As the Federal Reserve decides what to do about interest rates, retirement advisors and their clients are watching and worrying.

That's the picture painted by the latest

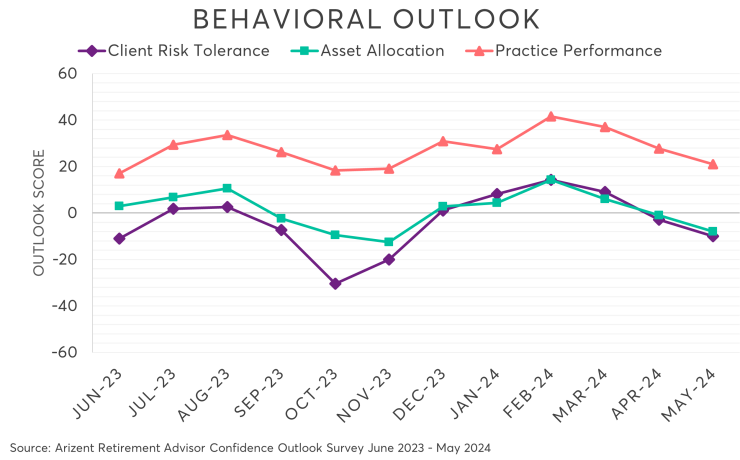

In May, that score dropped to minus-7. This was a seven-point drop from April's score of zero, and marked the third consecutive decrease since February.

What's driving confidence down? One advisor put it succinctly: "Powell, Powell, Powell."

In their open-ended survey responses, many wealth managers sounded unnerved by the apparent stalemate in the Fed's battle with inflation. The central bank, led by Chair Jerome Powell, signaled back in December that it

Last week, the Fed decided to

"We are just waiting on the Fed to make a real decision," one advisor wrote. "It is a lot of when and what with the Fed and the election."

As that advisor mentioned, another source of anxiety is the upcoming presidential contest.

"The looming election is on people's minds and, whether it has an impact or not, plenty of clients believe it does and it thus affects their personal outlook," another planner said.

Amid all this

"I think people are nervous going into the election," one advisor said. "They will want to take a wait-and-see approach."

Other measures declined as well. The score measuring practice performance fell to 21, down from 28 in April. And the score measuring the bullishness of asset allocations dropped from minus-1 last month to minus-8 in May.

Advisors were similarly pessimistic about the world outside their firms. Their faith in the overall economy dropped by a full 10 points, from a score of 22 in April to 12 in May. And the government policy score plummeted from 3 to minus-11.

"Wasted taxpayer money leads to the government increasing taxes so that they waste more taxpayer money," one wealth manager grumbled.

Separately, a poll found that 53% of advisors held a negative view of the global economic system, while just 7% held a positive one.

In many ways, planners seemed to be reacting to the confusing month the economy just finished — a month marked by both discouraging and encouraging news.

On the inflation front, the most recent numbers have been disappointing. On April 10, the consumer price index (CPI) for March came in

"It appears that inflation and higher interest rates are going to hang around a bit longer than all the financial experts originally told us," one wealth manager said.

On the other hand, many Fed watchers were reassured by Powell's recent relatively dovish

"I think it's unlikely that the next policy rate move will be a hike," Powell said.

Meanwhile, the most recent

READ MORE:

The result, for now, is a widespread sense among advisors and their clients that no one knows what to expect — for the election, inflation or its remedies from the Fed.

"Some clients are faring OK, but others are still not keeping up with price gains," one planner said. "The Fed is still trying to thread the needle. So far so good, but it's been a choppier ride."