As 2024 begins, one trend from late 2023 is still going strong: Retirement advisors are feeling more and more optimistic about the U.S. economy.

Every month, Arizent's

"The economy seems to remain strong, and this is good for client confidence," one advisor told the survey.

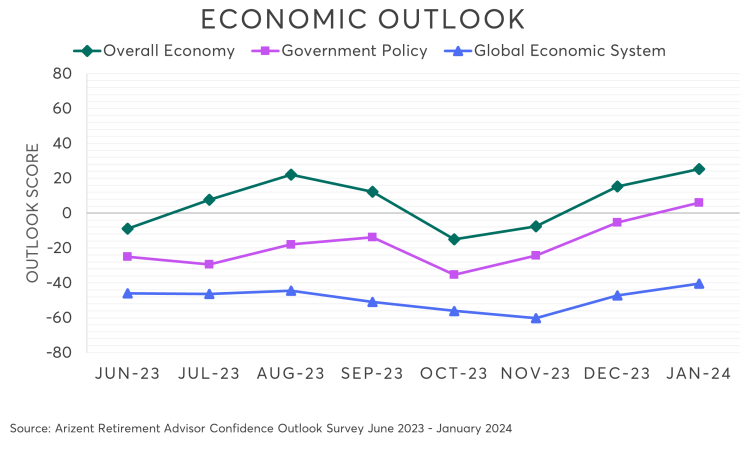

RACO's overall outlook score, which measures advisors' confidence on a scale of minus-100 to 100, rose to 5.12 in January — a new record, and only the second time the score has ever reached into positive territory.

The new data continues a long upswing in advisor bullishness. In October, the outlook score reached a record low of minus-21.35, but since then it's risen for three straight months.

"I think we are setting up for a good year if the global issues don't turn things very negative," another planner wrote.

What could account for this optimism? One clear reason is the Federal Reserve, which

Retirement advisors welcomed this news. RACO found that 57% of planners felt more optimistic about the economy as a result of the Fed's decision. And 40% expected monetary policy to have a positive impact on their clients' finances, compared to just 15% who thought the impact would be negative.

"Lower rates will help everything," one advisor said. "Should be good for all asset classes except commodities."

This positive view of the Fed may have boosted other RACO scores as well. Advisors' confidence in government policy rose to 5.9, and their outlook on the overall economy jumped to 25.2 — both new records for those categories.

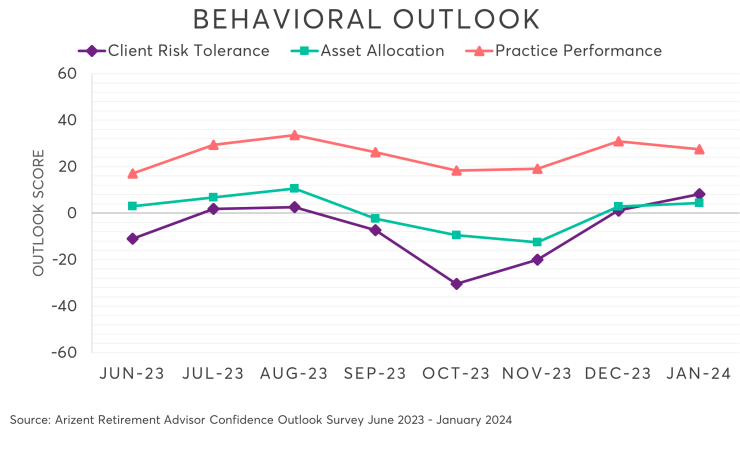

Client risk tolerance also reached new heights, inching up to a record score of 8.2. Some planners attributed this to the Fed as well.

"Rate cuts will help people take more risks and move out of cash if cuts are big enough," one wealth manager said.

On the other hand, not everyone thought the Fed's announcement was good news. In fact, 8% said the central bank's forecast made them less optimistic.

"Rate cuts mean that the Fed expects a too-slow economy," one advisor said.

Several other planners echoed this concern. Others worried the battle against rising prices was not yet won.

"Inflation remains stubbornly high despite aggressive rate hikes, indicating it could take longer to get under control," one wealth manager said.

READ MORE:

However, a much larger number of respondents noted that inflation has cooled significantly, raising their hopes for a stronger economy this year. Since June 2023, the yearly change in the

"I do feel that as of right now, inflation has stabilized," one planner said. "And with that, steady rates, if not rate cuts, will take place at some point this year."

In terms of advisors' own businesses, RACO's data was more mixed. The score measuring the bullishness of clients' asset allocations edged up to 4.4, only a slight increase from December's score of 2.8. And the score for practice performance slid downward, decreasing from 30.9 last month to 27.4 in January.

Nevertheless, wealth managers were generally more hopeful about the bigger picture. Even the score for the global economic system, which typically gets the lowest marks of all RACO's categories, rose to minus-40.4 — a record high.

"Lower inflation and lower interest rates should have a positive effect in the long term," one advisor said.

Another put it more simply: "Things will get better."