The Supreme Court has ruled 5-4 that Janus Capital Group is not liable for false statements in a prospectus for the Janus Investment Fund made at the time of the 2003 market-timing scandal.

Citing federal securities law, the court said the statements were made by the fund, not the investment advisor.

"We conclude that Janus Capital Management cannot be held liable because it did not make the statements in the prospectuses," wrote Justice Clarence Thomas.

The case, Janus Capital Group v. First Derivative Traders, alleged that Janus' stock fell nearly 25% in September 2003 due to the market timing scandal, and that Janus gave the misleading impression that it would take steps to prevent market timing.

The Supreme Court's decision reversed a ruling by the United States Court of Appeals for the Fourth Circuit, which had decided the class-action lawsuit could move forward. Experts say the decision will limit the ability of other shareholders to file suit against investment advisors.

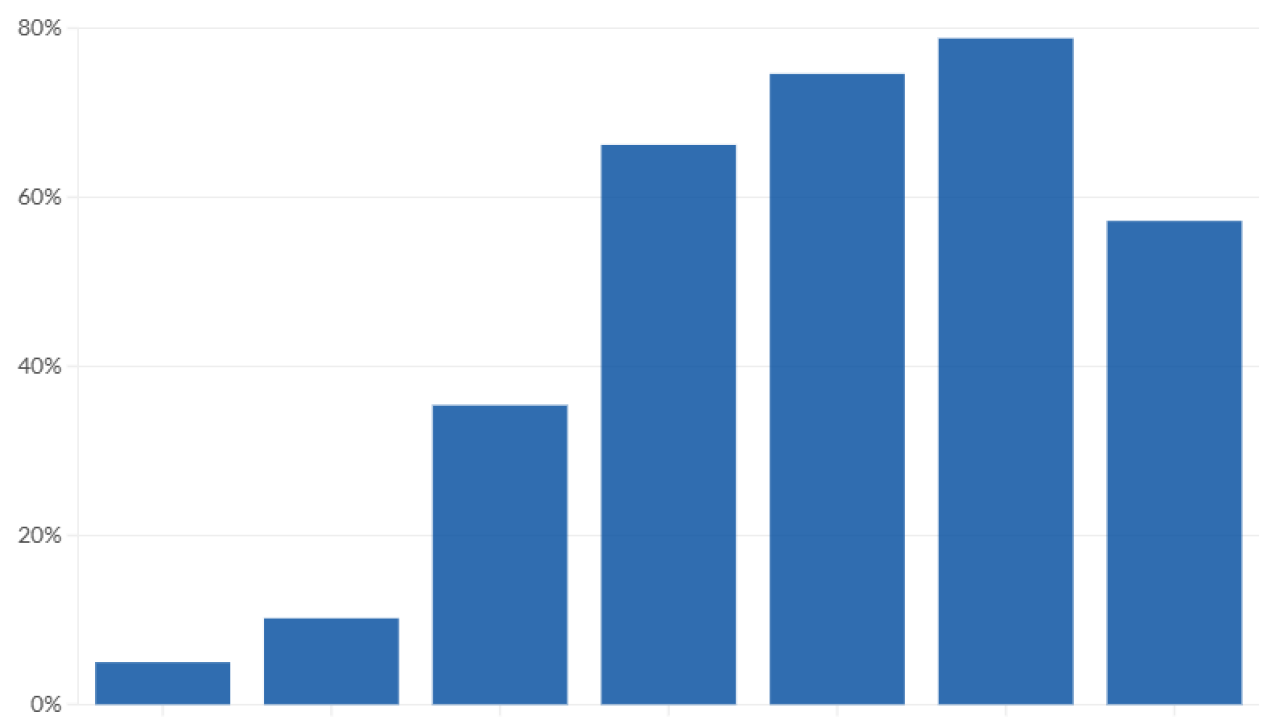

25% of Americans Not Saving for Retirement

A survey of 1,009 adults by Edward Jones on their retirement savings found good news and bad news. While 15% said their portfolios have recovered from the economic downturn, up from 12% in April 2010, 25% are not saving for retirement, up from 16% a year ago.

And among those between the ages of 18 and 34, 49% are not saving for retirement, a significant increase from 26% in 2010.

"We are seeing a positive trend in the recovery of retirement portfolios, but, unfortunately, more investors, particularly younger investors, are not taking advantage of the recovery and saving for retirement," said Scott Thomas, a member of the investment policy committee at Edward Jones. "While we cannot predict market corrections or when the next financial downturn will occur, we do know that it benefits all investors to stay invested through the various cycles and focus on long-term financial goals."

Morningstar to Offer Forward-Looking Ratings

Seeking to make it easier for financial planners and investors to analyze the vast mutual fund universe, Morningstar will soon launch forward-looking, analyst-driven fund ratings.

The ratings-which will range from Negative to AAA and be based on analysts' projections about a fund's ability to outperform its peer group or benchmark-will be in addition to the investment research firm's widely followed star ratings.

"We think of the star rating as an achievement test-it documents what the fund has done," said Don Phillips, president of fund research at Morningstar "We don't expect many funds to get the highest ratings," Phillips said.

The new initiative, covering funds worldwide, will begin this fall, replacing Morningstar's picks and pans. The firm expects to cover 1,500 mutual funds by next year. MME

Quote of the Week

"I think the absolute decline in household wealth resulted in a decline in confidence about the future. Most experts agree that over the long term, Americans are going to save more."

- Barbara Whitehead

Director

Templeton Center for Thrift and Generosity