Raymond James is setting records in terms of growth and revenue as it ups its recruiting efforts after losing some momentum during coronavirus.

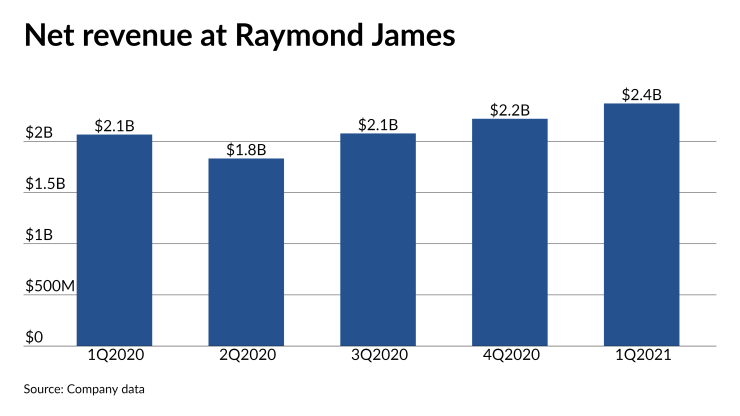

The company's net revenue increased 15% year-over-year in the first quarter. Its Private Client Group now holds more than $1 trillion in client assets, a 40% increase from 2020.

The company upped its recruiting package last year, a move that has been “very well received by prospective advisors,” Paul Reilly, CEO of Raymond James, said on an earnings call with analysts April 29.

“The number of advisors scheduled to join is up significantly, not only in our employee channel, but across all of our affiliation options,” Reilly said.

The regional BD reported 8,327 advisors in its Private Client Group this quarter, a net increase of 179 from March 2020.

Coronavirus and Fed interest rate cuts put pressure on the St. Petersburg-based firm and its margins over the last 12 months. The company made 108 fewer basis points in net interest margin by the end of March than it did during the year-ago period.

Reilly said on last quarter’s earnings call that the company had “faced some challenges” attracting advisors due to its remote operations. The company had also scaled back its advisor training program by 35 trainees (it typically targets 200, according to the firm) in an effort to cut costs and allot more resources to onboarding new recruits.

Now that it has tweaked its recruiting package, the company said it has attracted “probably the largest group of large teams we've ever had” to its pipeline, according to Reilly. While it acknowledges its offering to new recruits isn’t the highest on the Street, Reilly says advisors are willing to make the trade for the company’s culture.

“When we had deals that literally were almost twice as much as ours, it was hard for people to turn down the money, even though they might have preferred coming here,” Reilly said on the call.

The company has touted its RIA custody offering in recent months, which it reorganized and rebranded at the

Aside from their rock-bottom fees, those with the largest gains have at least one commonality: asset allocation.

The RIA & Custody Services division faced two blows to its bottom line over the last couple years. The company followed competitors in 2019 to

Raymond James Private Client Group had $567.6 billion in fee-based accounts at the end of March, a 48% increase from 2020.

Correction: A previous version of this article inaccurately used quotes from last quarter’s earnings call instead of the April 29, 2021 call. It also misstated the number of assets in fee-based accounts.