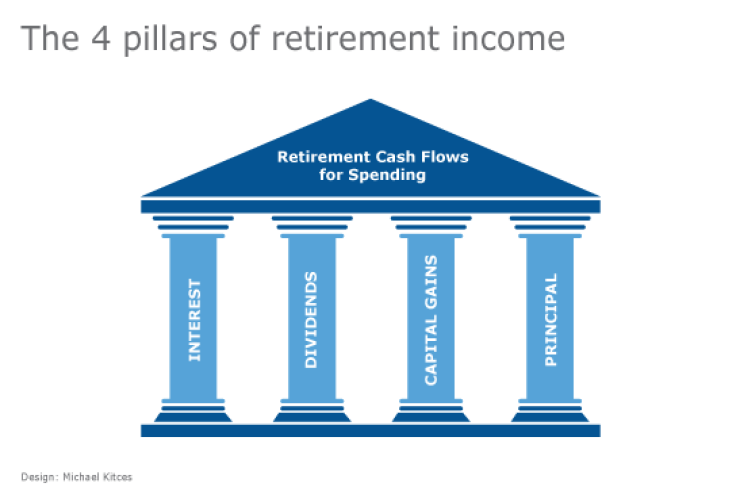

Though research around retirement portfolio strategies has been evolving for decades, consensus has coalesced around four pillars for retirement income: interest, dividends, capital gains and principal. Just because there’s consensus, however, doesn’t mean there’s broad agreement on how to manage these distinct sources of retirement cash flows.

What follows is a look at the forces that have shaped the planning industry’s thinking around portfolio management, and the challenges that lie ahead for wealth managers and planners alike.

BONDS AND COUPONS

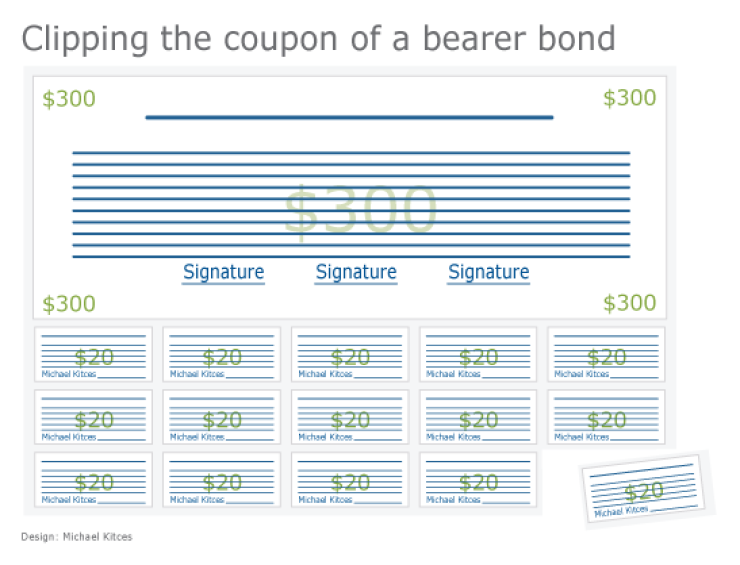

In the early days of bond investing, bonds were issued as so-called bearer certificates or

In turn, this meant the interest payments that bond issuers would pay to bond owners was paid directly to whoever actually held the bond — redeemed by a paper coupon attached to the bond that could be physically cut and presented for payment. This is why a bond’s interest rate is often called its coupon rate, and why collecting the interest payments from a bond is still often colloquially called clipping the coupon.

With the rise of the modern investing and retirement era after World War II, the strategy of buying bonds and clipping the coupons was the leading approach for retirement income from a portfolio — either in lieu of a pension or Social Security for those who didn’t have one or weren’t eligible, or to supplement it. The stable coupon payments were an effective substitute for stable pension payments, and were increasingly appealing through the late 1950s and into the ‘60s as interest rates drifted higher with economic growth.

And of course, for those who needed a little more money as well, the bonds could always be sold or held to maturity for some additional cash flow. In the context of pension funds and institutions that needed to support a large volume of ongoing payments, it was common to ladder the maturities of the bonds sequentially, which ensured that the principal value of a maturing bond would be available to supplement cash flows that year. For individuals, however, the liquidation of the bonds themselves was often more ad hoc, given the uncertainty of the retirement time horizon in the first place.

THE INFLATION SHIFT

One of the key challenges of the coupon-clipping bond strategy for retirement income was that bonds, particularly the ones issued in decades past, simply paid a nominal coupon rate that was always the same, regardless of inflation. This meant that over time, inflation could and did erode the purchasing power of the bond income. Fortunately though, inflation rates were modest in the ‘50s and ‘60s, and most people didn’t necessarily plan to live for decades in retirement, which further limited any material long-term danger from inflation.

Then the ‘70s struck, and an inflation rate that had averaged only 2% in the ‘50s and 2.3% in the ‘60s jumped to 6.2% in 1973 and then spiked to 11% in 1974, severely damaging the purchasing power of bonds purchased in the preceding decades. In fact, from 1973 to 1982 the average annual growth rate of inflation was a whopping 8.7%, which cumulatively cut the purchasing power of bond interest by 57% in a decade. At the same time, a growing realization was underway that with improving health, retirement could actually last a very long time — making the cumulative impact of inflation matter a lot.

The perfect retirement plan was one where the last check was for the undertaker — and it would bounce.

As a result, by the early ‘80s, the focus of retirement income planning portfolios had shifted from buying bonds and clipping the coupons to buying stocks and spending the dividends.

The bad news about dividends was that the yields weren’t as high: In 1982, the

For instance, if a company generated $1 million of revenue with $800,000 of expenses and the remaining $200,000 paid out in dividends — and inflation caused prices to double — then revenue would rise to $2 million, expenses would jump to $1.6 million and the business would pay out $400,000 in dividends. The end result: The business profit margins would remain the same, but doubling prices would cause the dividends to double along with it, allowing the dividend investor to maintain purchasing power.

And throughout the ‘80s, this is exactly what happened. In 1981, the S&P 500 paid out approximately $7 of dividends when the index was at $133, for a 5.3% yield, and by 1990 it was paying out about $12.50 when the index was up to $340, for a 3.7% yield. The end result was that the yield actually fell as stock prices rose, but the retirement spender saw their retirement cash flows rise almost 80% — from $7 to $12.50 — easily keeping up with the inflation rates of the decade, which averaged 4.7%, or a cumulative increase of just 58%.

Of course, the caveat of the dividend-paying stock strategy for retirement income was that dividends were not guaranteed, and in fact, the stocks themselves had economic risk. This meant dividend-paying strategies of the day typically focused on the highest-quality blue chip stocks, which were most likely to stick around and continue to raise their dividend payouts over time.

ENTER CAPITAL GAINS

By the ‘90s, the leading retirement income strategies began to shift again.

The challenge was that while dividends were in fact growing at a more than ample rate to keep pace with inflation, the underlying value of the stocks was growing as well, and quite significantly. As noted above, not only did dividend payouts rise 80% through the ‘80s, but the raw price level of the S&P 500 was up 150% as well. In other words, the retiree’s account balance by the end of the decade was more than 2.5 times the account balance at the beginning of the decade, even after spending all those dividends along the way.

A Department of Labor rule adopted under the Biden administration had many brokers worried about their ability to work as independent contractors. A new proposal would roll it back.

The financial advisory firm initially sought an industrial loan charter back in 2020. It's the third company to receive the necessary approvals this year, joining General Motors and Ford.

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

This recognition — that it was necessary to consider the impact of stock growth and capital gains — reformed the thinking on retirement income portfolios once again. The shift was on to view portfolios more holistically, considering the availability of interest, dividends and capital gains, and spending on the basis of the total-return portfolio. And given the sheer magnitude of the capital appreciation potential, the impact was substantial. Personal finance publications of the day routinely suggested that 7% to 8% withdrawal rates would be reasonable and sustainable, given total-return expectations for markets at the time.

Notably, the inclusion of capital gains as a pillar of retirement income portfolios was also aided greatly by the decline in investment transaction costs stemming from stock trading commissions being deregulated on

SPENDING PRINCIPAL

In the early years of a portfolio-based retirement, it was often used as a supplement to a defined contribution pension plan, Social Security or other income-producing assets like real estate. However, with the decline of the defined benefit plan and the meteoric rise of the defined contribution plan throughout the ‘80s and ‘90s, the use of a retirement portfolio shifted from being supplemental to the core of funding retirement. This introduced a new challenge to thinking about retirement planning: What to do with the retirement account balance itself?

In a world of defined benefit pension plans, there was no account balance. The retiree received payments for his/her life, or payments for the joint survivorship of the retiree and his/her spouse, and at death, the payments simply stopped. But with a defined contribution plan, there was an account balance that, if not fully used, would remain available for heirs. In some cases, the potential to leave a legacy of the remaining retirement account balance was simply a gift to bestow on family members or charitable entities.

When thinking about a retirement portfolio, it’s better to think in terms of retirement cash flows than retirement income.

But in many cases, the fundamental goal of the retiree was to use the money in retirement, which meant not only the growth on the retirement account, but the principal too. From this perspective, the retirement account was something to be spent and maximally consumed; a remaining balance at the end meant wasted opportunities of how the money could have been spent during life. The perfect retirement plan was one where the last check was for the undertaker — and it would bounce.

Of course, the challenge to this approach was that retirees didn’t necessarily know how long they’d live. This meant planning to bounce the undertaker’s check was risky, as if the retiree spent the principal down too soon and then failed to die in a timely manner, all the money would be gone. Thus, the use of retirement principal became another part of the balancing act; spending down too soon would lead to disaster, but not spending down at all was a waste too.

COORDINATING THE PILLARS

Ultimately, these components of interest, dividends, capital gains and principal form the aforementioned four pillars of retirement income planning. And ever-declining transaction costs made it comparable to spend interest and dividends, or reinvest them and liquidate capital gains from some other investment instead, or keep it all invested and spend from principal. In other words, the four pillars of retirement income became increasingly fungible and interchangeable, to be shifted around from year to year as necessary to fund the retirement goal.

In fact, liquidations from the modern retirement portfolio will likely shift among all four pillars from year to year and decade to decade. In some years, the biggest drivers to total return are from interest and dividends, which can be taken and spent. In other years, a bull market means ample capital gains that can be liquidated for retirement spending instead, especially in times of low yields from interest and dividends. In bad years, it may be preferable to tap principal in order to leave the rest of the portfolio invested for a hopeful future rebound.

In fact,

Notably, it’s crucial to recognize that not all retirement income is actually taxable income. In fact, the process to optimize the tax-efficient liquidation of retirement accounts is entirely separate, including determining when to tap

In fact, arguably when thinking about a retirement portfolio, it’s better to think in terms of

Consequently, while it’s necessary to consider — and possible to optimize — the tax treatment of income, ultimately the purpose of the retirement portfolio is to generate the cash flows on a total return basis to satisfy the retiree’s spending needs, regardless of whether the Internal Revenue Code calls it principal, income, taxable or tax-free.

RISK FACTORS

Notwithstanding the shift in thinking and research about retirement income from portfolios over the years, it’s notable that a material segment of retirement investors still focus on a traditional income-based approach to retirement, with a focus on investing for interest and dividends.

The first challenge of this approach is that it completely ignores the other two pillars: capital gains and principal. While some might simply argue that leaving the principal untouched and letting capital gains be a bonus is simple conservatism, the sheer magnitude of their potential introduces a risk that the retiree drastically underspends relative to the lifestyle that the portfolio could afford them.

As it is, even a total-return approach already

However, the situation is clearly further complicated in today’s environment due to the low absolute level of yields, including both dividend yields and bond interest rates. In turn, this can lead retirees to stretch for yield, which typically entails an increase in risk, as bond investors must either buy longer-term bonds, which increases interest-rate risk, or lower-quality bonds, which increases default risk, to get more yield.

Similarly, stock investors looking for better yields by focusing on the highest-dividend-paying stocks typically end up concentrating the portfolio into narrow sectors, which introduces new risks as well. After all, financials were the highest-dividend-paying sector of the mid-‘00s — right up until they weren’t, when the financial crisis unfolded in 2008.

And in today’s environment, the top-paying dividend sectors also include utilities and basic materials such as energy, both of which are now attracting warnings as valuations move to

But again, that’s actually the whole point of relying on all four pillars of retirement income. You don’t necessarily know which one will produce the desired results from year to year, but diversification gives you the best shot to get it from somewhere, without taking on excessive risk or portfolio concentration in stretching for yield along the way.