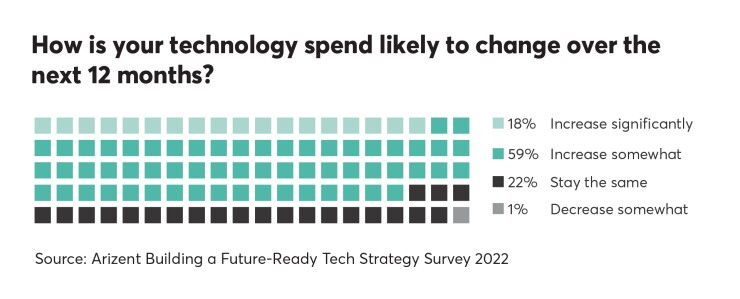

About three out of four respondents said they expect technology spending to increase in 2022. More than half (58%) said they will increase spending somewhat, while nearly one in five (18%) said they will increase spending significantly. About 22% of respondents said technology spending will remain stagnant, while just 1% plan to scale back.

Those findings were consistent with Financial Planning’s

That finding was encouraging for Bruckenstein, but he stresses that big spending without proper planning won’t move the needle for firms who feel they are playing catch up.

“I think as an industry, we've probably underinvested in tech for as long as I've been in this industry. Having said that, it's not equal across the board,” he said. “If you've been investing consistently over time, next year you might not need to invest all that much. But if you haven’t invested significantly over the last five years and you have no technology plan, then you're going to have to expend a tremendous amount of money to get up to speed.”