Tom Rieman believes that when done the right way, the impact of the financial advice profession is profound.

"The value proposition that can be in our industry is so compelling and so valuable, and we see that when it's delivered at the highest end," said Rieman, the former senior director and head of wealth solutions for J.D. Power and a 25-year veteran of the industry. "Those advisors are not only making a really big impact on the client's lives, but they are being rewarded extensively as well in terms of income and success and practice valuation.

"So that promise sits out there … but there's a pretty significant gap between what is and what can be."

With a mission to close that gap and make good on that promise, Rieman and a crew of other industry veterans this week launched a new wealthtech startup dedicated to delivering what he calls the "ideal advice experience."

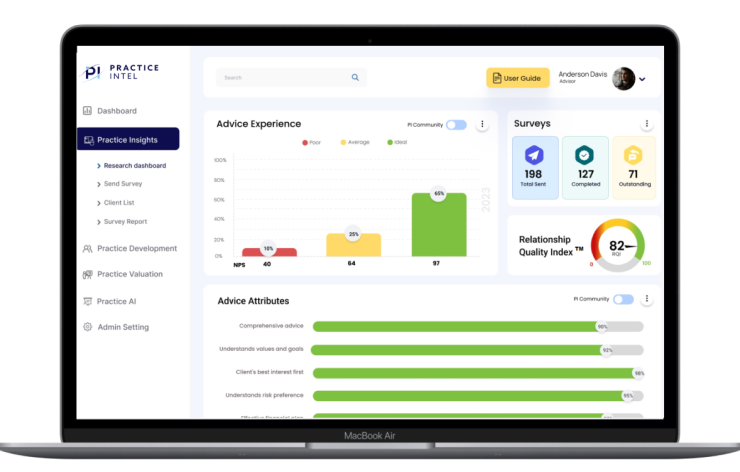

The offering is called Practice Intel, a growth platform designed to help advisors get on the same page as clients by developing a deep understanding of what they value most.

Rieman serves as CEO and founding partner. The Practice Intel co-founders are Kathy Cottrell, who will serve as chief of staff; and

The rest of the leadership team includes Larry Shumbres as president, Nicholas Gudz as chief growth officer and Andrew J. Evans as chief experience officer.

Like Rieman, Cherry feels that well-executed financial advice is transformative for both clients and advisors. The founder and president of Concurrent Financial Planning, who also holds a doctorate in personal financial planning from Texas Tech University, Cherry sees holistic planning as encompassing not just an empathetic understanding of clients but also storytelling that draws out obscured narratives.

"As advisors, we have the potential to make a significant impact on our communities. Comprehensive advice provides individuals with a better grasp of their financial well-being, leading to success defined on their terms," said Cherry. "Additionally, as our referral networks grow through advocacy, we can extend our help to more people, amplifying our positive influence."

Rieman said advisors on the Practice Intel platform will know with certainty what their clients think about their advice, noting that a common narrative in the industry is that the best advisors can't be replicated.

"It's their practice, their way. They're seen as unicorns. But we've cracked the code by understanding both the strategic drivers of an ideal advice experience and the mechanisms to accelerate their adoption," Rieman said. "By providing a model for success, guidance on execution and the ability to measure progress, we can help experienced advisors up their game and reduce future advisors' learning curves by years."

The new endeavor comes at a time when clients are seeking more. Recent J.D. Power studies revealed that less than 15% of clients say their advisor provides an ideal advice experience, which is defined as delivering on core attributes.

These include delivering comprehensive advice, a deep understanding of the client, putting the clients' best interests first and being connected to the clients' lives, among other factors.

In the aggregate, these attributes form the basis of a compelling and differentiated advisor value proposition that yields higher client advocacy.

This less-than-ideal "state of advice" can be attributed, in part, to the industry's legacy sales culture and limited insights into individual advisor practices, according to Rieman. To address this, he said the Practice Intel platform incorporates practice-level research capabilities, advisor development resources, embedded growth valuations and artificial intelligence-driven insights.

It also gives advisors something to shoot for by attempting to quantify the quality of their client relationships. Practice Intel includes what it's called the "Relationship Quality Index," or RQI.

Essentially a scorecard for advisors, the RQI combines multiple metrics to measure the quality of client relationships, which have a direct impact on practice valuation. High scores indicate embedded growth, while lower scores suggest attrition and regulatory risk, Rieman said.

"This provides that ability to go to their clients, get the feedback they need and have that irrefutable moment of truth — to say I'm doing a pretty good job, but maybe I'm not hitting the nail on the head every time," he said. "That leads to the ability to actually improve how you're delivering on the advice experience. Because it's one thing to know where you are. But the second thing is to improve."

To make all of this work, Rieman said the team focused on making the platform easy to use and impactful at a glance. Charts react in real time as advisors open new tabs to see how they rate on the metrics that make up their RQIs.

The software's practice development resources also include video content to give advisors looking to get better a steady flow of insight from the minds who power the platform.

"It's going to be the framework. We are going to be embedding personal videos of Preston and me grabbing a concept and saying, 'OK, let's pause on this one for a second and think. What does this really mean?'" Rieman said. "So we're going to continue to deepen and expand the development content, because the goal of this whole thing is for that continuum, that dispersion, those attributes to move. To turn from red to yellow to green."

Rieman added that the journey to self improvement will be unique for each advisor who turns to Practice Intel for help.

What is important is that both advisors with stellar scores and those with lower marks walk away from the process with the same desire to improve.

"Those with the high scores, I think they innately are always striving to get better. So that motivation is already embedded. We launched a day ago, and we're getting demo requests already," Rieman said. "What I'm noting as I look at the folks who asked for a demo, they tend to be more experienced. I can tell they are good advisors just by looking at their website and getting a little insight. So I think that self motivation is already there. But the other motivation is recognizing that standing still is moving backwards."

He added that there are other advisors out there who look at something like the chance to have the experience they deliver quantified, and say "I don't want to know."

"And the reason they don't want to know is because they already know … but the truth shall set you free" Rieman said. "Just because you don't want to find out exactly what it is doesn't mean it doesn't exist. It always comes back."