President Trump has made no secret of the fact that U.S. stocks have performed quite well under his tenure. Not only does the president claim credit for past performance, he also made

“While Trump is clearly bullish on U.S. stocks, he faces a fairly high bar if he plans for stocks to do better than they did under Obama over his entire term,” Allan Roth says.

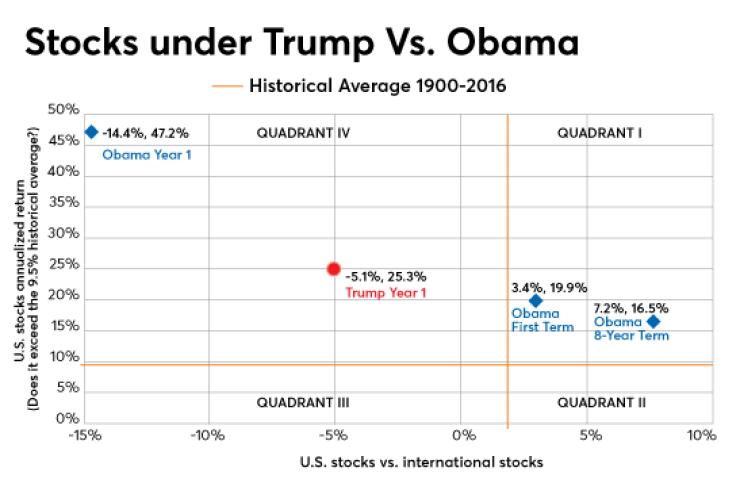

I decided to take a two-dimensional look at stock performance. First, how does the current performance of U.S. stocks compare to the long-run historic average? Since the stock market is essentially a vote by millions of investors on future cash flows of companies, growing faster than average would indicate that, at least on this dimension, Trump is delivering on his promise to “Make America great again.” (American companies, that is.)

Of course, the stock market is a global election, as well, so in my analysis, the second dimension is how U.S. stocks compare to the rest of the world. If U.S. stocks outperformed international ones, that would certainly be a global vote that Trump’s economic policies are putting “America first.”

For a long-term history of global markets, I turned to

On Dec. 31, 1989, the U.S. represented approximately 15% of the value of all global stocks. By the end of 2016, that increased dramatically to 53.2%. In part, this increase was due to the fact that U.S. stocks turned in a nominal return of 9.5% annually compared to only 7.3% for the rest of the world. The authors, based in the U.K., call the U.S. a “financial superpower.”

While less relevant to this exercise, one of the major takeaways from this yearbook relates to how dramatically the world has changed over time. For example, in 1900, the rail industry comprised far more than half of U.S. and global stock values. Now, it’s insignificant.

Returning to the framework, I compared performance on the following two dimensions:

- Make America great again: Did the U.S. stock market grow faster than the 9.5% historical average?

- America first: Did the U.S. stock market best the rest of the world by more than the 2.2 annual percentage point historical average?

To track performance during the last two administrations, I used the total returns (with dividend reinvestment) of these two funds:

- Vanguard Total Stock Market Index Investor (

VTSMX )

- Vanguard Total International Stock Market Investor (

VGTSX )

I selected the investor share class rather than the lower-cost ETF or Admiral share classes because the latter share classes did not exist during both administrations for international stocks.

Finally, I used the inauguration dates of Jan. 20, 2009, for Obama and Jan. 20, 2017, for Trump as the start dates. Though there is an argument to use the election dates as the start point, it’s likely to make little difference in the long run. Also, politicians have been known to abandon campaign policy promises and adapt new policies not in their campaign. I suspect this may not shock you.

The first year results are just about in as we approach the anniversary date of Trump’s first year. Investors "voted" that Trump did quite well with his promise to “Make America great again,” delivering a 24.6% return through Jan. 5, 2017, which more than doubled the 9.5% long-run return.

On the other hand, international stocks turned in a 29.8% return. U.S. stocks lagged international stocks by 5.2 percentage points vs. the historical average of besting international stocks by 2.2 percentage points. Thus, U.S. stocks under the president performed roughly 7.4 percentage points lower than the long-run historical average. Global investors clearly voted more heavily for international stocks rather than “America first.”

How did stocks under the Obama administration fare? With more history than Trump, these measures came in as follows:

- First year: U.S. up 47.2% but lagged international by 14.4 percentage points.

- First term: U.S. up 19.9% annually and bested international stocks by 3.4 percentage points.

- Two terms: U.S. up by 16.5% annually and bested international by 7.2 percentage points annually.

Under these same measures in the first year, U.S. stocks did far better under Obama, trouncing the historic average, but lagged international stocks by 14.4%, or a whopping 16.6 percentage point shortfall versus the historical average.

This means that, after year one of Trump, U.S. stock returns are besting the historic average but are lagging Obama’s first year significantly. On the other hand, his shortfall versus international stocks was also far less than under Obama.

- Quadrant I: U.S. stocks grew faster than the 9.5% historical average and bested international stocks by more than 2.2 percentage points. (This is the best quadrant for U.S. stocks.)

- Quadrant II: U.S. stocks underperformed their 9.5% historical average but outperformed international stocks by at least 2.2 percentage points.

- Quadrant III: U.S. stocks underperformed their 9.5% historical average and did not best international stocks by more than 2.2 percentage points. (This is the worst quadrant for U.S. stocks.)

- Quadrant IV: U.S. stocks grew faster than the 9.5% historical average but did not best international stocks by more than 2.2 percentage points.

While Trump is clearly bullish on U.S. stocks, he faces a fairly high bar if he plans for stocks to do better than they did under Obama over his entire term. By the end of Obama’s first term, U.S. stocks averaged a 19.9% annual return, besting international stocks by 3.4 percentage points, more than the 2.2 percentage point historical average. By the end of his second term, Obama’s eight-year track record clocked in a 16.5% annualized return, trouncing international stocks by a whopping 7.2 percentage points, or five percentage points more than the historical average.

Over both Obama’s first term and entire eight-year term, U.S. stocks gained significantly more than average and significantly bested international stocks. In other words, stocks supported both the “Make America great” and “America first” dimensions for U.S. companies.

Clearly there are key elements that are beyond either president’s control. Obama took office after stocks had already plunged, whereas Trump entered the White House when stocks were already at or near all-time highs. The relevance of these facts is unclear. On one hand, there’s the argument that valuations were far more attractive when Obama took over, and as a result, stock gains were easier to come by. But another argument is that Obama had to right a sinking ship, while Trump inherited a stock market and economy with strong tail winds.

Momentum is a major factor in investing, and Trump inherited the momentum of strong U.S. stock performance on both an absolute basis as well as compared to international stocks. Trump has so far only been able to carry forward the momentum on an absolute basis but not on a relative basis compared to international stocks.

Here’s another key question: How much do presidents really influence the stock market?

Do presidents really have that much influence on the stock market? Forbes reports that

I asked financial theorist and historian William Bernstein how much the president impacted the stock market. He responded:

“Republican administrations during both the 1920s and 2000s regulated markets lightly, which contributed to subsequent financial crises. In both cases, this led to Democratic administrations that came into office in the depths of those two crises at a low point in equity prices, so it’s not surprising that the subsequent returns during the Roosevelt and Obama presidencies were high. It's not that Roosevelt and Obama were financial geniuses, only that they came into office at propitious times to buy stocks.”

If stocks do falter over the next three years, will Trump take responsibility as he so far has taken credit for gains?

My viewpoint is that capitalism is stronger than politics — even dysfunctional politics. Those that bailed on stocks because they didn’t like either Obama or Trump paid a heavy price. Early on, I went on record advising

That is not to say I’m not concerned: I am, deeply. Both about the mushrooming debt, which will grow even more quickly under the Republican tax overhaul, and about the rolling back of regulations enacted on the financial services industry after the financial crisis.

Regardless of those concerns, I have to ask myself if I know something the rest of the stock market doesn’t already know. Since the answer is “no,” I’m staying the course and advise my clients to do the same.

That advice applies both under this president and the next.